Final Accounts are the accounts, which are prepared at the end of a fiscal year. It gives a precise idea of the financial position of the business/organization to the owners, management, or other interested parties. Financial statements are primarily recorded in a journal; then transferred to a ledger; and thereafter, the final account is prepared (as shown in the illustration).

Usually, a final account includes the following components:

- Trading Account

- Manufacturing Account

- Profit and Loss Account

- Balance Sheet

-

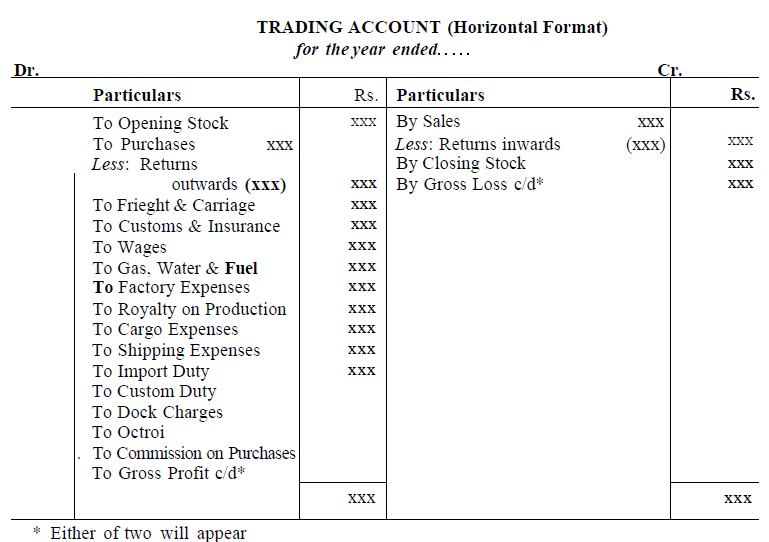

Trading Account

Trading accounts represents the Gross Profit/Gross Loss of the concern out of sale and purchase for the particular accounting period.

Study of Debit side of Trading Account

(a) Opening Stock: Unsold closing stock of the last financial year is appeared in debit side of the Trading Account as “To Opening Stock“ of the current financial year.

(b) Purchases: Total purchases (net of purchase return) including cash purchase and credit purchase of traded goods during the current financial year appeared as “To Purchases” in the debit side of Trading Account.

(c) Direct Expenses: Expenses incurred to bring traded goods at business premises/warehouse called direct expenses. Freight charges, cartage or carriage charges, custom and import duty in case of import, gas, electricity fuel, water, packing material, wages, and any other expenses incurred in this regards comes under the debit side of Trading Account and appeared as “To Particular Name of the Expenses”.

(d) Sales Account: Total Sale of the traded goods including cash and credit sales will appear at outer column of the credit side of Trading Account as “By Sales.” Sales should be on net releasable value excluding Central Sales Tax, Vat, Custom, and Excise Duty.

(e) Closing Stock: Total Value of unsold stock of the current financial year is called as closing stock and will appear at the credit side of Trading Account.

Closing Stock = Opening Stock + Net Purchases – Net Sale

(f) Gross Profit: Gross profit is the difference of revenue and the cost of providing services or making products. However, it is calculated before deducting payroll, taxation, overhead, and other interest payments. Gross Margin is used in the US English and carries same meaning as the Gross Profit.

Gross Profit = Sales – Cost of Goods Sold

(g) Operating Profit: Operating profit is the difference of revenue and the costs generated by ordinary operations. However, it is calculated before deducting taxes, interest payments, investment gains/losses, and many other non-recurring items.

Operating Profit = Gross Profit – Total Operating Expenses

(h) Net Profit: Net profit is the difference of total revenue and the total expenses of the company. It is also known as net income or net earnings.

Net Profit = Operating Profit – (Taxes + Interest)

2. Manufacturing Account

Manufacturing account prepared in a case where goods are manufactured by the firm itself. Manufacturing accounts represent cost of production. Cost of production then transferred to Trading account where other traded goods also treated in a same manner as Trading account.

Important Point Related to Manufacturing Account

Apart from the points discussed under the section of Trading account, there are a few additional important points that need to be discuss here:

(a) Raw Material: Raw material is used to produce products and there may be opening stock, purchases, and closing stock of Raw material. Raw material is the main and basic material to produce items.

(b) Work-in-Progress: Work-in-progress means the products, which are still partially finished, but they are important parts of the opening and closing stock. To know the correct value of the cost of production, it is necessary to calculate the correct cost of it.

(c) Finished Product: Finished product is the final product, which is manufactured by the concerned business and transferred to trading account for sale.

Raw Material Consumed (RMC) − It is calculated as.

RMC = Opening Stock of Raw Material + Purchases – Closing Stock

3. Profit and Loss Account

Profit & Loss account represents the Gross profit as transferred from Trading Account on the credit side of it along with any other income received by the firm like interest, Commission, etc.

Debit side of profit and loss account is a summary of all the indirect expenses as incurred by the firm during that particular accounting year. For example, Administrative Expenses, Personal Expenses, Financial Expenses, Selling, and Distribution Expenses, Depreciation, Bad Debts, Interest, Discount, etc.

4. Balance Sheet

A balance sheet reflects the financial position of a business for the specific period of time. The balance sheet is prepared by tabulating the assets (fixed assets + current assets) and the liabilities (long term liability + current liability) on a specific date.

Assets

Assets are the economic resources for the businesses. It can be categorized as:

(a) Fixed Assets: Fixed assets are the purchased/constructed assets, used to earn profit not only in current year, but also in next coming years. However, it also depends upon the life and utility of the assets. Fixed assets may be tangible or intangible. Plant & machinery, land & building, furniture, and fixture are the examples of a few Fixed Assets.

(b) Current Assets: The assets, which are easily available to discharge current liabilities of the firm called as Current Assets. Cash at bank, stock, and sundry debtors are the examples of current assets.

(c) Fictitious Assets: Accumulated losses and expenses, which are not actually any virtual assets called as Fictitious Assets. Discount on issue of shares, Profit & Loss account, and capitalized expenditure for time being are the main examples of fictitious assets.

(d) Cash & Cash Equivalents: Cash balance, cash at bank, and securities which are redeemable in next three months are called as Cash & Cash equivalents.

(e) Wasting Assets: The assets, which are reduce or exhausted in value because of their use are called as Wasting Assets. For example, mines, queries, etc.

(f) Tangible Assets: The assets, which can be touched, seen, and have volume such as cash, stock, building, etc. are called as Tangible Assets.

(g) Intangible Assets: The assets, which are valuable in nature, but cannot be seen, touched, and not have any volume such as patents, goodwill, and trademarks are the important examples of intangible assets.

(h) Accounts Receivables: The bills receivables and sundry debtors come under the category of Accounts Receivables.

(i) Working Capital: Difference between the Current Assets and the Current Liabilities are called as Working Capital.

2 thoughts on “Final Accounts in Horizontal format”