Risk in the context of finance and investment, refers to the uncertainty regarding the financial returns or outcomes of an investment, and the potential for an investor to experience losses or gains different from what was initially expected. It is a fundamental concept that underpins nearly all financial decisions and strategies. The essence of risk is the variability of returns, which can be influenced by a myriad of factors, including economic changes, market volatility, political instability, and specific events affecting individual companies or industries.

-

Market Risk (Systematic Risk)

Market risk, also known as systematic risk, encompasses the risk inherent to the entire market or market segment. It is the uncertainty that any financial instrument might face due to fluctuations in market variables such as interest rates, foreign exchange rates, stock prices, and commodity prices. Market risk cannot be eliminated through diversification because it affects all investments to some degree. This type of risk is influenced by geopolitical events, economic recessions, and changes in fiscal policy. Investors manage market risk through hedging strategies and asset allocation.

-

Credit Risk (Default Risk)

Credit risk, or default risk, refers to the possibility that a borrower will fail to meet their obligations in accordance with agreed terms. This risk is of particular concern to lenders, bondholders, and creditors. Credit risk assessment models evaluate the likelihood of default. To mitigate credit risk, lenders often require collateral or use credit derivatives and diversify their lending portfolio across various sectors and borrowers.

-

Liquidity Risk

Liquidity risk involves the risk that an entity will not be able to meet its short-term financial obligations due to the inability to convert assets into cash without significant loss. It affects both individuals and institutions and can be subdivided into asset liquidity risk and funding liquidity risk. Asset liquidity risk is the difficulty in selling assets quickly at their fair value, while funding liquidity risk relates to the challenge in obtaining funds to meet obligations. Management strategies include maintaining adequate cash reserves and having access to reliable funding sources.

-

Operational Risk

Operational risk is associated with failures in internal processes, people, and systems, or from external events. This includes everything from business disruptions, system failures, fraud, and cyberattacks to legal risks and natural disasters. Unlike market or credit risk, operational risk is more difficult to quantify and manage because it encompasses a wide range of unpredictable factors. Organizations address operational risk through robust internal controls, continuous monitoring, and having effective disaster recovery and business continuity plans.

-

Country and Political Risk

Country risk involves the uncertainties that international investing brings, including economic, political, and social instability in the country where the investment is made. Political risk refers more specifically to the risk of loss from changes in government policy, expropriation of assets, and civil unrest. These risks can affect the overall investment climate and specific asset values. Investors mitigate these risks through geopolitical analysis, diversification, and sometimes, by purchasing political risk insurance.

-

Interest Rate Risk

Interest rate risk is the risk that an investment’s value will change due to a change in the absolute level of interest rates, in the spread between two rates, in the shape of the yield curve, or in any other interest rate relationship. This type of risk particularly affects bonds, as their prices are inversely related to interest rates. Managing interest rate risk involves adjusting portfolio duration, diversifying across different types of rates, and using interest rate derivatives.

