Central Securities Depository Ltd. (CSDL), Functions, Benefits

Central Securities Depository Ltd. (CSDL) is a significant entity in the Indian financial market, playing a pivotal role in the dematerialization of securities and enhancing the efficiency of the securities settlement process. It is responsible for managing the holding and settlement of securities in electronic form, a service that has revolutionized the Indian securities market by facilitating paperless transactions, reducing risks, and promoting transparency.

CSDL was established in 1999 and is one of the two depositories operating in India, the other being the National Securities Depository Limited (NSDL). Both CSDL and NSDL are regulated by the Securities and Exchange Board of India (SEBI), which ensures their compliance with industry standards and governance practices.

Functions of CSDL:

-

Dematerialization of Securities:

CSDL’s primary function is to convert physical securities, such as shares, bonds, and debentures, into electronic form. This process is called dematerialization, and it has significantly reduced the risks associated with physical securities, including theft, forgery, and loss. Investors can hold securities in their demat accounts, and transactions are executed electronically.

- Settlement of Securities:

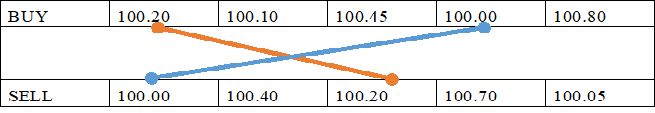

CSDL plays a vital role in the settlement of securities transactions in the stock markets. It facilitates the efficient transfer of securities between buyers and sellers by ensuring that securities are transferred electronically upon payment, ensuring seamless and secure transactions.

- Centralized Custody:

CSDL provides centralized custody of securities, allowing investors to hold their securities in a safe and accessible electronic format. By acting as a custodian, it minimizes the risks of holding securities physically and offers a more transparent, secure, and efficient system.

-

Investor Services:

CSDL offers various services to investors, such as corporate actions (like dividend payments, stock splits, bonus issues, etc.), electronic transfer of securities, and nomination facilities for demat accounts. It also provides an electronic platform for investors to access their holdings, monitor transactions, and update account details.

- Pledge and Lien Services:

CSDL offers a pledge and lien facility that enables investors to pledge their securities for borrowing purposes. This facility is essential for leveraging securities as collateral in various financial transactions, such as margin funding or loans.

-

Electronic Book Entry System:

CSDL’s electronic book entry system ensures that securities transactions are recorded electronically, ensuring that investors’ holdings are updated and accessible instantly. This system eliminates paperwork, reduces human errors, and accelerates the settlement process.

- Systematic Investment Plan (SIP):

CSDL has enabled Systematic Investment Plans (SIPs) through mutual fund units. Investors can automatically invest in mutual fund schemes through their demat accounts, which are electronically recorded and tracked by CSDL.

Benefits of CSDL

- Efficiency and Speed:

By converting physical securities into electronic form, CSDL ensures that securities transactions are processed quickly, reducing the time and effort required for manual paperwork. The settlement time is also significantly reduced, contributing to quicker transfer of securities and funds.

- Reduced Risk:

CSDL reduces the risks associated with holding physical securities. The chances of theft, damage, or loss of securities are eliminated since all transactions are executed electronically. Additionally, it reduces counterparty risks and the potential for fraud in securities transfers.

- Cost-Effectiveness:

The dematerialization process eliminates the need for printing and handling physical certificates, leading to reduced administrative and processing costs. Investors also save on expenses like stamp duty and courier charges for physical certificates.

- Transparency and Security:

The electronic system operated by CSDL ensures greater transparency in the securities market. All transactions are recorded in real-time, making it easier to track ownership and transfer of securities. This system enhances investor confidence and reduces the potential for manipulation.

- Accessibility:

CSDL provides easy access to securities for investors. They can hold and trade their securities in a convenient manner through their demat accounts. The platform is accessible 24/7, providing a reliable and efficient interface for securities management.

- Corporate Actions:

CSDL ensures that all corporate actions (such as dividends, bonus issues, stock splits, etc.) are automatically credited to the respective demat accounts of investors. This removes the need for manual intervention and ensures that investors receive their entitlements promptly.

- Global Access:

CSDL’s services are not limited to Indian investors. It also enables foreign investors to hold Indian securities in demat form, facilitating foreign investment in Indian markets and promoting capital inflows into the country.

Regulatory and Compliance Role:

CSDL is regulated by SEBI, which monitors and ensures that the depository’s operations are in line with Indian securities regulations. This regulatory oversight provides an added layer of trust for investors and ensures that CSDL follows best practices in terms of governance, security, and operational standards. It is also required to comply with International Financial Reporting Standards (IFRS), Anti-Money Laundering (AML) laws, and other industry norms.