The national income and national product accounts of a country describe the economic performance or production performance of a country.

The most frequently cited summary measures of an economy’s performance are the gross national product (GNP) or gross domestic product (GDP). However, there is a subtle distinction between GNP and GDP since both move closely together. Anyway, the distinction between the two will be presented in due time.

- It shows flows of goods and services and factors of production between firms and households

- The circular flow shows how national income or Gross Domestic Product is calculated

Businesses produce goods and services and in the process of doing so, incomes are generated for factors of production (land, labour, capital and enterprise) for example wages and salaries going to people in work.

The national product is the value of final goods and services produced in a country. Since all the value produced must belong to someone in the form of a claim on the value, national product is equal to national income. Each transaction in an economy involves a buyer and a seller. Households spend money for buying goods and services produced.

Thus, from the buyer’s side comes the flow of money demand. In other words, we have expenditure side transaction. On the seller’s side, money payments go to factor owners in the form of rent, wages, etc. Firms spend money for buying input services. Thus, we have income- side transaction from the seller’s side. These two are obverse and reverse of the same coin. This is called circular flow of income and expenditure.

Firms and households.

Firms make production decision. Households are consuming units which absorb output produced in the business firms. Again, firms coordinate and employ different factor units which are owned by households.

In Fig. 8.1, goods and services flow from firms to households via the product market in return for the money payment for these goods and services by firms.

Arrowhead indicates such goods flow and money flow between firms and households. It is clear that the flow of monetary payment on goods and services by buyers must be identical to the money value of all goods and services that firms produce and sell to the households.

But wherefrom do the households get money? The diagram answers this question. Households supply factor inputs to firms via the factor market. In return, households receive money from firms in the form of rent, wages, etc. These income payments to households on hiring input services must be identical to the firms’ income.

This is the essence of the circular flow of income in a two-sector economy where there is no governmental activity and the economy is a closed one.

Adding these, we have:

Y = C + I

Where, Y denotes national incomes, C private consumption spending and I private investment spending.

In a three-sector (closed) economy, the government intervenes. It spends not only for the benefits of the general people and firms but also imposes taxes on them to finance its spending. If we add government activities (levying of taxes, T, and incurring expenditures, G), we have

Y = C + I + G

The relationship between households, firms and the government have been presented in a circular way in Fig. 8.2:

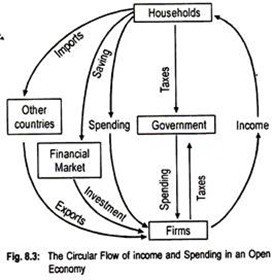

A four-sector economy is called an open economy in the sense that the country gets money by sending its goods outside, i.e., exports (X), and spends money by buying foreign-made goods and services, i.e., imports (M).

In other words, in an open economy, there occurs a trading relationship between nations. The circular flow model in a four-sector open economy has been shown in Fi g. 8.3. Adding (X – M) in the above equation, we get

g. 8.3. Adding (X – M) in the above equation, we get

Y = C + I + G + (X – M)

The only difference in the circular flow of income between a closed economy and an open economy is that, in a four-sector economy, households purchase foreign-made goods and services (i.e., imports). Likewise, people of other countries purchase goods and services not produced domestically (i.e., exports).

Imports constitute leakage from the circular flow while exports constitute injection in the circular flow. For simplicity’s sake, we have not shown in the diagram that firms and governments also sell export goods and purchase import goods.

Note that (I + G + X) constitute injections into the circular flow of income while(S + T + M) constitute withdrawals or leakages from the circular flow of income. Injections increase national income and leakages decrease national income.

The national product or national income measures the overall economic performance of a nation. To measure the national product, we add up the value of all final goods and services produced in a country in a year. Thus, we focus on firms or sellers which receive payment for the production. This is the product method of calculating national income.

Leakages (withdrawals) from the circular flow

Not all income will flow from households to businesses directly. The circular flow shows that some part of household income will be:

- Put aside for future spending, i.e. savings (S) in banks accounts and other types of deposit

- Paid to the government in taxation (T) e.g. income tax and national insurance

- Spent on foreign-made goods and services, i.e. imports (M) which flow into the economy

Withdrawals are increases in savings, taxes or imports so reducing the circular flow of income and leading to a multiplied contraction of production (output)

Injections into the circular flow are additions to investment, government spending or exports so boosting the circular flow of income leading to a multiplied expansion of output.

- Capital spending by firms, i.e. investment expenditure (I) e.g. on new technology

- The government, i.e. government expenditure (G) e.g. on the NHS or defence

- Overseas consumers buying UK goods and service, i.e. UK export expenditure (X)

An economy is in equilibrium when the rate of injections = the rate of withdrawals from the circular flow.