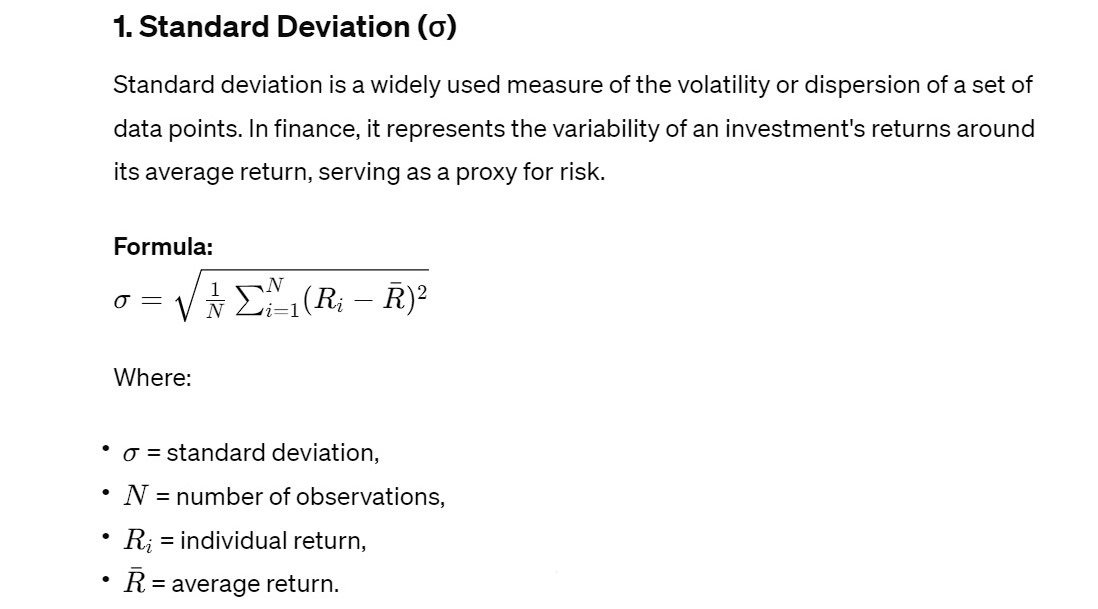

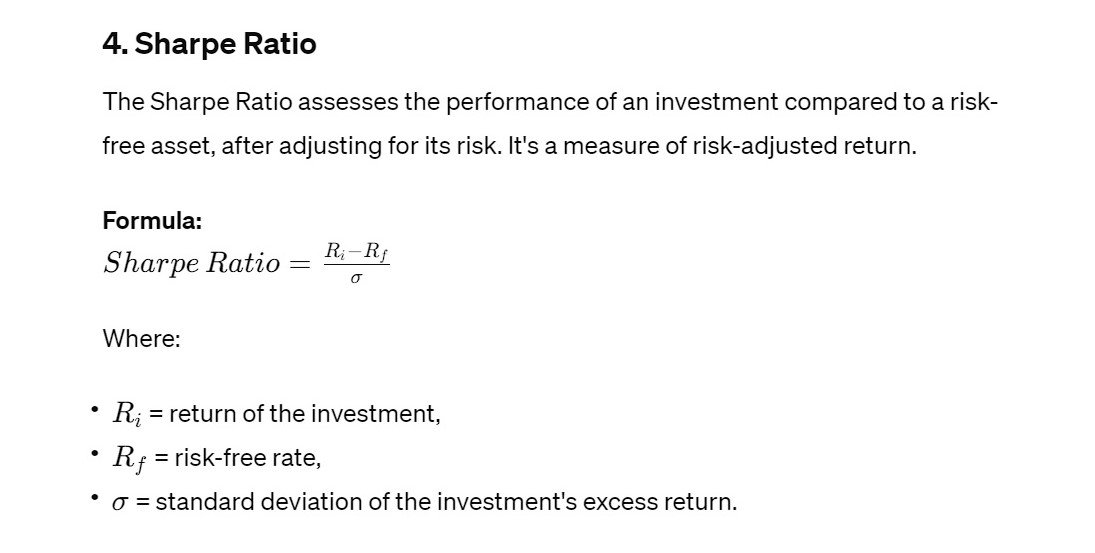

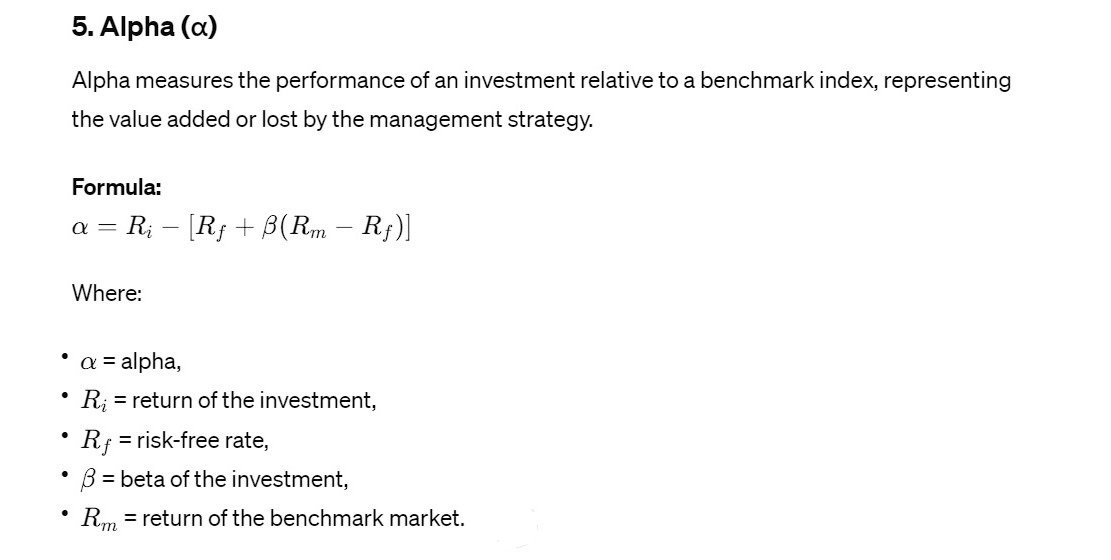

Measuring Risk