Market structure refers to the organizational and competitive characteristics of a market that influence the behavior of buyers and sellers. It explains how firms operate, how prices are determined, and how output decisions are made within a particular industry. The structure depends on factors such as the number of firms, nature of products, degree of competition, and entry barriers. In business economics, market structure helps analyze the level of competition and the power firms possess in influencing prices and production.

Definitions of Market Structure

- According to E. H. Chamberlin

Market structure is the set of conditions under which firms compete with one another in a market, including the number of sellers and the degree of product differentiation.

Market structure refers to the organizational characteristics of a market that affect the nature of competition and pricing policies of firms operating within it.

Market structure is the composition of a market in terms of the number of firms, their size distribution, and the degree of product homogeneity.

Characteristics of Market Structure

The number of firms operating in a market is a primary characteristic of market structure. It determines the degree of competition among sellers. In perfect competition, there are many small firms, while in monopoly there is only one seller. Oligopoly has a few large firms dominating the market. A higher number of firms increases competition and reduces individual control over price. Fewer firms lead to greater market power and influence over pricing decisions.

Market structure depends on whether products are homogeneous or differentiated. Homogeneous goods are identical in quality, size, and features, such as wheat or rice in perfect competition. Differentiated goods have branding, design, or quality differences, as seen in monopolistic competition. In monopoly, the product has no close substitute. Product differentiation allows firms to charge different prices and create brand loyalty, whereas identical goods restrict price variations and strengthen competition among firms.

The intensity of competition varies in different market structures. Perfect competition has intense competition because many sellers offer identical products. Monopolistic competition has moderate competition due to product differentiation. Oligopoly involves strategic competition among a few large firms, often through advertising and pricing strategies. Monopoly has no competition as only one firm controls the entire market. The degree of competition influences pricing policy, advertising efforts, and output decisions of firms.

- Freedom of Entry and Exit

Another important characteristic is the ease with which firms can enter or leave the market. In perfect competition and monopolistic competition, entry and exit are generally free, encouraging new businesses and innovation. In oligopoly and monopoly, there are strong barriers like high capital requirements, patents, government regulations, and control over raw materials. Restricted entry protects existing firms and reduces competition, while free entry promotes efficiency and fair pricing.

- Price Determination (Price Control)

Market structure determines whether firms are price takers or price makers. In perfect competition, individual firms cannot influence price and must accept the market price. In monopolistic competition, firms have limited control due to product differentiation. In oligopoly, firms have significant control and may follow price leadership. In monopoly, the single seller has complete power to fix prices, though government regulation may limit this power to protect consumers.

- Knowledge of Market Conditions

Perfect knowledge about prices, quality, and market conditions is another feature of market structure. In perfect competition, buyers and sellers have full information regarding price and product quality. In other market forms, information is imperfect. Sellers may use advertising to influence consumer decisions. Lack of knowledge gives certain firms an advantage and allows them to charge higher prices or promote brand loyalty among consumers.

- Mobility of Factors of Production

Factor mobility refers to the ease with which labour and capital can move from one industry to another. In highly competitive markets, factors of production are mobile, enabling resources to shift to more profitable uses. In monopoly and oligopoly, mobility may be limited due to specialized skills, contracts, or control of resources. Greater mobility increases efficiency, encourages optimal allocation of resources, and helps maintain balanced economic development.

- Role of Government Regulation

Government intervention varies across market structures. Perfect competition requires minimal regulation because competition protects consumers. Monopolistic competition may need consumer protection laws against false advertising. Oligopoly often faces regulation to prevent collusion and unfair trade practices. Monopoly markets are highly regulated to prevent exploitation and ensure fair pricing. Government policies such as price control, taxation, and licensing significantly affect market behavior and business decisions.

Elements or Determinants of Market Structure

- Number and Size Distribution of Firms

The number of firms and their relative size largely determine the type of market structure. When many small firms exist, the market becomes competitive. When a few large firms dominate, the market tends toward oligopoly. If only one firm controls production and supply, monopoly arises. Size distribution also matters because large firms possess greater market power, resources, and influence over pricing. Thus, the structure of the market depends on how sellers are organized and their relative economic strength.

- Nature of Product (Homogeneous or Differentiated)

Product characteristics strongly affect market structure. If firms produce identical or homogeneous products, competition becomes intense, and no firm can charge a different price. However, if products are differentiated through branding, packaging, or quality, firms gain some control over price. Product differentiation reduces direct competition and creates customer loyalty. Monopoly exists when a product has no close substitutes. Therefore, the nature of the product determines the level of competition and pricing power in the market.

