Trade Cycle, also known as the business cycle, refers to the recurring fluctuations in economic activity characterized by periods of expansion, peak, contraction, and trough. These cycles reflect the natural rhythm of economic growth and contraction within a market economy. During expansion phases, economic output, employment, and consumer spending increase, leading to prosperity. Peaks mark the highest point of economic activity. Contractions, or recessions, follow, characterized by decreased production, rising unemployment, and reduced consumer spending. Finally, troughs represent the lowest point of the cycle, before the economy begins to recover. Understanding trade cycles is crucial for policymakers, businesses, and investors to anticipate and manage the impacts of economic fluctuations on various sectors and stakeholders.

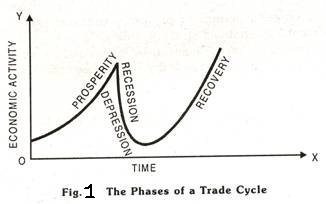

Four Phases of a Trade cycle are:

- Prosperity phase: Expansion or the upswing.

- Recessionary phase: A turn from prosperity to depression (or upper turning point).

- Depressionary phase: Contraction or downswing.

- Revival or recovery phase: The turn from depression to prosperity (or lower turning point).

The above four phases of a trade cycle are shown in Fig. 1. These phases are recurrent and follow a regular sequence.

Phases of a Trade Cycle

1. Expansion Phase:

The expansion phase marks the beginning of the trade cycle. It is characterized by increasing economic activity across various sectors of the economy. During this phase, several key indicators typically show positive trends:

- Gross Domestic Product (GDP) Growth:

GDP, which measures the total value of goods and services produced within a country’s borders, tends to rise during the expansion phase. Increased production, consumer spending, and investment contribute to this growth.

- Employment:

As economic activity expands, businesses experience rising demand for goods and services. This often leads to increased hiring to meet the growing demand, resulting in lower unemployment rates.

- Consumer Spending:

Consumers tend to have more disposable income during periods of economic expansion, leading to increased spending on goods and services. This increased consumer demand further fuels economic growth.

- Business Investment:

Businesses are more likely to invest in capital goods, such as machinery and equipment, during the expansion phase. Higher confidence in future economic prospects encourages firms to expand their productive capacity to meet growing demand.

- Stock Market Performance:

Stock prices typically rise during the expansion phase as investors anticipate higher corporate profits and economic growth. Bull markets, characterized by rising stock prices, are common during this phase.

2. Peak Phase:

The peak phase represents the highest point of economic activity within the trade cycle. It is characterized by several key features:

- Full Capacity Utilization:

During the peak phase, resources such as labor and capital are fully utilized as demand for goods and services reaches its highest levels. Production may be operating at or near maximum capacity.

- Inflationary Pressures:

As demand outstrips supply during the peak phase, prices tend to rise, leading to inflationary pressures. This can be reflected in higher consumer prices, wage growth, and increased production costs.

- Tight Labor Market:

With low unemployment rates and high demand for labor, competition for workers intensifies during the peak phase. This can lead to wage increases and labor shortages in certain industries.

- Business Confidence:

Businesses may become increasingly optimistic about future economic prospects during the peak phase, leading to higher levels of investment and expansion plans.

- Stock Market Volatility:

While stock prices may continue to rise during the peak phase, volatility often increases as investors become more cautious about the sustainability of economic growth.

3. Contraction Phase:

Following the peak phase, the economy enters the contraction phase, also known as a recession or downturn. This phase is characterized by declining economic activity and several negative trends:

- GDP Contraction:

Economic output, as measured by GDP, begins to decline during the contraction phase as demand for goods and services weakens. This can be driven by factors such as reduced consumer spending, declining investment, and falling exports.

- Rising Unemployment:

As businesses cut back on production and investment in response to weakening demand, unemployment rates tend to rise. Layoffs and hiring freezes become more common as companies adjust to the downturn.

- Decreased Consumer Spending:

Consumer confidence often declines during the contraction phase, leading to reduced spending on discretionary goods and services. Consumers may prioritize essential purchases and cut back on non-essential items.

- Declining Business Investment:

Businesses become more cautious about investing in new capital projects and expansion plans during the contraction phase. Uncertainty about future economic conditions and weak demand can lead to a decrease in business investment.

- Stock Market Decline:

Stock prices typically fall during the contraction phase as investors react to negative economic news and uncertainty about future earnings prospects. Bear markets, characterized by falling stock prices, are common during recessions.

4. Trough Phase:

The trough phase represents the lowest point of the trade cycle and marks the end of the contraction phase. While economic conditions remain challenging, there are signs of stabilization and the beginning of recovery:

- Stabilization of Economic Indicators:

Economic indicators such as GDP, employment, and consumer spending may stabilize or show signs of improvement during the trough phase. The rate of decline in economic activity begins to slow down.

- Policy Responses:

Governments and central banks often implement monetary and fiscal policies to stimulate economic growth during the trough phase. These may include interest rate cuts, fiscal stimulus measures, and efforts to restore confidence in the financial system.

- Inventory Rebuilding:

Businesses may start to rebuild inventories during the trough phase in anticipation of future demand. This can contribute to a gradual increase in production and economic activity.

- Bottoming Out of Stock Market:

While stock prices may still be volatile during the trough phase, there may be signs that the market is bottoming out as investors anticipate a recovery in corporate earnings and economic growth.

- Early Signs of Recovery:

Some sectors of the economy may begin to show signs of improvement during the trough phase, signaling the start of the recovery process. These early indicators can include increased consumer confidence, rising business investment, and stabilization in housing markets.