Return in finance refers to the profit or loss generated on an investment over a specific period, typically expressed as a percentage of the initial investment amount. It represents the financial gains or losses an investor realizes from their investment activity and is a key measure of investment performance. Understanding the concept of return is essential for investors as it helps assess the effectiveness of investment decisions, evaluate the performance of investment portfolios, and make informed decisions about future investment opportunities.

Returns can be classified into two main categories: absolute returns and relative returns.

-

Absolute Returns:

Absolute returns measure the actual monetary gain or loss generated by an investment over a specific period. It represents the difference between the final value of the investment and its initial cost, irrespective of external factors. Absolute returns provide a clear picture of the profitability of an investment and are expressed in terms of currency units (e.g., dollars, euros).

-

Relative Returns:

Relative returns compare the performance of an investment against a benchmark or a reference index. It assesses how well an investment has performed relative to a standard measure of performance. Relative returns are particularly useful for evaluating the performance of actively managed investment portfolios compared to a passive benchmark. They provide insights into whether an investment has outperformed or underperformed the market or a specific asset class.

Returns can be generated from various sources:

-

Capital Appreciation:

Capital appreciation occurs when the market value of an investment increases over time, resulting in a profit when the investment is sold at a higher price than its purchase price.

-

Income Generation:

Income generation involves earning periodic payments from an investment, such as interest, dividends, or rental income. These payments contribute to the overall return generated by the investment.

-

Dividend Reinvestment:

Dividend reinvestment involves using dividends received from an investment to purchase additional shares or units of the same investment, thereby increasing the potential for future returns through compounded growth.