- Barriers to Entry and Exit

Barriers to entry refer to obstacles preventing new firms from entering a market. These include high capital requirements, legal restrictions, patents, licenses, control over raw materials, and technological superiority. Strong barriers create monopoly or oligopoly markets, while weak barriers encourage competition. Exit barriers such as heavy investments and long-term contracts may also keep firms in the industry. Free entry and exit lead to a competitive market, whereas restricted entry reduces competition and increases market concentration.

- Degree of Control Over Price

The extent to which firms can influence price is an important determinant of market structure. In perfect competition, firms have no control and are price takers. In monopolistic competition, firms have limited control due to product differentiation. Oligopolistic firms possess considerable influence over price through mutual understanding or price leadership. A monopolist has maximum control over price because no close substitutes exist. Therefore, pricing power helps identify the nature of the market structure.

- Degree of Competition and Rivalry

Competition among firms shapes the market structure. When firms compete aggressively in price, output, and quality, the market becomes highly competitive. Limited competition leads to cooperative behavior among firms, often seen in oligopoly. Monopoly lacks competition entirely. The intensity of rivalry affects advertising, innovation, and production decisions. Greater rivalry encourages efficiency and better consumer service, while lower rivalry may lead to higher prices and restricted output.

- Availability of Market Information

The level of knowledge available to buyers and sellers also determines market structure. In a perfectly competitive market, both parties have complete information about prices, quality, and alternatives. In other market forms, information is imperfect and firms use advertising and promotion to influence consumers. Limited information provides an advantage to certain sellers and allows price variations. Hence, the transparency of market information affects consumer choice and the functioning of the market.

- Mobility of Factors of Production

The ability of labour and capital to move from one industry to another influences the structure of the market. High mobility supports competition because resources shift toward profitable industries. Low mobility creates concentration and strengthens market power. Specialized skills, legal restrictions, and location factors can limit mobility. When factors move freely, inefficient firms leave the market, and efficient firms grow, promoting competitive conditions and efficient resource allocation.

- Government Policy and Regulation

Government policies such as taxation, licensing, price control, and anti-monopoly laws affect market structure. Strict regulation may limit entry and create monopoly conditions. Antitrust laws promote competition by preventing unfair practices and collusion. Public sector monopolies may exist in essential services like railways or electricity to protect public interest. Therefore, government intervention plays a significant role in shaping the competitive environment and determining the structure of markets.

Types of market structure

1. Perfect Competition

Perfect competition is an idealized market structure where a large number of small firms sell identical products. No single firm can influence the price, making them price takers. The product is homogeneous, and all buyers and sellers have perfect knowledge. Entry and exit are completely free, and there is no government intervention. Examples include agricultural markets like wheat or rice, where products are uniform and pricing is dictated by market forces. Long-run profits tend toward normal, and efficiency is maximized.

2. Monopoly

A monopoly exists when a single firm dominates the entire market with no close substitutes for its product. The firm is a price maker, meaning it has full control over the price. High entry barriers such as patents, licenses, large capital requirements, or government protection prevent other firms from entering. Consumers have limited choices, and the monopolist maximizes profit by producing where marginal cost equals marginal revenue. Examples include utilities like electricity and water supply in many regions.

3. Monopolistic Competition

This structure features many sellers offering similar but differentiated products. Firms have some price-setting power due to brand identity, quality, packaging, or advertising. Entry and exit are relatively easy, and information is fairly well distributed among buyers and sellers. This market is common in retail sectors like clothing, restaurants, or consumer electronics, where consumers perceive differences in brands even if the underlying product is similar. Firms compete on both price and non-price factors like style, location, and service.

4. Oligopoly

In an oligopoly, a few large firms dominate the market. Products may be homogeneous (e.g., steel, cement) or differentiated (e.g., cars, smartphones). Firms are interdependent and often respond to each other’s actions—especially regarding pricing and output. Barriers to entry are high, which keeps competition limited. Pricing may be rigid due to fear of price wars. Strategic planning and collusion (formal or informal) are common. Real-world examples include the airline industry, telecom sector, and automobile manufacturing.

