Monopolistic Competition, Concepts, Meaning, Definitions, Characteristics, Price Determination, Advantages and Disadvantages

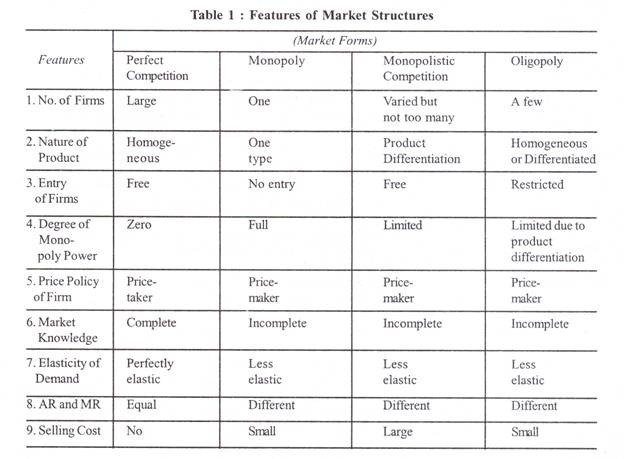

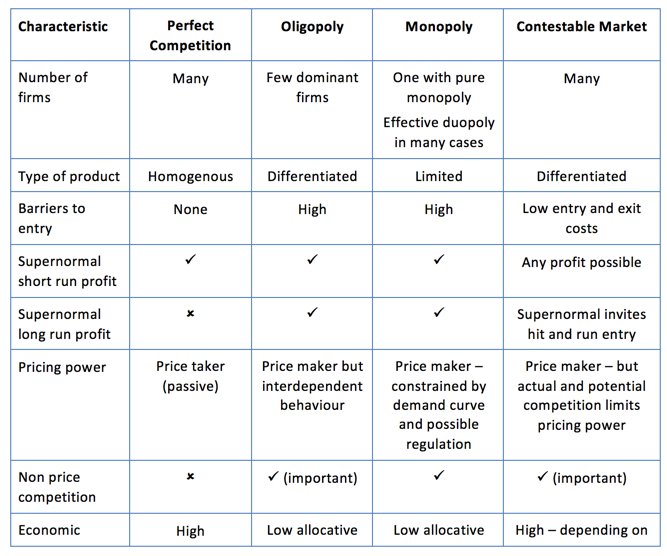

Monopolistic competition is a market structure that combines elements of both monopoly and perfect competition. In this system, a large number of firms operate in the market, each producing a product that is similar but not identical to others. Product differentiation is the core concept of monopolistic competition. Firms attempt to distinguish their products through branding, quality, design, packaging, or services. Although firms enjoy some degree of monopoly power over their own products, this power is limited due to the presence of close substitutes.

Meaning of Monopolistic Competition

Monopolistic competition refers to a market situation where many sellers sell differentiated products to a large number of buyers. Each firm acts independently and has limited control over price. Consumers perceive differences among products, even though they serve the same basic purpose. Because of differentiation, firms face downward-sloping demand curves. Entry and exit of firms are relatively free, which ensures that abnormal profits exist only in the short run, while in the long run firms earn normal profits.

Definitions of Monopolistic Competition

- Edward Chamberlin’s Definition

According to Edward Chamberlin, “Monopolistic competition is a market structure in which there are many sellers selling differentiated products. Each firm has a certain degree of monopoly power over its own product due to differentiation, but close substitutes are available in the market, limiting excessive pricing.”

- Joan Robinson’s Definition

Joan Robinson defined monopolistic competition as “a market structure where many firms produce similar but not identical products, and each firm competes independently with limited control over price.”

- Leftwich’s Definition

According to Leftwich, “Monopolistic competition is a market structure in which there are many firms producing differentiated products, and there is freedom of entry and exit in the long run.”

Characteristics of Monopolistic Competition

- Large Number of Buyers and Sellers

Monopolistic competition involves many buyers and sellers operating in the market. However, unlike perfect competition, each firm holds a relatively small market share and operates independently. No single firm has enough influence to affect overall market supply or pricing significantly. The presence of numerous sellers ensures that customers have multiple choices. Each firm faces competition from others offering close substitutes, although products are not identical. This structure encourages innovation and marketing strategies to capture consumer attention and retain a loyal customer base.

