In the stock market, there is always a buyer and a seller. So, when a person buys a certain number of shares, there is another trader who sells the shares. This trade is settled only when the buyer receives the shares and the seller receives the money.

There are three phases in a secondary market transaction:

- Trading

- Clearing

- Settlement

- Trading

In the stock market, a large number of trades occur simultaneously. The stock exchanges use an electronic order matching system to match ‘buy’ and ‘sell’ orders from different traders. This way, each trade is executed.

For instance, imagine that stock ‘X’ is trading in the stock market.

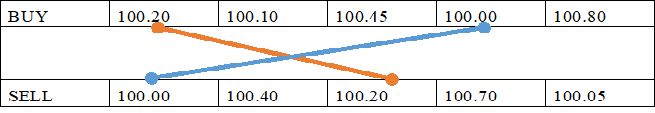

The buy and sell orders for this stock are as follows:

Here the costliest buy prices are matched against the cheapest available sell prices, and whenever the buy price is less than or equal to the best available sell price a match is done. This of course also depends on the respective quantities available in the market across buys and sells and is known as market depth.

So even if a particular price may result in a match, if there is not enough quantity available at the seller side at that price, the buy order will still not be fully traded.

The market depth is created by brokerages who collect orders from different investors and pass it on to the stock exchanges, most likely to be the two most popular exchanges in India the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). In this process, brokerages act as the intermediary between the investor and the stock exchange.

-

Clearing

Once two orders match and a trade is executed, the clearing process takes place. Clearing is the identification of what security is owed to the buyer and how much money is owed to the seller. The entire process is managed by ‘clearing houses’. These are independent entities.

For example, imagine that there are two traders: Ramesh and Suresh.

However, in the real market scenario, traders tend to conduct multiple transactions. As a result, the clearing house identifies all the transactions and the net amount or net securities owed to the trader are calculated.

-

Settlement

The next step is to fulfil the financial obligations identified in the clearing step. This involves the transaction settlement for the buyers and sellers.

So once the buyer receives the security and the seller receives the payment, the transaction is settled.

Participants Involved in the Process

-

Clearing Corporation

Clearing corporation is one of the major participants involved in clearing and settlement process in stock market. The responsibility for clearing and settlement of trade executed at the stock exchange lies on the National Securities Clearing Corporation Limited (NSCCL). It is also in charge of risk management and is obligated for meeting all settlement regardless of the member defaults.

-

Clearing Members/Custodians

They are another participant in the clearing and settlement process in Indian stock market. When trading members place deals in the stock exchange, the same is moved to NSCCL, which transfers them to the clearing members. The clearing member is in charge of determining the position of share to suit the trade.

-

Clearing banks

Clearing banks are responsible for the settlement of funds. There are 13 clearing banks, and each clearing member needs to open a clearing account with either one of them. In case of a pay-out, clearing members receive funds in the clearing account and in case of pay-in they need to make funds available.

-

Depositories

There are two depositories in India – National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL). These two depositories hold your Demat account, and clearing members also need to maintain a clearing pool account with them.

Clearing members need to transfer the securities to the clearing pool account they hold with the depositories on the date of settlement.

-

Professional Clearing Members

These are special category members appointed by the NSCCL. However, note that they are not allowed to trade, and they can only clear and settle trades executed for their clients. Professional clearing members generally constitute banks, custodians, etc.

One thought on “Trade Settlement Procedures”