Factors influencing Market Structure

- Number of Firms in the Market

The number of firms determines the level of competition in a market. A large number of firms typically results in a competitive structure like perfect or monopolistic competition, where no single firm dominates. Fewer firms may lead to oligopoly or monopoly, where market power is concentrated. The higher the number of firms, the less control each has over pricing and supply. This factor directly affects how freely new businesses can enter the market, influence prices, and affect consumer choices, shaping the overall structure and nature of business rivalry.

The similarity or differentiation of products significantly impacts market structure. Homogeneous products, such as grains or steel, lead to perfect competition, where firms compete solely on price. Differentiated products, like branded clothing or electronics, result in monopolistic competition or oligopoly, where firms gain some price control through branding and features. A unique product with no substitutes, as seen in a monopoly, gives complete pricing power to the firm. The more distinct the product, the higher the potential for firms to establish loyal customer bases and exercise market influence.

The degree of control firms have over pricing determines their influence in the market. In perfect competition, firms are price takers—they cannot alter prices due to intense rivalry. In monopoly, a firm is a price maker, controlling prices due to a lack of substitutes. Oligopolistic firms have considerable price-setting power but often avoid price wars through collusion or tacit agreements. Price control is shaped by product uniqueness, brand value, and the availability of alternatives. More price control indicates less competition and a more concentrated market structure.

- Barriers to Entry and Exit

Barriers affect how easily new firms can enter or leave a market. Low barriers promote competition, as seen in perfect and monopolistic competition. High barriers, like legal restrictions, high startup costs, and access to technology, protect established firms in oligopolies and monopolies, reducing competition. These barriers determine market dynamics, profitability, and innovation levels. The ease or difficulty of entering the market shapes the competitive intensity, and hence, the overall market structure. Exit barriers, such as long-term contracts or sunk costs, also influence firms’ decisions and market fluidity.

When firms grow large enough to lower average costs through mass production, they experience economies of scale. This factor influences market structure by favoring oligopolies and monopolies, where large firms dominate due to cost advantages. Smaller firms find it difficult to compete, leading to a concentrated market. The presence of economies of scale raises entry barriers, discouraging new entrants and reducing competition. Industries like telecom, aviation, and energy often display this trait. This factor strengthens the position of existing firms and shapes the strategic behavior in the industry.

- Level of Innovation and Technology

High levels of innovation and advanced technology can significantly affect market structure. In tech-driven industries, early adopters often gain a temporary monopoly due to patents, proprietary processes, or first-mover advantages. Rapid innovation can reduce entry barriers if technology is widely accessible, but may also create new barriers when it involves complex, capital-intensive processes. Innovation leads to product differentiation, changing competitive dynamics and often shifting markets from monopolistic to oligopolistic forms. It influences firm growth, pricing strategies, and the overall shape of market competition.

- Government Policies and Regulations

Government intervention through licensing, tariffs, price controls, and antitrust laws significantly influences market structure. Policies that encourage free trade and deregulation promote competition, while those granting monopoly rights or subsidies can limit it. Regulatory frameworks may either lower or raise entry barriers, depending on their objectives. For instance, strict patent laws can create monopolies, while competition laws may break up large firms. These rules impact pricing, market access, and competitive fairness, playing a crucial role in shaping the structure and efficiency of different markets.

