Sources of finance refer to the various ways a business or individual can obtain funds to meet operational, investment, or expansion needs. These sources are broadly classified into internal and external sources. Internal sources include retained earnings, depreciation funds, and asset sales, which do not require external borrowing. External sources include equity financing (issuing shares), debt financing (loans, bonds), and government grants. Short-term sources like trade credit and bank overdrafts help manage working capital, while long-term sources like venture capital and public deposits support growth. The choice of finance depends on factors like cost, risk, and repayment terms. A balanced mix ensures financial stability, minimizes risk, and enhances business sustainability.

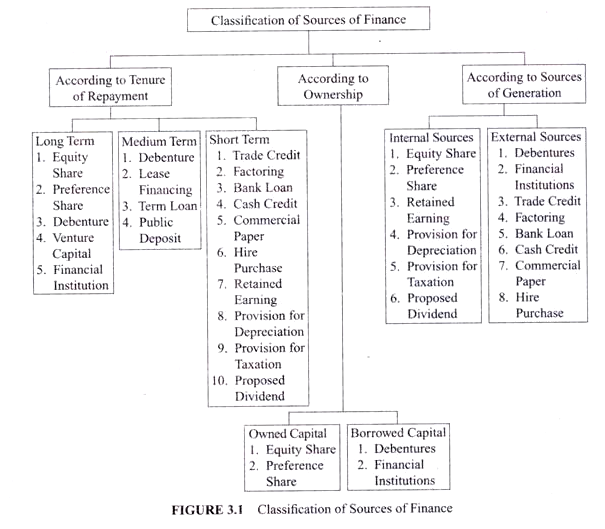

A firm can obtain funds from a variety of sources (see Figure 3.1), which may be classified as follows:

-

Long-term Sources:

A firm needs funds to purchase fixed assets such as land, plant & machinery, furniture, etc. These assets should be purchased from those funds which have a longer maturity repayment period. The capital required for purchasing these assets is known as fixed capital. So funds required for fixed capital must be financed using long-term sources of finance.

-

Medium-term Sources:

Funds required for say, a heavy advertisement campaign, the benefit of which lasts for more than one accounting period, should be financed through medium-term sources of finance. In other words expenditure that results in deferred revenue should be financed through medium-term sources.

-

Short-term Sources:

Funds required for meeting day-to-day expenses, i.e. revenue expenditure or working capital should be financed from short-term sources whose maturity period is one year or less.

-

Owned Capital:

Owned capital represents equity capital, retained earnings and preference capital. Equity share has a perpetual life and are entitled to the residual income of the firm but the equity shareholders have the right to control the affairs of the business because they enjoy the voting rights.

-

Borrowed Capital:

Borrowed capital represents debentures, term loans, public deposits, borrowings from bank, etc. These are contractual in nature. They are entitled to get a fixed rate of interest irrespective of profit and are to be repaid on a fixed date.

-

Internal Sources:

If the funds are created internally, i.e. without using debt, such sources can be termed as internal sources. Examples of such could be: Ploughing back of profits, provision for depreciation, etc.

-

External Sources:

If funds are re-used through the sources which create some obligation to the firm, such sources can be termed as external sources, e.g. lease financing, hire purchase, etc..

One thought on “Source of Finance”