The competencies may be classified into following categories:

- Personal entrepreneurial competencies

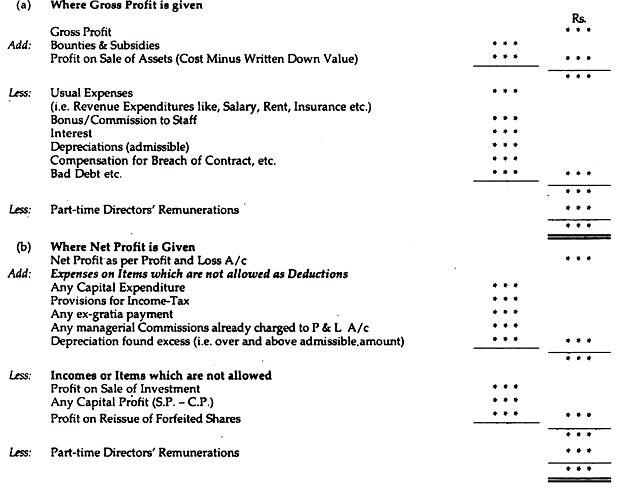

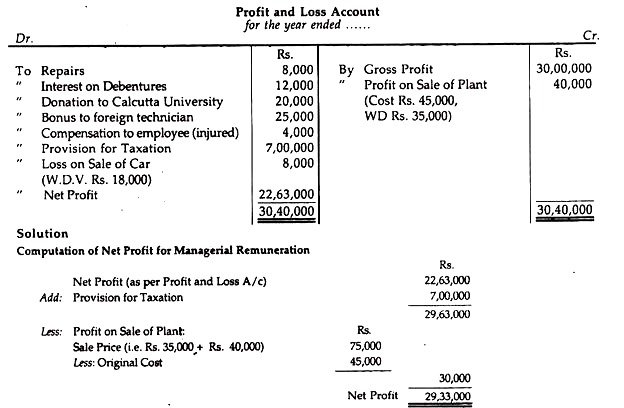

- Venture initiation and success competencies

a) Enterprise launching competencies

b) Enterprise management competencies

-

Personal Entrepreneurial competencies

It is the personal characteristics of an individual who possess to perform the task effectively and efficiently.Personal entrepreneurial competencies include the following:

a) Initiative

The entrepreneur should be able to take actions that go beyond his job requirements and to act faster. He is always ahead of others and able to become a leader in the field of business.He Does things before being asked or compelled by the situation and acts to extend the business into new areas, products or services.

b) Sees and acts on opportunities

An entrepreneur always looks for and takes action on opportunities. He Sees and acts on new business opportunities and Seizes unusual opportunities to obtain financing, equipment, land, work space or assistance.

c) Persistence

An entrepreneur is able to make repeated efforts or to take different actions to overcome an obstacle that get in the way of reaching goals. An entrepreneur takes repeated or different actions to overcome an obstacle and Takes action in the face of a significant obstacle.

- d) Information Seeking

An entrepreneur is able to take action on how to seek information to help achieve business objectives or clarify business problems.They do personal research on how to provide a product or service.They seek information or ask questions to clarify what is wanted or needed.They personally undertake research and use contacts or information networks to obtain useful information.

e) Concern for High Quality of Work

An entrepreneur acts to do things that meet certain standards of excellence that gives him greater satisfaction. An entrepreneur states a desire to produce or sell a top or better quality product or service. They compare own work or own company’s work favourably to that of others.

f) Commitment to Work Contract

An entrepreneur places the highest priority on getting a job completed.They make a personal sacrifice or take extraordinary effort to complete a job.They accept full responsibility for problems in completing a job for others and express concern for satisfying the customer.

g) Efficiency Orientation

A successful entrepreneur always finds ways to do things faster or with fewer resources or at a lower cost.They look for or finds ways to do things faster or at less cost.An entrepreneur uses information or business tools to improve efficiency. He expresses concern about costs vs. benefits of some improvement, change, or course of action.

h) Systematic Planning

An entrepreneur develops and uses logical, step-by-step plans to reach goals.They plan by breaking a large task into subtask and develop plans,then anticipate obstacles and evaluate alternatives.They take a logical and systematic approach to activities.

i) Problem Solving

Entrepreneurs identify new and potentially unique ideas to achieve his goals.They generate new ideas or innovative solutions to solve problems and they take alternative strategies to solve the problems.

j) Self-Confidence

Entrepreneur with this competency will have a strong belief in self and own abilities.They express confidence in their own ability to complete a task or meet a challenge.They stick to their own judgment while taking decision.

k) Assertiveness

An entrepreneur confronts problems and issues with others directly.Entrepreneur with this competency vindicate the claim to asset their own rights on others.They demand recognition and disciplines those failing to perform as expected.They asset own competence,reliability or other personal or company’s qualities.They also assert strong confidence in own company’s or organization’s products or service.

l) Persuasion

Entrepreneurs with this competency successfully pursue others to perform the activities effectively and efficiently.An entrepreneur can persuade or influence others for mobilizing resources, obtaining inputs, organizing productions and selling his products or services.

m) Use of Influence Strategies

An entrepreneur is able to make use of influential people to reach his business goals.Entrepreneurs with this competency influence the environment (Individuals/Institution) for mobilizing resources organizing production and selling goods and services to develop business contacts.

n) Monitoring

Entrepreneurs with this competency normally monitor or surprise all the activities of the concern to ensure that the work is completed by maintaining good quality.

o) Concern for Employee Welfare

Entrepreneurs with this competency take action to improve the welfare of employees and take positive action in response of employee’s personal concerns.

