Market structure refers to the nature and degree of competition in the market for goods and services. The structures of market both for goods market and service (factor) market are determined by the nature of competition prevailing in a particular market.

Determinants of Market Structure

There are a number of determinants of market structure for a particular good.

They are:

(1) The number and nature of sellers.

(2) The number and nature of buyers.

(3) The nature of the product.

(4) The conditions of entry into and exit from the market.

(5) Economies of scale

They are discussed as under:

- Number and Nature of Sellers

The market structures are influenced by the number and nature of sellers in the market. They range from large number of sellers in perfect competition to a single seller in pure monopoly, to two sellers in duopoly, to a few sellers in oligopoly, and to many sellers of differentiated products.

- Number and Nature of Buyers

The market structures are also influenced by the number and nature of buyers in the market. If there is a single buyer in the market, this is buyer’s monopoly and is called monopsony market. Such markets exist for local labour employed by one large employer. There may be two buyers who act jointly in the market. This is called duopoly market. They may also be a few organized buyers of a product.

This is known as oligopoly. Duopoly and oligopoly markets are usually found for cash crops such as rice, sugarcane, etc. when local factories purchase the entire crops for processing.

- Nature of Product

It is the nature of product that determines the market structure. If there is product differentiation, products are close substitutes and the market is characterized by monopolistic competition. On the other hand, in case of no product differentiation, the market is characterized by perfect competition. And if a product is completely different from other products, it has no close substitutes and there is pure monopoly in the market.

- Entry and Exit Conditions

The conditions for entry and exit of firms in a market depend upon profitability or loss in a particular market. Profits in a market will attract the entry of new firms and losses lead to the exit of weak firms from the market. In a perfect competition market, there is freedom of entry or exit of firms.

But in monopoly and oligopoly markets, there are barriers to entry of new firms. Usually, governments have a monopoly in public utility services like postal, air and road transport, water and power supply services, etc. By granting exclusive franchises, entries of new supplies are barred. In oligopoly markets, there are barriers to entry of firms because of collusion, tacit agreements, cartels, etc. On the other hand, there are no restrictions in entry and exit of firms in monopolistic competition due to product differentiation.

- Economies of Scale

Firms that achieve large economies of scale in production grow large in comparison to others in an industry. They tend to weed out the other firms with the result that a few firms are left to compete with each other. This leads to the emergency of oligopoly. If only one firm attains economies of scale to such a large extent that it is able to meet the entire market demand, there is monopoly.

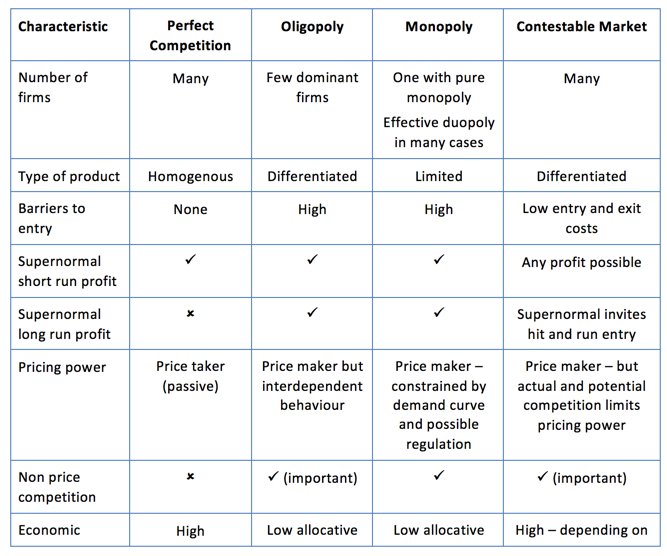

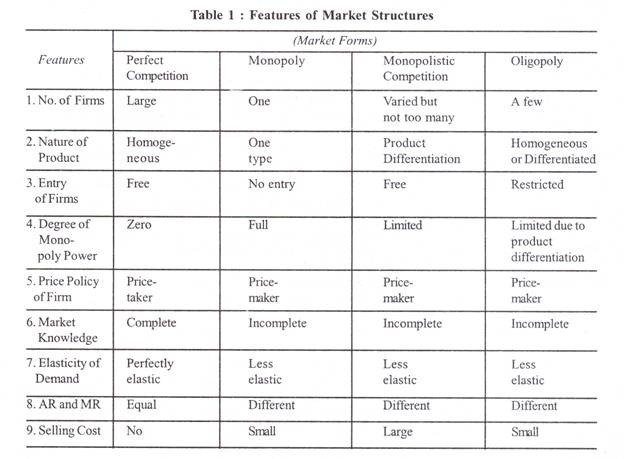

The features of market structures are shown in Table 1.

Traditionally, the most important features of market structure are:

- The number of firms (including the scale and extent of foreign competition)

- The market share of the largest firms (measured by the concentration ratio – see below)

- The nature of costs (including the potential for firms to exploit economies of scale and also the presence of sunk costs which affects market contestability in the long term)

- The degree to which the industry is vertically integrated – vertical integration explains the process by which different stages in production and distribution of a product are under the ownership and control of a single enterprise. A good example of vertical integration is the oil industry, where the major oil companies own the rights to extract from oilfields, they run a fleet of tankers, operate refineries and have control of sales at their own filling stations.

- The extent of product differentiation (which affects cross-price elasticity of demand)

- The structure of buyers in the industry (including the possibility of monopsony power)

- The turnover of customers (sometimes known as “market churn”) – i.e. how many customers are prepared to switch their supplier over a given time period when market conditions change. The rate of customer churn is affected by the degree of consumer or brand loyalty and the influence of persuasive advertising and marketing.