- Product Differentiation

One of the most defining features of monopolistic competition is product differentiation. Firms sell products that are similar but not identical, which gives consumers the perception of uniqueness. Differentiation can be based on quality, packaging, features, branding, style, or customer service. This perceived uniqueness allows firms to charge slightly higher prices than competitors. For example, different brands of toothpaste or clothing are essentially the same but marketed differently. Product differentiation creates brand loyalty and gives firms a degree of pricing power in the market.

- Freedom of Entry and Exit

Monopolistic competition allows free entry and exit of firms in the long run. New firms can enter the market when existing firms are earning supernormal profits, increasing competition and reducing profit margins over time. Conversely, firms that incur losses can leave without major obstacles. This flexibility ensures that no single firm dominates the market permanently. As firms enter or exit, the number of sellers stabilizes, and long-run equilibrium is achieved where each firm earns normal profit. This characteristic promotes healthy competition and market dynamism.

- Some Degree of Price Control

Firms in monopolistic competition have some pricing power due to product differentiation. Unlike perfect competition, where firms are price takers, here each firm faces a downward-sloping demand curve, allowing them to set prices independently within a certain range. However, the presence of close substitutes limits this power. If a firm charges significantly higher prices, consumers may shift to competing products. Thus, while firms can influence prices to a limited extent, their pricing decisions are closely tied to how well they differentiate their product.

- Non-Price Competition

In monopolistic competition, firms often engage in non-price competition to attract and retain customers. Since raising prices can drive customers to competitors, businesses focus on marketing tactics such as advertising, sales promotions, improved packaging, customer service, or introducing new features. These strategies build brand identity and customer loyalty without directly altering the price. For instance, mobile phone brands emphasize camera quality or screen resolution over price cuts. Non-price competition is vital in this market structure to maintain customer base and market share.

- Independent Decision Making

Each firm in monopolistic competition makes its own independent business decisions regarding pricing, output, marketing, and product design. There is no formal coordination among firms as seen in oligopolies. The strategic decisions are based on individual cost structures, market analysis, and competitive positioning. Although firms are aware of competitors’ actions, they don’t engage in collective behavior like price fixing. This autonomy allows firms to experiment, innovate, and adopt different business strategies tailored to their product and target customers.

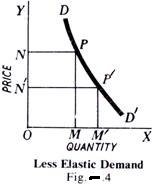

- Elastic Demand Curve

A firm in monopolistic competition faces a highly elastic but not perfectly elastic demand curve. Because there are many close substitutes available, a small increase in price may lead to a significant decrease in quantity demanded. However, due to product differentiation, the firm retains some customers who are loyal to the brand or specific features. This elasticity reflects the balance between customer preference and market competition. Firms must therefore carefully assess the price sensitivity of their consumers to maintain sales volume and revenue.

- High Selling and Promotional Costs

Advertising, promotional campaigns, and other selling efforts are prominent in monopolistic competition. Since products are differentiated, firms spend heavily on selling costs to inform, persuade, and remind customers of their product’s uniqueness. These costs are necessary to sustain brand loyalty and attract new buyers in a highly competitive environment. Companies may invest in social media, endorsements, packaging innovations, or after-sale services. Though these expenses don’t directly enhance production, they significantly impact consumer perception and play a central role in business success.

Price Determination under Monopolistic Competition

Price determination under monopolistic competition explains how firms fix prices in a market where many sellers offer similar but differentiated products. Each firm has limited control over price because its product is unique, yet close substitutes restrict excessive pricing. Price is not decided by the entire industry but by individual firms based on demand, cost, and competition. This pricing mechanism combines elements of monopoly power and competitive pressure, making it highly relevant to real-world markets.

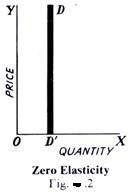

- Nature of Demand Curve

In monopolistic competition, each firm faces a downward-sloping demand curve. This is because product differentiation creates brand loyalty, allowing firms to reduce prices to increase sales. However, demand is relatively elastic since consumers can switch to close substitutes if prices rise. The downward slope indicates that firms must lower prices to sell more units, which directly influences how price is determined in the market.

- Role of Product Differentiation

Product differentiation plays a crucial role in price determination. Firms differentiate products through quality, design, packaging, brand image, and services. Greater differentiation reduces price sensitivity and gives firms more control over pricing. Consumers are willing to pay higher prices for preferred brands. However, differentiation does not eliminate competition, as substitute products limit excessive price increases. Entrepreneurs rely on differentiation to influence demand and pricing flexibility.

