The Heckscher–Ohlin model (H–O model) is a general equilibrium mathematical model of international trade, developed by Eli Heckscher and Bertil Ohlin at the Stockholm School of Economics. It builds on David Ricardo’s theory of comparative advantage by predicting patterns of commerce and production based on the factor endowments of a trading region. The model essentially says that countries export products that use their abundant and cheap factors of production, and import products that use the countries’ scarce factors.

The Heckscher-Ohlin model is an economic theory that proposes that countries export what they can most efficiently and plentifully produce. Also referred to as the H-O model or 2x2x2 model, it’s used to evaluate trade and, more specifically, the equilibrium of trade between two countries that have varying specialties and natural resources.

The model emphasizes the export of goods requiring factors of production that a country has in abundance. It also emphasizes the import of goods that a nation cannot produce as efficiently. It takes the position that countries should ideally export materials and resources of which they have an excess, while proportionately importing those resources they need.

Features of the model

Relative endowments of the factors of production (land, labor, and capital) determine a country’s comparative advantage. Countries have comparative advantages in those goods for which the required factors of production are relatively abundant locally. This is because the profitability of goods is determined by input costs. Goods that require locally abundant inputs are cheaper to produce than those goods that require locally scarce inputs.

For example, a country where capital and land are abundant but labor is scarce has a comparative advantage in goods that require lots of capital and land, but little labor such as grains. If capital and land are abundant, their prices are low. As they are the main factors in the production of grain, the price of grain is also low and thus attractive for both local consumption and export. Labor-intensive goods, on the other hand, are very expensive to produce since labor is scarce and its price is high. Therefore, the country is better off importing those goods.

Theoretical Development

The Ricardian model of comparative advantage has trade ultimately motivated by differences in labour productivity using different “technologies”. Heckscher and Ohlin did not require production technology to vary between countries, so (in the interests of simplicity) the “H–O model has identical production technology everywhere”. Ricardo considered a single factor of production (labour) and would not have been able to produce comparative advantage without technological differences between countries (all nations would become autarkic at various stages of growth, with no reason to trade with each other). The H–O model removed technology variations but introduced variable capital endowments, recreating endogenously the inter-country variation of labour productivity that Ricardo had imposed exogenously. With international variations in the capital endowment like infrastructure and goods requiring different factor “proportions”, Ricardo’s comparative advantage emerges as a profit-maximizing solution of capitalist’s choices from within the model’s equations. The decision that capital owners are faced with is between investments in differing production technologies; the H–O model assumes capital is privately held.

Evidence Supporting the Heckscher-Ohlin Model

Although the Heckscher-Ohlin model appears reasonable, most economists have had difficulty finding evidence to support it. A variety of other models have been used to explain why industrialized and developed countries traditionally lean toward trading with one another and rely less heavily on trade with developing markets.

The Linder hypothesis outlines and explains this theory. It states that countries with similar incomes require similarly valued products and that this leads them to trade with each other.

Heckscher-Ohlin Theorem:

According to Ricardo and other classical economists, international trade is based on differences in comparative costs. It is important to note that Heckscher and Ohlin agreed with this fundamental proposition and only elaborated this by explaining the factors which cause differences in comparative costs of commodities between different regions or countries. Ricardo and others who followed him explained differences in comparative costs as arising from differences in skill and efficiency of labour alone.

This is not a satisfactory explanation of differences in comparative cots. Ohlin pointed out more significant factors, namely, differences in factor endowments of the nations and difference in factor proportions of producing different commodities, which account for differences in comparative costs and hence from the ultimate basis of inter-regional or international trade.

Thus, Heckscher-Ohlin theory does not contradict and supplant the comparative cost theory but supplements it by offering sufficiently satisfactory explanation of what causes differences in comparative costs.

According to Ohlin, the underlying forces behind differences in comparative costs are twofold:

- The different regions or countries have different factor endowments.

- The different goods require different factor-proportions for their production.

It is a well-known fact that various countries (regions) are differently endowed with productive factors required for production of goods. Some countries posses relatively more capital, some relatively more labour, and some relatively more land.

The factor which is relatively abundant in a country will tend to have a lower price and the factor which is relatively scarce will tend to have a higher price. Thus, according to Ohlin, factor endowments and factor prices are intimately associated with each other.

