Preparation of Liquidator’s Final Statement of Account

04/05/2021 1 By indiafreenotesThe liquidator is required to prepare an account of winding up known as Liquidator’s Final Statement of Account after the affairs of the company are fully wound up. The liquidator is required to prepare an account of winding up known as Liquidator’s Final Statement of Account after the affairs of the company are fully wound up. In every mode of winding up, the liquidator is required to keep proper books to record receipt and payment which is known as liquidator’s final statement. The statement prepared by the liquidator showing receipts and payments of cash in case of voluntary winding up is called “Liquidators’ statement of account”.

The liquidator has to submit a report along with the audited final accounts to the CRO. There is no double entry involved in the preparation of the liquidator’s statement of account. The liquidator has to submit the statement to the court in the case of compulsory liquidation and to the company in voluntary liquidation. There is no double entry involved in the preparation of the liquidator’s statement of account. It is the duty of the liquidator to realize the assets and disburse the same among those who have a proper claim.

The liquidator has to settle down the liability of the company on the following priority:

- Expenses incurred in liquidating the company.

- Salaries and wages, provident fund, gratuity and other amounts payable to employees and other workers.

- Taxes, charges, fees, royalties, etc. payable to the government or to any local autonomous body.

- Secured loans obtained against the assets mortgaged to the extent of the sum recovered by the sale of assets in the market.

- Other debts.

The surplus, after settling all the debts of the company as stated above, will be distributed first among the preference shareholders and then among the equity shareholders.

The equity shareholders have distributed the surplus in proportion to the shares held by them.

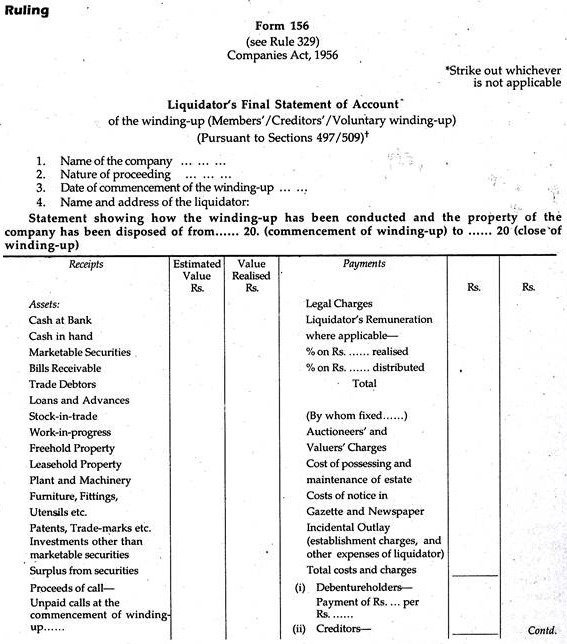

The specimen of Liquidator’s Final Statement is as under:

State face value and class of share.

(1) The following assets estimated to be of the value of Rs….. have proved to be unrealizable:

(Give details of the assets which have proved to be unrealizable).

(2) Amount paid into the company’s Liquidation Account in respect of:

(a) Unclaimed dividend payable to creditors in winding-up Rs…..

(b) Other unclaimed distributions in the winding-up Rs…..

(c) Money held by the company in trust in respect of dividends or other sum due before the commencements of the winding-up to any person as a member of the company Rs

(3) Add here any remarks the liquidator thinks desirable:

Dated this………… day of……… 20

Sd/- Liquidator

I declare that the above statement is true and contains a full and accurate account of the winding-up from the commencement to the close of the winding-up.

Sd/- Liquidator

Dated this……… day of…………. 20

Statement:

Liquidator’s Statement of Account

- Receipts………………………………Amount………Payments……………………..Amount

- To Assets Realized………………..XXX…………..By Secured Creditors……..XXX

- To Surplus from securities………XXX………….By liquidation cost…………XXX

- To Unpaid calls and due calls…..XXX…………By preferential creditors…..XXX

- ……………………………………………………………By Debenture holders……….XXX

- ……………………………………………………………By Unsecured creditors……..XXX

- ……………………………………………………………By Preference shareholders.XXX

- ……………………………………………………………BY equity shareholders………XXX

Total………………………………………….XXX………. Total………………………………

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- More

[…] VIEW […]