Primary distribution involves apportionment or allocation of overhead to all departments in a factory on logical and rational basis. This process of apportionment is also known as departmentalisation of overhead. It is to be carefully noted that at the time of making primary distribution, the distinction between production and service departments is ignored.

Following points should be considered for primary distribution of items of overheads:

(i) Basis for distribution should be equitable and practicable;

(ii) Method adopted for distribution should not be time-consuming;

(iii) Overhead expenses should be distributed among different departments on the basis of benefits received by departments;

For the purpose of primary distribution, a departmental distribution summary is prepared in the following way:

Basis of Apportionment of Factory Overhead:

Expenses:

- Lighting, heating, rent, rates and taxes, depreciation on building, repair cost of building, caretaking etc.

- Insurance on Plant and Machinery, Building; Depreciation on Plant and Machinery; Maintenance of Plant and Machinery.

- Insurance on tools and fixtures, power, repairs and maintenance cost etc.

- Canteen subsidy or expenses, pension, medical expenses, personnel department expenses, cost of recreational facilities. Expenses of wage department

- Cost of supervision.

Base:

- Floor area occupied by each department. Light points for lighting.

- Capital values of Assets.

- Direct Labour hours or Machinery hours.

- Number of employees or workers.

- Time devoted.

Apportionment of Overhead

Secondary Distribution:

In a factory a product does not pass through Service department (S), but service department renders service to production departments for carrying on production function. It is, therefore, logical that the product cost should bear the equitable share of cost of service department. Under this backdrop, the second step is to distribute the total cost of service departments among the production departments.

The process of redistributing the cost of service departments among production departments is known as secondary distribution. Here, the cost of service department means the apportioned overheads plus direct materials plus direct labour and direct expenses of concerned service department.

Bases for Secondary Distribution:

Service Department Costs:

(i) Employment department

(ii) Maintenance department

(iii) Purchase department

(iv) Store keeping

(v) Canteen, welfare and recreation

Basis of Redistribution:

(i) Rate of labour-turnover or number of employees.

(ii) Hours worked for each department.

(iii) No. of purchase orders or value of materials purchased.

(iv) No. of requisitions.

(v) No. of employees of each department.

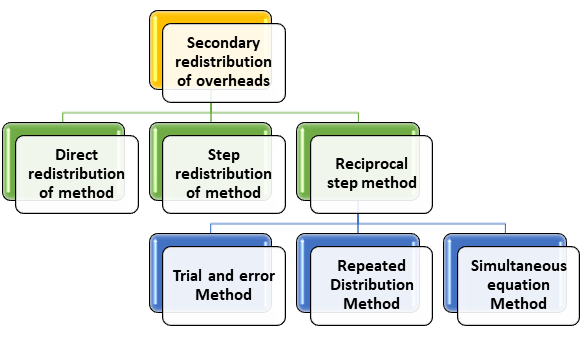

(i) Direct Redistribution Method:

Under this method, service department’s costs are apportioned to production departments only ignoring service rendered by one service department to another. When this method is followed, the number of secondary distribution will be equal to number of secondary department.

(ii) Step Method:

This method of redistribution gives cognizance to the service rendered by one service department to another service department. The cost of service department which renders service to the largest number of other departments is distributed first.

After this is done, the cost of service department serving the next largest number of department is apportioned. This process continues till the cost of last service department is apportioned. The cost of last service department is apportioned among production departments only.

(iii) Reciprocal Distribution Method:

There may be two or more service departments in a factory and they may render service to each other. In that situation it is logical to give weight to inter-departmental services while distributing the expenses of service departments.

There are three methods for dealing with the distribution of inter-departmental services:

(A) Trial and Error Method

(B) Repeated Distribution Method

(C) Simultaneous Equation Method.

One thought on “Overhead costing: Primary and Secondary”