Overall Maximum and Minimum Remunerations Legal Restrictions:

The Companies Act provides some restrictions on the managerial remuneration provided by a private company (a subsidiary of a public company) or a public company.

These restrictions are enumerated:

(a) Maximum Limit:

According to Sec. 198 of the Companies act, the total managerial remuneration payable by a public company or a private company—which is subsidiary of a public company—to its directors and its managers in respect of a financial year computed in the manner laid down in Sections 349, 350 and 351— except that the remuneration of the directors shall not be deducted from the gross profit.

Explanation:

‘Remuneration’ includes (as per Sections 309, 311, 348 and 387):

(a) Any expenditure incurred by the company in providing any rent-free accommodation or any other benefit or amenity in respect of accommodation free of charge, to any of the persons aforesaid.

(b) Any expenditure incurred by the company in providing any other benefit or amenity free of charge or at a concessional rate to any of the persons aforesaid.

(c) Any expenditure incurred by the company in respect of any obligation or service, which, but for such expenditure by the company, would have been incurred by any of the persons aforesaid;

(d) Any expenditure incurred by the company to effect any insurance on the life of, or to provide any pension, annuity or gratuity for any of the person aforesaid or his spouse or child.

It is to be noted that according to Sec. 200 of the Companies’ Act, 1956, no company can now pay to any of its officer or employees remuneration, fee or any tax or varying with any tax payable by him.

(b) Minimum Limit:

According to Sec. 198 (Subsection 4) of the Companies (Amendment) Act, 1988—subject to the provisions of Sec. 269 (Schedule XIII)—a company shall not pay to its Directors (including any managing or whole time Director or manager) by way of remuneration any sum exclusive of any fees payable to Directors under Sec. 309 (2) except with the previous approval of the Central Government, if the company has inadequate profits or no profits in any financial year. This is subject to the of Sec. 209 (which deals with appointment of managing or whole time Director or manager) read with Schedule XHL

Remuneration to Directors:

The remuneration to Directors is governed by Sec. 309 of the Companies Act, which is to be determined by – the Articles or by the resolution (special resolution if the articles so require).

Fees may be payable by the articles for attendance of the meeting of the board or committee subject to:

(a) A whole-time or managing director may be paid remuneration by way of monthly pay and/or specified percentage of net profit of the company (not exceeding 5% where there is only one such director, and not exceeding 10% in all where there are more than one whole-time director).

(b) A part-time director (i.e., not whole-time or managing director) may be remunerated either by way of monthly, quarterly or annually (with the approval of the Central Government or by way of commission (if the company by special resolution authorizes) not exceeding 1% for all such Directors, Secretaries, Treasurers or Managers and not exceeding 3% for all such Directors in other cases, or at higher percentage with the approval of the Central Government.

(c) Any whole-time or managing director shall not be entitled to receive any commission from any subsidiary of such company.

(d) The special resolution shall remain in force for a maximum period of 5 years. It may, however, be renewed, from time to time, by a special resolution for further periods of 5 years but no renewal can be effected earlier than 1 year from the date on which it is to come into force.

(e) A Director may be paid fees for attending each meeting of the Board or a committee thereof attended by him.

(f) If any Director receives any sum in excess of remuneration due to him, he shall keep the excess amount in trust for the company and shall refund it to the company. The company, however, cannot waive the recovery of any such sum.

(g) The above rules shall not apply to a private company unless it is a subsidiary of a public company.

(h) Prohibition of tax-free payment. A company shall not pay any officer or employee remuneration free of tax (Sec. 200).

(i) The net profit for the purpose of Directors’ remuneration shall be computed as per prescribed manner laid down in Sections 349 and 350 without deducting the Directors’ remuneration from the gross profit.

However, Sec 310 of the Companies Act, 1956, provides that any increase in remuneration of any Director of a public company or a private company which is a subsidiary of a public company, shall not be valid:

(i) In case where Schedule XIII is applicable (unless such increase is as per the conditions specified in that Schedule) and

(ii) In any other case, unless the same is approved by the Central Government.

Sec. 309 does not apply to a private company unless it is a subsidiary of a public company.

It should be noted that the remuneration payable to a director shall include all remuneration payable to him for services rendered in any other capacity unless the services are rendered in professional capacity and the director possesses the requisite qualifications for the practice of the profession in the opinion of the Central Government.