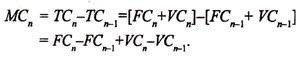

- Cost Conditions and Pricing

Cost conditions strongly influence price determination under monopolistic competition. Firms analyze average cost and marginal cost before fixing prices. Profit maximization occurs where marginal cost equals marginal revenue. The price is then determined from the demand curve at that output level. If production or selling costs increase, firms may raise prices, provided consumers accept the increase. Efficient cost management is therefore essential for competitive pricing.

- Short-Run Price Determination

In the short run, firms under monopolistic competition may earn supernormal profits, normal profits, or incur losses. When demand is high and costs are low, firms can charge prices above average cost. Price is determined where marginal cost equals marginal revenue. Short-run profits attract new firms, increasing competition. Thus, short-run price determination reflects temporary market conditions rather than long-term equilibrium.

- Long-Run Price Determination

In the long run, free entry of firms eliminates supernormal profits. New firms introduce close substitutes, reducing the demand for existing firms. The demand curve shifts leftward until it becomes tangent to the average cost curve. At this point, firms earn only normal profits. Price equals average cost but remains higher than marginal cost, reflecting product differentiation and excess capacity.

- Role of Selling Costs

Selling costs such as advertising and promotion influence price determination under monopolistic competition. Firms incur selling costs to shift the demand curve to the right by increasing brand awareness and loyalty. These costs raise total cost and often lead to higher prices. While selling costs strengthen competitive position, excessive advertising increases prices without proportionate consumer benefit, affecting overall efficiency.

- Impact of Competition on Pricing

Competition limits price control under monopolistic competition. Firms must consider competitor prices and consumer reactions before fixing prices. Excessive pricing may lead to loss of customers to substitutes. At the same time, price wars are uncommon because firms prefer non-price competition. This balanced competitive pressure ensures moderate prices, innovation, and product variety while preventing monopolistic exploitation.

Advantages of Monopolistic Competition

- Wide Variety of Products

One of the major advantages of monopolistic competition is the availability of a wide variety of products. Firms differentiate their goods based on quality, design, packaging, branding, and features. This variety satisfies diverse consumer tastes and preferences. Consumers can choose products that best match their needs, income levels, and lifestyles. Unlike perfect competition, where products are homogeneous, monopolistic competition enhances consumer satisfaction through choice and diversity.

- Consumer Satisfaction

Monopolistic competition increases consumer satisfaction by offering differentiated products and improved services. Firms focus on customer needs to maintain brand loyalty. Better after-sales services, warranties, and attractive packaging enhance consumer experience. Consumers are not forced to buy a single standardized product and can switch brands easily. This freedom of choice empowers consumers and encourages firms to continuously improve product quality and customer service.

- Freedom of Entry and Exit

Another important advantage is the freedom of entry and exit of firms. New firms can easily enter the market if they perceive profit opportunities. Similarly, inefficient firms can exit without major barriers. This flexibility promotes healthy competition and innovation. It prevents long-term monopolistic profits and ensures efficient resource allocation. Free entry and exit also make the market dynamic and adaptable to changing consumer preferences.

- Encouragement to Innovation

Monopolistic competition strongly encourages innovation and creativity. Firms continuously introduce new designs, features, and improvements to differentiate their products from competitors. Innovation helps firms attract consumers and gain a competitive edge. This leads to technological advancement and improved product quality over time. Continuous innovation benefits consumers and contributes to overall economic development by promoting research and development activities.

- Limited Price Control

Firms under monopolistic competition enjoy limited price control due to product differentiation. They can set prices slightly above competitors without losing all customers. However, this control is not absolute because close substitutes exist. This balance allows firms to recover costs and earn normal profits while protecting consumers from excessive pricing. Thus, price stability is maintained through competitive pressure.

- Role of Non-Price Competition

Non-price competition is a significant advantage of monopolistic competition. Firms compete through advertising, branding, quality improvement, and customer service rather than aggressive price wars. This reduces the risk of destructive competition and encourages market stability. Non-price competition enhances product awareness and helps consumers make informed choices. It also strengthens brand identity and long-term customer relationships.

- Better Quality and Services

Under monopolistic competition, firms focus on improving quality and services to retain customers. Since consumers can easily switch to substitutes, firms strive to maintain high standards. Better quality, innovation, and customer-oriented services become essential survival strategies. This results in overall improvement in market offerings and enhances consumer welfare.

