EBIT-EPS analysis for Capital Structure decision

18/05/2020EBIT-EPS analysis gives a scientific basis for comparison among various financial plans and shows ways to maximize EPS. Hence EBIT-EPS analysis may be defined as ‘a tool of financial planning that evaluates various alternatives of financing a project under varying levels of EBIT and suggests the best alternative having highest EPS and determines the most profitable level of EBIT’.

Concept of EBIT-EPS Analysis:

The EBIT-EBT analysis is the method that studies the leverage, i.e. comparing alternative methods of financing at different levels of EBIT. Simply put, EBIT-EPS analysis examines the effect of financial leverage on the EPS with varying levels of EBIT or under alternative financial plans.

It examines the effect of financial leverage on the behavior of EPS under different financing alternatives and with varying levels of EBIT. EBIT-EPS analysis is used for making the choice of the combination and of the various sources. It helps select the alternative that yields the highest EPS.

We know that a firm can finance its investment from various sources such as borrowed capital or equity capital. The proportion of various sources may also be different under various financial plans. In every financing plan the firm’s objectives lie in maximizing EPS.

Advantages of EBIT-EPS Analysis:

We have seen that EBIT-EPS analysis examines the effect of financial leverage on the behavior of EPS under various financing plans with varying levels of EBIT. It helps a firm in determining optimum financial planning having highest EPS.

Various advantages derived from EBIT-EPS analysis may be enumerated below:

Financial Planning:

Use of EBIT-EPS analysis is indispensable for determining sources of funds. In case of financial planning the objective of the firm lies in maximizing EPS. EBIT-EPS analysis evaluates the alternatives and finds the level of EBIT that maximizes EPS.

Comparative Analysis:

EBIT-EPS analysis is useful in evaluating the relative efficiency of departments, product lines and markets. It identifies the EBIT earned by these different departments, product lines and from various markets, which helps financial planners rank them according to profitability and also assess the risk associated with each.

Performance Evaluation:

This analysis is useful in comparative evaluation of performances of various sources of funds. It evaluates whether a fund obtained from a source is used in a project that produces a rate of return higher than its cost.

Determining Optimum Mix:

EBIT-EPS analysis is advantageous in selecting the optimum mix of debt and equity. By emphasizing on the relative value of EPS, this analysis determines the optimum mix of debt and equity in the capital structure. It helps determine the alternative that gives the highest value of EPS as the most profitable financing plan or the most profitable level of EBIT as the case may be.

Limitations of EBIT-EPS Analysis:

Finance managers are very much interested in knowing the sensitivity of the earnings per share with the changes in EBIT; this is clearly available with the help of EBIT-EPS analysis but this technique also suffers from certain limitations, as described below

No Consideration for Risk:

Leverage increases the level of risk, but this technique ignores the risk factor. When a corporation, on its borrowed capital, earns more than the interest it has to pay on debt, any financial planning can be accepted irrespective of risk. But in times of poor business the reverse of this situation arises—which attracts high degree of risk. This aspect is not dealt in EBIT-EPS analysis.

Contradictory Results:

It gives a contradictory result where under different alternative financing plans new equity shares are not taken into consideration. Even the comparison becomes difficult if the number of alternatives increase and sometimes it also gives erroneous result under such situation.

Over-capitalization:

This analysis cannot determine the state of over-capitalization of a firm. Beyond a certain point, additional capital cannot be employed to produce a return in excess of the payments that must be made for its use. But this aspect is ignored in EBIT-EPS analysis.

Indifference Points:

The indifference point, often called as a breakeven point, is highly important in financial planning because, at EBIT amounts in excess of the EBIT indifference level, the more heavily levered financing plan will generate a higher EPS. On the other hand, at EBIT amounts below the EBIT indifference points the financing plan involving less leverage will generate a higher EPS.

Concept:

Indifference points refer to the EBIT level at which the EPS is same for two alternative financial plans. According to J. C. Van Home, ‘Indifference point refers to that EBIT level at which EPS remains the same irrespective of debt equity mix’. The management is indifferent in choosing any of the alternative financial plans at this level because all the financial plans are equally desirable. The indifference point is the cut-off level of EBIT below which financial leverage is disadvantageous. Beyond the indifference point level of EBIT the benefit of financial leverage with respect to EPS starts operating.

The indifference level of EBIT is significant because the financial planner may decide to take the debt advantage if the expected EBIT crosses this level. Beyond this level of EBIT the firm will be able to magnify the effect of increase in EBIT on the EPS.

In other words, financial leverage will be favorable beyond the indifference level of EBIT and will lead to an increase in the EPS. If the expected EBIT is less than the indifference point then the financial planners will opt for equity for financing projects, because below this level, EPS will be more for less levered firm.

Computation:

We have seen that indifference point refers to the level of EBIT at which EPS is the same for two different financial plans. So the level of that EBIT can easily be computed. There are two approaches to calculate indifference point: Mathematical approach and graphical approach.

Graphical Approach:

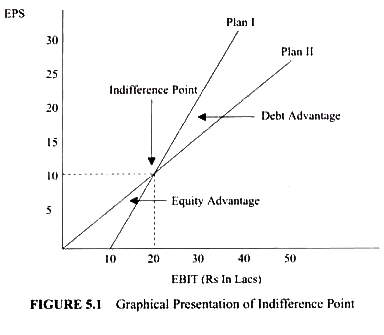

The indifference point may also be obtained using a graphical approach. In Figure 5.1 we have measured EBIT along the horizontal axis and EPS along the vertical axis. Suppose we have two financial plans before us: Financing by equity only and financing by equity and debt. Different combinations of EBIT and EPS may be plotted against each plan. Under Plan-I the EPS will be zero when EBIT is nil so it will start from the origin.

The curve depicting Plan I in Figure 5.1 starts from the origin. For Plan-II EBIT will have some positive figure equal to the amount of interest to make EPS zero. So the curve depicting Plan-II in Figure 5.1 will start from the positive intercept of X axis. The two lines intersect at point E where the level of EBIT and EPS both are same under both the financial plans. Point E is the indifference point. The value corresponding to X axis is EBIT and the value corresponding to 7 axis is EPS.

These can be found drawing two perpendiculars from the indifference point—one on X axis and the other on Taxis. Similarly we can obtain the indifference point between any two financial plans having various financing options. The area above the indifference point is the debt advantage zone and the area below the indifference point is equity advantage zone.

Above the indifference point the Plan-II is profitable, i.e. financial leverage is advantageous. Below the indifference point Plan I is advantageous, i.e. financial leverage is not profitable. This can be found by observing Figure 5.1. Above the indifference point EPS will be higher for same level of EBIT for Plan II. Below the indifference point EPS will be higher for same level of EBIT for Plan I. The graphical approach of indifference point gives a better understanding of EBIT-EPS analysis.

Financial Breakeven Point:

In general, the term Breakeven Point (BEP) refers to the point where the total cost line and sales line intersect. It indicates the level of production and sales where there is no profit and no loss because here the contribution just equals to the fixed costs. Similarly financial breakeven point is the level of EBIT at which after paying interest, tax and preference dividend, nothing remains for the equity shareholders.

In other words, financial breakeven point refers to that level of EBIT at which the firm can satisfy all fixed financial charges. EBIT less than this level will result in negative EPS. Therefore EPS is zero at this level of EBIT. Thus financial breakeven point refers to the level of EBIT at which financial profit is nil.

Financial Break Even Point (FBEP) is expressed as ratio with the following equation:

[…] VIEW […]