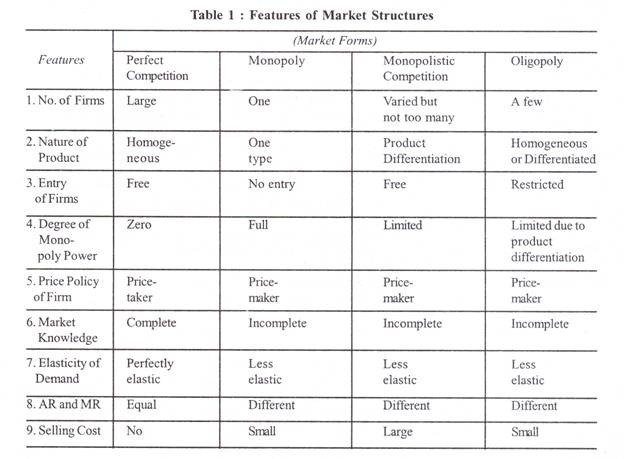

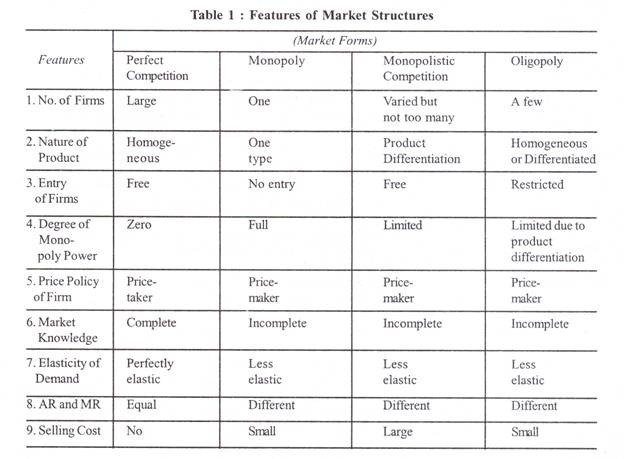

The features of market structures are shown in Table 1.

Important features of market structure

- Number and Size of Buyers and Sellers

The number and relative size of buyers and sellers directly influence the nature of competition in a market. In perfect competition, there are many small buyers and sellers, so no single entity can influence the price. In contrast, monopoly features one large seller dominating the entire market. Oligopoly has few large sellers, while monopolistic competition has many sellers offering differentiated products. The balance of power between buyers and sellers determines price-setting behavior, market entry, and overall market dynamics.

Products can be homogeneous (identical) or differentiated. Homogeneous goods (e.g., wheat, sugar) are typical of perfect competition, where consumers have no preference between suppliers. Differentiated products (e.g., smartphones, clothing) are associated with monopolistic competition or oligopoly, where branding and features give firms some pricing power. In monopoly, the product is unique with no close substitutes. The product’s nature shapes consumer choice, pricing strategy, and firm competitiveness, making it a key feature in defining the structure of a market.

Price control refers to how much influence firms have over the price of their products. In perfect competition, firms are price takers, accepting market-determined prices. In contrast, monopolies are price makers, having full control due to lack of substitutes. Oligopolies have partial control and often avoid price wars through mutual understanding. Monopolistic competitors can influence prices slightly due to product differentiation. The ability to control prices affects profitability, strategic planning, and the level of consumer surplus in different market structures.

- Entry and Exit Conditions

The ease with which firms can enter or exit the market impacts the level of competition. Free entry and exit, seen in perfect and monopolistic competition, keeps profits normal in the long run. High entry barriers in monopoly and oligopoly markets, such as large capital requirements, patents, and government regulations, protect existing firms from new competitors. These conditions influence firm behavior, investment decisions, and the long-term structure of the industry. Exit barriers also matter, including sunk costs and contractual obligations.

Market transparency, or the availability of information, significantly impacts decision-making. In perfect competition, information is perfect and freely available to all participants, ensuring rational decisions and uniform prices. In monopoly, oligopoly, or monopolistic competition, information may be asymmetric—some firms have better access to market data, customer preferences, or production techniques. Information asymmetry leads to inefficiencies, mispricing, and poor resource allocation. The better the information flow, the more efficient and competitive the market structure becomes.

- Interdependence Among Firms

In oligopoly, firms are highly interdependent; the actions of one firm significantly impact others. For example, a price cut by one may trigger retaliatory pricing. In monopoly and perfect competition, interdependence is minimal—monopolies face no rivals, and perfect competitors are too small to affect market outcomes. Monopolistic competition lies in between, with firms competing based on product features. This interdependence influences strategic behavior, including pricing, advertising, and innovation, and it makes game theory and collusion relevant in oligopolistic settings.

- Government Regulation and Legal Framework

Government rules and policies shape the nature and behavior of market structures. Antitrust laws, price controls, trade regulations, and licensing influence how freely firms can operate, compete, or dominate. Monopolies may be state-sanctioned, while competitive markets are supported by policies promoting transparency and consumer rights. Legal restrictions may also create barriers to entry, affecting the long-term dynamics of the industry. In regulated markets, government action balances business interests with consumer welfare, playing a crucial role in defining market behavior and structure.

- Profit Margins and Cost Efficiency

The structure of a market significantly impacts potential profit margins and cost structures. Perfect competition leads to minimal profit margins due to intense competition and price pressure. In contrast, monopolies enjoy higher profit margins due to price-setting power and absence of competition. Oligopolistic firms also enjoy significant profits through collusion or differentiated services. Monopolistic competitors rely on brand value to maintain margins. Additionally, cost efficiency varies—larger firms may benefit from economies of scale, leading to lower average costs and higher profitability in certain structures.

Like this:

Like Loading...

Related