- Balanced Market Structure

Monopolistic competition provides a balanced market structure by combining competition and monopoly elements. It avoids the extremes of perfect competition and pure monopoly. Consumers enjoy choice and quality, while firms benefit from product differentiation and reasonable pricing power. This balance makes monopolistic competition suitable for real-world markets such as retail, clothing, restaurants, and consumer goods industries.

Disadvantages of monopolistic competition

- Inefficiency in Resource Allocation

Monopolistic competition often leads to inefficient allocation of resources. Firms do not produce at the minimum point of their average cost curve, unlike in perfect competition. Since each firm has some market power due to product differentiation, they charge a higher price than marginal cost, causing underproduction and inefficiency. This misallocation leads to deadweight loss and limits overall welfare. It implies that the economy does not make the best use of its resources, resulting in reduced productivity and consumer surplus.

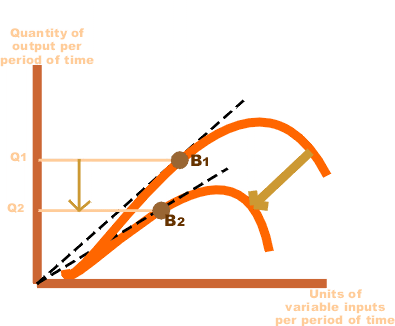

- Excess Capacity

Firms in monopolistic competition often operate with excess capacity, meaning they do not produce at full potential or minimum average cost. Due to downward-sloping demand curves and market saturation, firms can’t maximize their scale. This inefficiency results from the competitive pressure to differentiate and maintain uniqueness. Firms intentionally avoid producing large quantities to preserve price control. This leads to wasted resources, higher unit costs, and underutilization of infrastructure and labor, which ultimately reflects a less-than-optimal economic output for the industry.

- Higher Prices for Consumers

Due to product differentiation, firms in monopolistic competition have some price-setting power, leading to higher prices than in perfect competition. Consumers end up paying more for essentially similar products just because of perceived differences. This pricing strategy reduces consumer welfare, especially when the higher price is not justified by proportional quality improvements. In the long run, although supernormal profits are eroded by new entrants, prices still remain above marginal cost, resulting in persistent market inefficiency and higher expenditure for consumers.

- Wastage on Advertising and Selling Costs

Firms in monopolistic competition incur excessive costs on advertising, branding, packaging, and other selling expenses to differentiate their products. These selling costs are not directly related to improving product quality or quantity but aim to manipulate consumer perception. This results in a significant portion of resources being used for persuasive rather than productive purposes. From a societal point of view, this is considered wasteful, as these expenditures could have been used for more value-adding activities or price reductions.

- Misleading Product Differentiation

Product differentiation in monopolistic competition is often more artificial than real. Firms use branding, slogans, and packaging to create a false sense of uniqueness. This may lead consumers to believe one product is significantly better than another, even if the actual difference is minimal. Such strategies may manipulate customer decisions rather than improve the product itself. It can also promote consumerism and irrational buying behavior, where choices are driven more by image than by real value or utility.

- Lack of Long-Term Innovation

Firms in monopolistic competition may lack incentives for long-term innovation. Since the market is crowded and profits are normal in the long run, firms often focus on short-term promotional gains rather than investing in research and development. Innovation may be limited to superficial changes like packaging or color variants. In contrast to monopolies that can invest in technological advancement due to sustained profits, monopolistic firms are under constant pressure and may avoid risky, long-term improvements that require substantial capital.

- Unstable Market Structure

The ease of entry and exit in monopolistic competition creates a dynamic yet unstable market structure. Continuous entry of new firms erodes existing profits, while poorly performing firms frequently exit. This causes fluctuating market shares, inconsistent pricing strategies, and unpredictable consumer loyalty. The lack of stability makes it difficult for firms to plan for long-term investments or build lasting competitive advantages. This volatility can also confuse consumers due to rapidly changing product varieties and brands.

- Duplication of Resources

Due to multiple firms offering similar yet differentiated products, there is often a duplication of efforts and resources. Each firm invests separately in advertising, packaging, distribution, and retail space for products that fulfill nearly the same function. This redundancy leads to higher production and operating costs industry-wide. It also creates environmental and logistical inefficiencies, such as excess packaging waste or transport emissions, which could be reduced in a more centralized or coordinated market structure like perfect competition or monopoly.