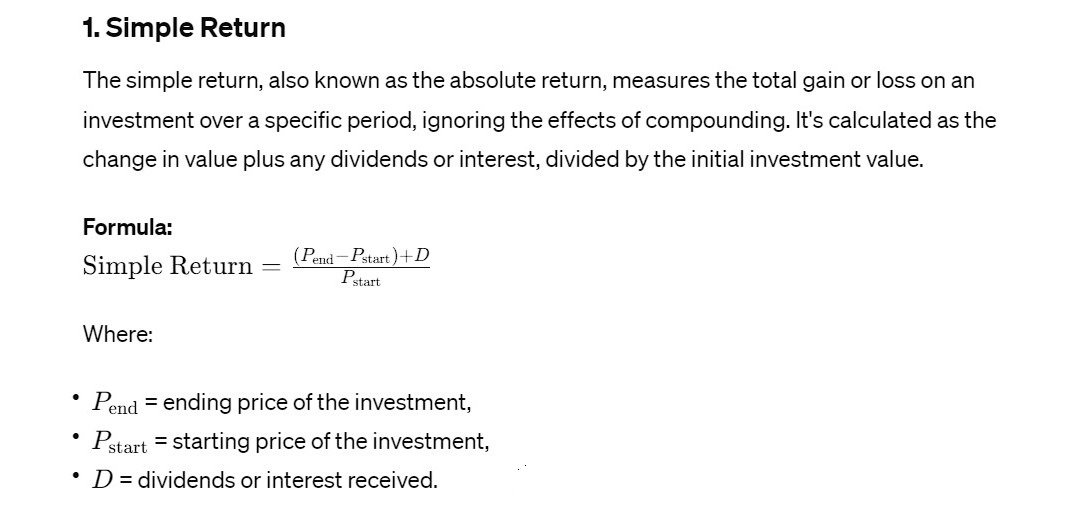

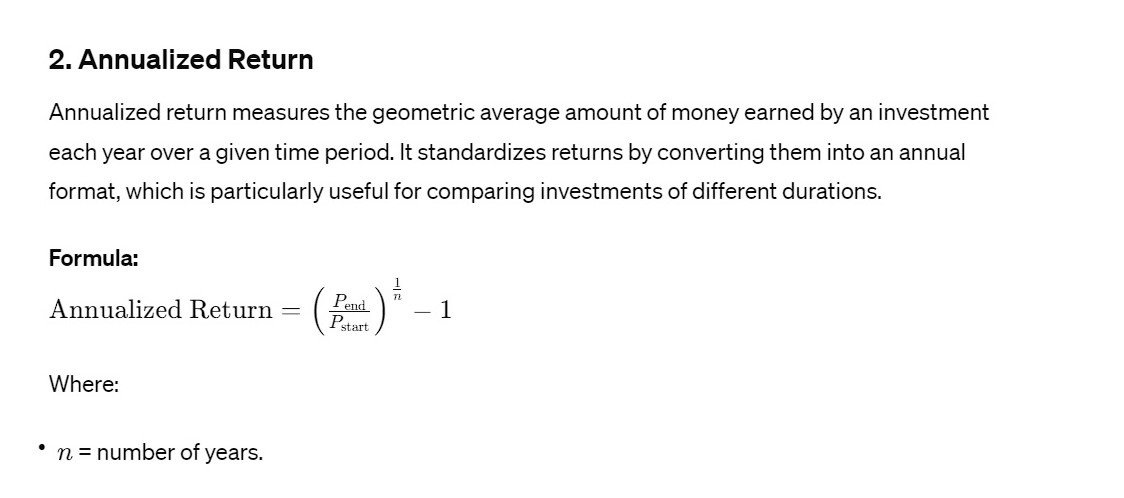

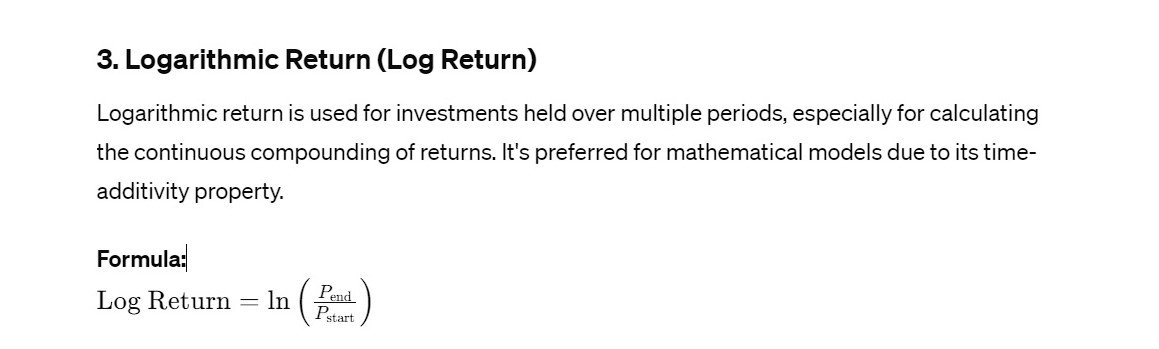

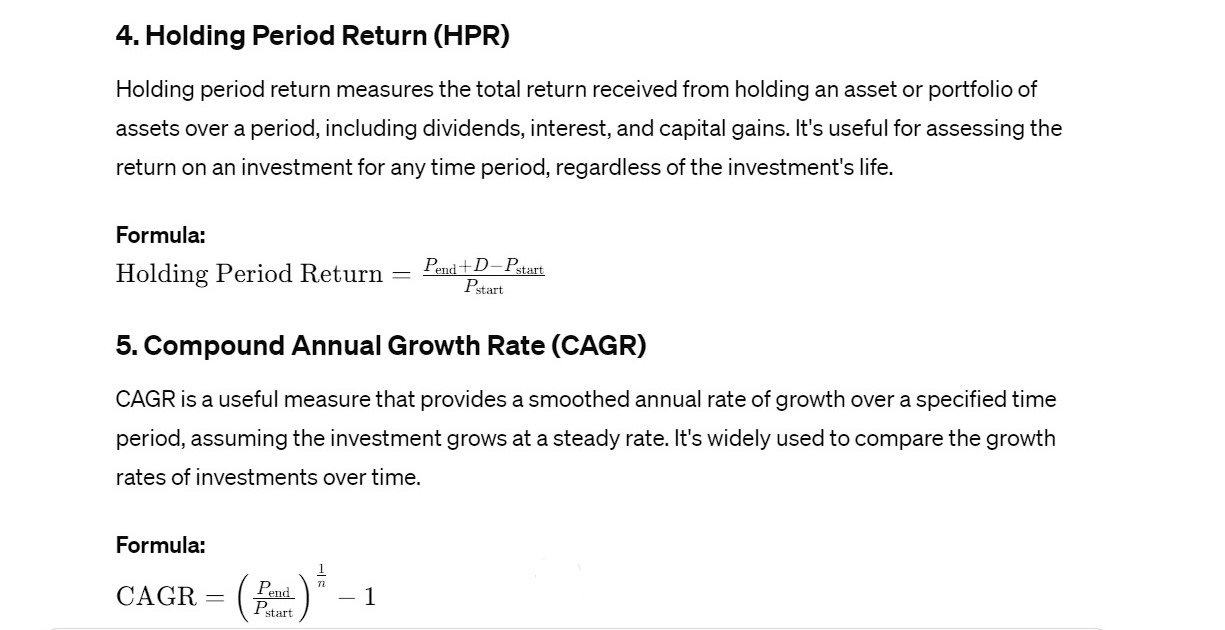

Measures of Return

One thought on “Meaning of Return, Measures of Return, Holding period of Return, Annualized return, Expected Return”