The analysis of factory overhead variances is more complex than variance analysis for direct materials and direct labour. There is no standardisation of the terms or methods used for calculating overhead variances. For this reason, it is necessary to be familiar with the different approaches which can be applied in overhead variances.

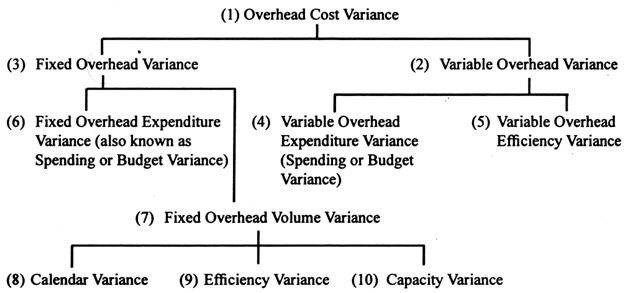

Generally, the computation of the following overhead variances are suggested:

(1) Total Overhead Cost Variance:

This overall overhead variance is the difference between the actual overhead cost incurred and the standard cost of overhead for the output achieved.

This can be computed by applying the following formula:

(Actual overhead incurred) – (Standard hours for the actual output x Standard overhead rate per hour)

Or

(Actual overhead incurred) – (Actual output x Standard overhead rate per unit)

(2) Variable Overhead Variance:

It is the difference between actual variable overhead cost and standard variable overhead allowed for the actual output achieved.

The formula for computing this variance is as follows:

(Actual Variable Overhead Cost) – (Actual Output x Variable Overhead rate per unit)

Or

(Actual Variable Overhead Cost) – (Std. hours for actual output x Std. Variable overhead rate per hour)

(3) Fixed Overhead Variance:

This variance indicates the difference between the actual fixed overhead cost and standard fixed overhead cost allowed for the actual output.

This variance is found by using the following formula:

Fixed Overhead Variance = (Actual Fixed Overhead Cost – Fixed Overhead absorbed)

Or

(Actual Fixed Overhead Cost) – (Actual Output x Fixed Overhead rate per unit)

Or

(Actual fixed overhead cost) – (Std. hours for actual output x Std. fixed overhead rate per hour)

(4) Variable Overhead Expenditure (Spending or Budget) Variance:

This variance indicates the difference between actual variable overhead and budgeted variable overhead based on actual hours worked.

This variance is found by using the following:

(Actual variable overhead – Budgeted variable overhead)

(5) Variable Overhead Efficiency Variance:

This variance is like labour efficiency variance and arises when actual hours worked differ from standard hours required for good units produced. The actual quantity produced and standard quantity fixed might be different because of higher or lower efficiency of workers employed in the manufacturing of goods.

This variance is found by using the following formula:

(Actual hours – Standard hours for actual output) x Standard variable overhead rate per hour

(6) Fixed Overhead Expenditure (Spending or Budget) Variance:

This variance indicates the difference between actual fixed overhead and budgeted fixed overhead.

The formula for computing this variance is as follows:

(Actual fixed overhead – Budgeted fixed overhead)

(7) Fixed Overhead Volume Variance:

Volume variance relates to only fixed overhead. This variance arises due to the difference between the standard fixed overhead cost allowed (absorbed) for the actual output and the budgeted fixed overhead based on standard hours allowed for actual output achieved during the period. The variance shows the over-or-under-absorption of fixed overheads during a particular period. If the actual output is more than the standard output, there is over-absorption and variance is favourable. If actual output is less than the standard output, the volume variance is unfavourable.

The formula for computing this variance is as follows:

(Budgeted fixed overhead applied to actual output – Budgeted fixed overhead based on standard hours allowed for actual output)

Or

(Actual production – Budgeted production) x Std. fixed overhead rate per unit

Volume variance is further sub-divided into three variances:

(8) Fixed Overhead Calendar Variance:

It is that portion of volume variance which is due to the difference between the number of actual working days in the period to which the budget is applicable and budgeted number of days in the budget period.

If actual working days is more than the budgeted working days, the variance is favourable as work has been done on days more than budgeted or allowed and vice-versa.

The formula is as follows:

(No. of actual working days – No. of budgeted working days) x Std. fixed overhead rate per day. Calendar variance can be computed based on hours or output.

Then the formulae are:

Hours Basis:

Calendar Variance = (Revised Budget Capacity hours – Budget Hours) x Std. Fixed Overhead rate per hour

If revised budgeted capacity hours are more than the budgeted hours, the variance will be favourable. In the reverse situation, the variance will be unfavourable.

Output Basis:

Calendar Variance = (Revised budgeted quantity in terms of actual number of days worked – Budgeted quantity) x Standard fixed overhead rate per unit

If revised budgeted quantity is more than the budgeted quantity; the variance is favourable; if revised budgeted quantity is less, the variance will be unfavourable.

(9) Fixed Overhead Efficiency Variance:

It is that portion of volume variance which arises when actual hours of production used for actual output differ from the standard hours specified for that output. If actual hours worked are less than the standard hours, the variance is favourable and when actual hours are more than the standard hours, the variance is unfavourable.

The formula is:

Fixed Overhead Efficiency Variance = (Actual hours – Standard hours for actual production) x Fixed overhead rate per hour

Fixed Overhead Efficiency Variance = (Actual production – Standard production as per actual time available) x Fixed overhead rate per unit

(10) Fixed Overhead Capacity Variance:

It is that part of fixed overhead volume variance which is due to the difference between the actual capacity (in hours) worked during a given period and the budgeted capacity (expressed in hours). The formula is

Capacity Variance = (Actual Capacity Hours – Budgeted Capacity) x Standard fixed overhead rate per hour

This variance represents idle time also. If actual capacity hours are more than the budgeted capacity hours, the variance is favourable and if actual capacity hours are less than the budgeted capacity hours the variance will be unfavourable.

In case actual number of days and budgeted number of days are also given, then budgeted capacity hours will be calculated in terms of actual number of days and it will be known as revised budgeted capacity hours, i.e., budgeted hours in actual days worked.

In this situation, the formula for calculating capacity variance will be as follows:

Capacity Variance = (Actual Capacity hours – Revised Budgeted Capacity hours) x Standard fixed overhead rate per hr.

In the above formula, the variance will be favourable if actual capacity hours are more than the revised budgeted hours. However, if actual capacity hours are lesser than the revised budgeted hours, the variance will be adverse as lesser hours means that lesser actual hours have been worked taking the actual days utilised into account.

Two-way, Three-way and Four-way Variance Analysis:

The above overhead variances are also classified as Two-way, Three-way and Four-way variance.

The different variances under these categories are listed below:

(A) Two-way Variance Analysis:

The two-way analysis computes two variances budget variance (sometimes called flexible budget or controllable variance) and volume variance, which means:

(i) Budget variance = Variable spending variance + Fixed spending (budget) Variance + Variable efficiency variance

(ii) Volume variance = Fixed volume variance

(B) Three -Way Variance Analysis:

The three-way analysis computes three variances spending, efficiency and volume variances. Therefore,

(i) Spending variance = Variable spending variance + Fixed spending (budget) variance

(ii) Efficiency variance = Variable efficiency variance

(iii) Volume variance = Fixed volume variance

(C) Four-way Variance Analysis:

The four-way analysis includes:

(i) Variable spending variance

(ii) Fixed spending (budget) variance

(iii) Variable efficiency variance

(iv) Fixed volume variance.

One thought on “Overhead Variance”