-

Successful Money Management

A. Money management: The day-to-day financial activities necessary to manage current personal economic resources while working toward long-term financial security.

B. Opportunity Cost and Money Management

-

-

- Spending money on current living expenses reduces the amount you can use for saving and investing for long-term financial security.

- Saving and investing for the future reduce the amount you can spend now.

- Buying on credit results in payments later and reduces the amount of future income available for spending.

- Using savings for purchases results in lost interest earnings and an inability to use savings for other purposes.

- Comparison shopping can save you money and improve the quality of your purchases but uses up something of value you cannot replace: your time.

-

C. Components of Money Management

-

-

- Personal Financial Records and Documents

- Personal Financial Statements

- A Budget or Spending Plan

-

A System for Personal Financial Records

-

3. Personal Financial Statements

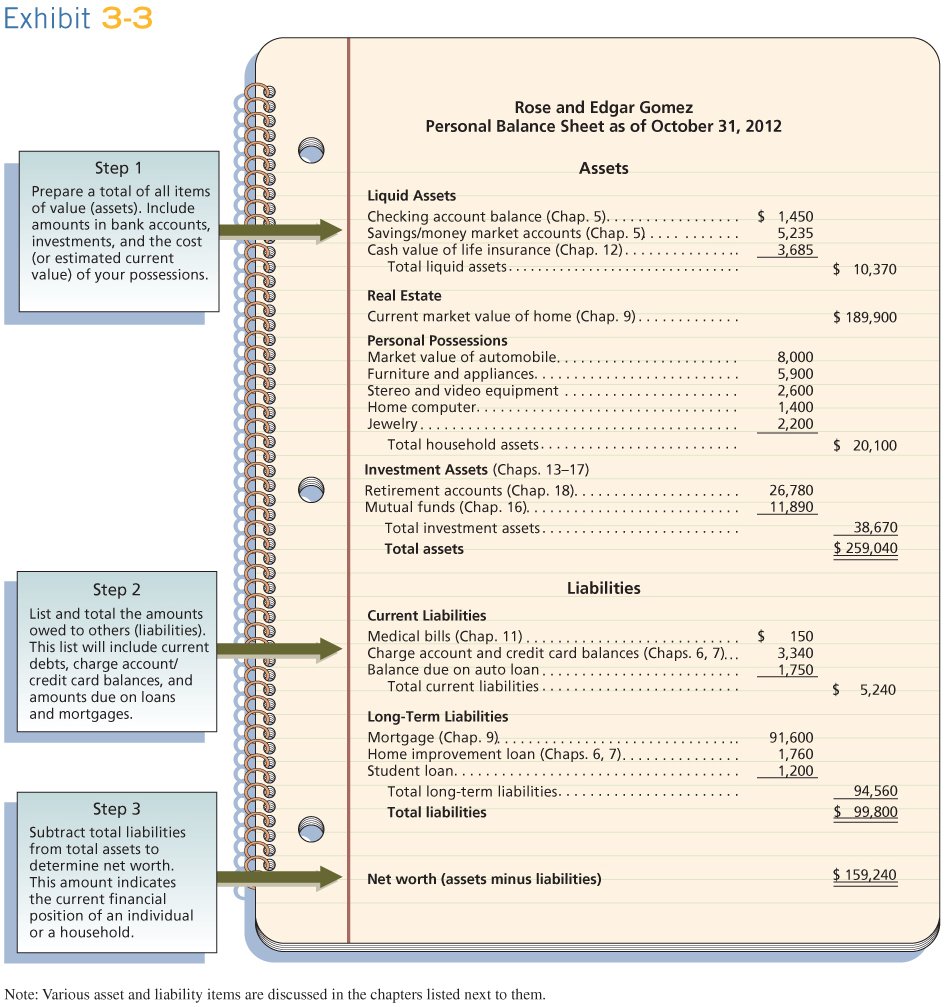

A. The Personal Balance Sheet: Where are You Now?

Items of Value – Amounts Owed = Net Worth

B. Evaluating Your Financial Positiion

If you are a traditional college student, don’t be surprised if your net worth is negative.

C. The Cash Flow Statement: Where Did Your Money Go?

Total Cash Received during the time period – Cash Outflow during the time period = Cash Surplus or Deficit