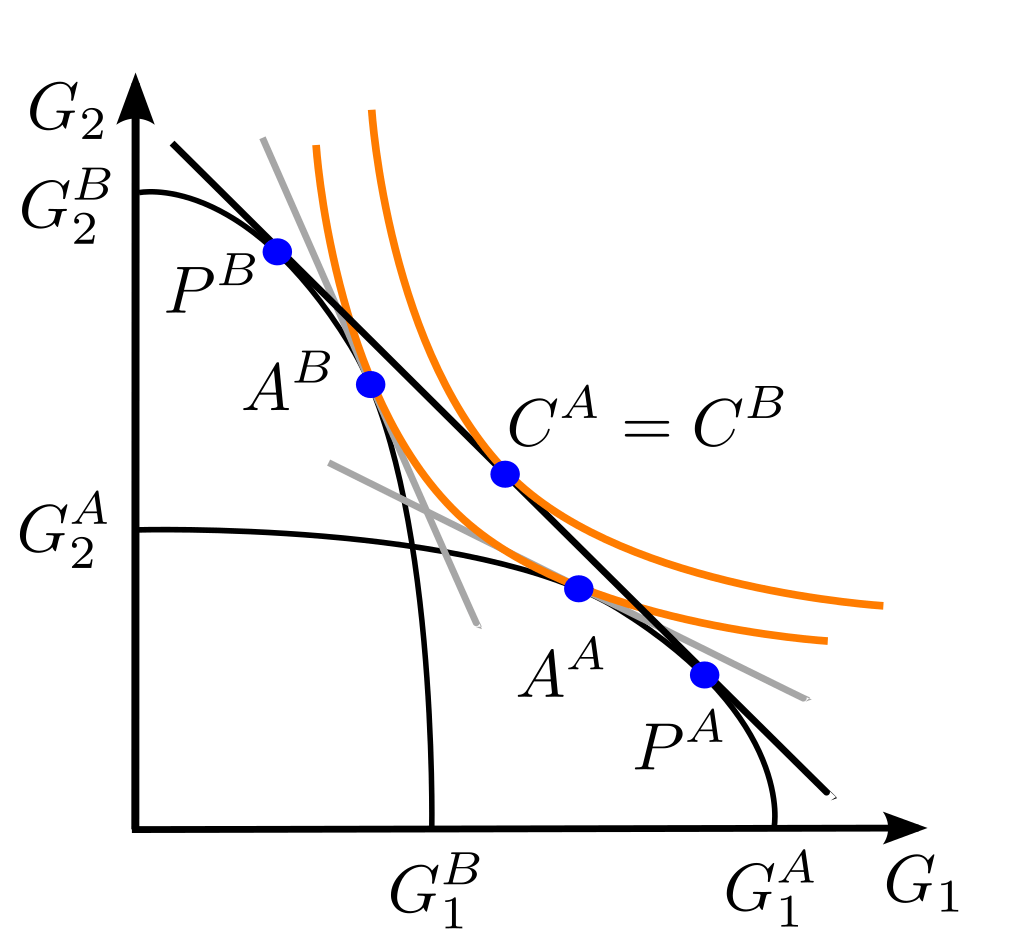

Suppose K stands for the availability or supply of capital in a country, L for that of labour and PK for price of capital and PL for the price of labour. Further, take two countries A and B; in country A capital is relatively abundant and labour is relatively scarce. The reverse is the case in country B. Given these factor-endowments, in country A capital will be relatively cheaper.

In symbolic terms:

Since (K/L)A > (K/L)B

Since (PK/PL)A < (PK/PL)B

Thus, the differences in factor endowments cause differences in factor prices and therefore account for differences in comparative costs of producing different commodities. Together with the difference in factor-endowments, differences in factor proportions required for the production of different commodities also constitute an important force underlying differences in comparative costs as between different countries.

Some commodities are such that their production requires relatively more capital than other factors; they are therefore called capital- intensive commodities. Still other commodities require relatively more land than capital and labour and are therefore called land-intensive commodities.

These differences in factor-productions (or what is also called differences in factor-intensities) needed for the production of different commodities account for differences in comparative costs of producing different commodities. The differences in comparative costs of producing different commodities lead to the differences in market prices of different commodities in different countries.

It follows from above that some countries have a comparative advantage in the production of a commodity for which the required factors are found in abundance and comparative disadvantage in the production of a commodity for which the required factors are not available in sufficient quantities.

Thus, a country A which has a relative abundance of capital and relative scarcity of labour will have a comparative advantage in specialising in the production of capital-intensive commodities and in return will import labour-intensive goods. This is because (PK/PL)A < (PK/PL)B.

On the other hand, a labour-abundant country B with a scarcity of capital will have a comparative advantage in specialising in the production of labour-intensive commodities and export some quantities of them and in exchange for import capital-intensive commodities. This is because in this country (PL/PK)B < (PL/PK)A.

If factor endowments in the two countries are the same and factor-productions used in the production of different commodities do not differ, there will be no differences in relative factor prices [i.e. (PK/PL)A < (PK/PL)B] which will mean differences in comparative costs of producing commodities in the two countries will be non-existent. In this situation the countries will not gain from entering into trade with each other.

Let us graphically explain the Heckscher-Ohlin theory of international trade. Take two countries U.S.A. and India. Assume that there is a relative abundance of capital and scarcity of labour in U.S.A. and, on the contrary, there is a relative abundance of labour and scarcity of capital in India. (This is the real situation as well).

By WissensDürster – Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=41687581