Remuneration to Manager:

According to Sec. 2 (24), ‘Manager’ means an individual who has the management of the whole or substantially the whole of the affairs of a company. He is actually subject to the superintendence, control and directions of the Board of Directors. Thus, ‘Manager’ includes a director or any other person accompanying the position of a manager—by whatever name called.

A company cannot have more than one manager at a time

The remuneration to manager is governed by Sec. 387 of the Companies Act. The manager of a company may receive remuneration by way of a monthly payment and/or by way of a specified percentage on net profit calculate according to Sees. 349, 351 provided that such remuneration shall not exceed in the aggregate of 5% of the net profit without the approval of the Central Government— Sec. 387.

The provisions do not apply to private company unless it a subsidiary of public company.

To Sum Up:

It has already been highlighted above that the Companies Act provides certain restrictions on managerial remuneration (the same is not, however, applicable to a private company which is not a subsidiary of a public company.)

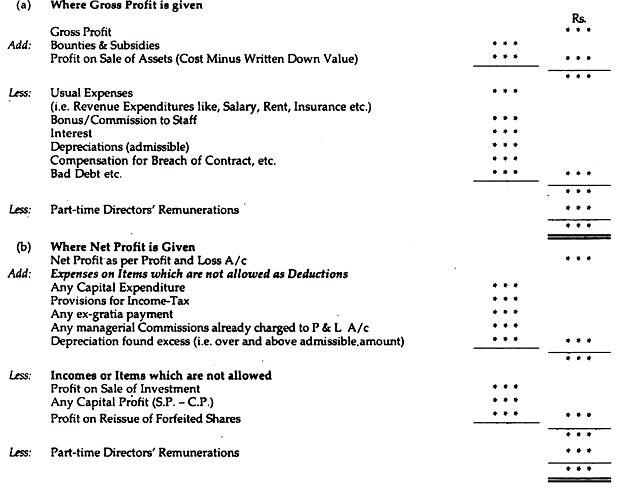

Method of Computation of ‘Profit’ for Calculating Managerial Remuneration:

General Illustrations:

Computation of Managerial Remuneration under Different Conditions:

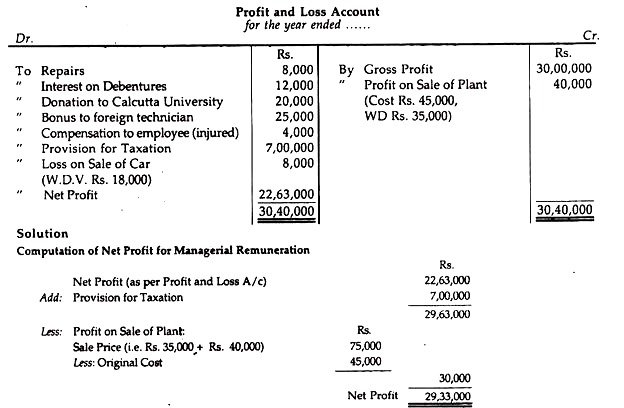

Illustration 1:

From the following Profit and Loss Account of X Ltd. compute the maximum permissible managerial remunerations under each of the following conditions:

(a) When there is only one whole-time Director

(b) When there are two whole-time directors

(c) When there are two whole-time Directors, a part-time director and a manager

(d) When there is only a part-time Director and no whole-time directors.

Calculation of Maximum Managerial Remuneration:

(a) When there is only one Director:

As per Sec. 349 of the Companies Act, where there is only one Director the maximum limit of managerial remuneration will be @ 5% of the net profit. So, the Managerial Remuneration will be Rs.1, 46,650 (i.e. Rs.29, 33,000 x5/100)

(b) When there are two Whole-time Directors:

The Maximum limit of managerial remuneration will be @ 10% of net profit i.e. Rs.2,93,300 (i.e. Rs. 29,33,000 x 10/100)

(c) When there are two Whole-time Directors, a Part-time Director and a Manager

Under the circumstances, the maximum limit of managerial remuneration will be @ 11% of Net Profit.

So, the Managerial Remuneration will be Rs.3, 22,630. (i.e. Rs.29, 33,000 x11/100).

(d) When there is only a Part-time Director and no Whole-time Director:

The maximum limit of managerial remuneration in this case will be only @ 1% of net profit. So the managerial remuneration will be Rs.29, 330 (i.e. Rs.29, 33,000 x 1/100).

One thought on “Financial Statements of companies including Managerial Remuneration”