-

Venture Initiation and success Competencies

In addition to personal competencies Entrepreneur must also possess the competencies required to launch the enterprise and for its growth and survival.

It is further divided into two categories of competencies:

- Enterprise launching competencies

- Enterprise management competencies

1) Enterprise launching competencies

- Competency to understand the nature of business

-To analyse the personal advantage of owning a small business.

-To analyse the personal risks of owning a small business.

-To analyse how to maximize the opportunities and minimize the risks of owning a business.

- Competency to determine the potential as an entrepreneur

-To consider the personal qualification and abilities needed to manage own business.

-To evaluate the own potentials for decision-making,problem solving and creativity.

-To determine own potential for management,planning,operations,personnel and public relations.

- Competency to develop a business plan

-To identify how a business plan helps the entrepreneur.

-To recognize how a business plan should be organized.

-To identify and use the mechanisms for developing a business plan.

- Competency to obtain technical assistance

-To prepare for using technical assistance.

-To select professional consultants.

-To work effectively with consultants.

- Competency to a choose the type of ownership

-To analyse the type of ownership of business.

-To follow the steps necessary to file for ownership of the business.

-To define politics and procedures for a successful multi-owner.

- Competency to plan the market strategy

-To use goods classification and life cycle analysis as planning tools for marketing.

-To develop and modify marketing mixes for a business.

-To use decision making tools and aid in evaluating marketing activities.

-To evaluate operations to improve decision making about marketing.

- Competency to locate the business

-To analyse customer transportation,access,parking and so forth. i.e. relative to alternative site locations.

-To complete a location feasibility study for the business.

-To determine the cost of renovating or improving a site for the business.

-To prepare an occupancy contrast for the business.

- Competency to finance the business

-To describe the source of information available to help in estimating the financing necessary to start a new business.

-To determine the finance necessary to start a new business.

-To prepare a project profit and loss statement and a projected cash flow statement for the new business.

-To prepare a loan application package.

- Competency to deal with the business

-To determine the need for legal assistance.

-To select the provisions that is desired in the lease.

-To prepare sales contract(such a s credit sales or long term sales) that may be utilized in the contracts

-To evaluate contracts.

-To determine the need for protection of ideas and intentions.

- Competency to comply with government regulations

-To appraise the effects of various regulations on the business operations.

-To acquire the information necessary to comply with the various rules and regulations affecting the business.

-To develop policies for the business to comply with the Government rules and regulations.

2) Enterprise Management Competencies

- Competency to manage the business

-To plan goals and objectives for the business.

-To develop a diagram showing the organizational structure for the business.

-To establish control practices and procedures for the business

- Competency to manage human resources

-To plan goals and objectives for the business.

-To develop a diagram showing the organizational structure for the business.

-To establish control practices and procedures for the business.

- Competency to manage human resources

-To write a job description for a position in the business.

-To develop a training programme online for employees.

-To develop a list of personnel for employees in the business.

-To develop an outline for an employee evaluation system.

-To plan a corrective interview with an employee concerning a selected problem.

- Competency to promote the business

-To create a long-term promotional plan.

-To describe the techniques used to prepare advertising and promotion

-To analyse competitive promotional activities.

-To evaluate promotional effectiveness.

-To plan a community relations programme.

- Competency to manage sales efforts.

-To develop a sales plan for the business.

-To develop policies and procedures for serving the customers.

-To develop a plan for training and motivating sales people.

- Competency to keep business records

-To determine who will keep the books for the business and how they will be maintained.

-To describe double-entry bookkeeping.

-Select the types of journals and ledges that you will use in the business.

-To identify the types of records that will be used in the business to record sales,cash receipts,cash disbursements,accounts receivable,accounts payable,payroll,petty cash,inventory,budgets and other items.

-To evaluate the business records.

-To identify how a micro-computer may be used to keep he business records.

- Competency to manage the finances

-To explain the importance of cash flow management.

-To identify financial control procedures.

-To describe how to find cash flow patterns.

-To analyse trouble spots in financial management.

-To describe how to prepare an owner’s equity financial statement.

-To analyse financial management ratios applicable to a small business.

-To identify the components of break even point problem.

-To review microcomputer application for financial management.

- Competency to manage customer credit and collection

-To analyse the legal rights and resource of credit guarantors.

-To develop a series of credit collection reminders and the follow up activities.

-To develop various credit and collection policies.

-To prepare a credit promotion plan.

-To discuss information resources and systems that apply to credit and collection procedures.

- Competency to protect the business

-To prepare policies for the firm that will help minimize losses due to employee theft, vendor theft, bad cheques, shoplifting, robbery, injury or product liability.

Like this:

Like Loading...