The term ‘macro’ was first used in economics by Ragner Frisch in 1933. But as a methodological approach to economic problems, it originated with the Mercantilists in the 16th and 17th centuries. They were concerned with the economic system as a whole.

Macroeconomics is a branch of economics that studies the behavior and performance of an economy as a whole rather than focusing on individual units like consumers or firms. It deals with large-scale economic variables such as national income, aggregate demand and supply, unemployment, inflation, economic growth, fiscal and monetary policies, and international trade. The term “macro” is derived from the Greek word “makros,” meaning large, which reflects the comprehensive nature of its scope.

Unlike microeconomics, which analyzes specific markets or individual decisions, macroeconomics provides a broad perspective on how an entire economy functions. It examines how different sectors of the economy interact and how policy changes impact overall economic performance. Key indicators such as Gross Domestic Product (GDP), inflation rate, employment levels, interest rates, and exchange rates are central to macroeconomic analysis.

One of the primary aims of macroeconomics is to ensure economic stability and sustainable growth by understanding and managing economic fluctuations. It helps governments and policymakers design strategies to control inflation, reduce unemployment, and promote long-term development. Macroeconomics also explores the impact of external factors such as global trade, foreign investment, and international financial markets on a country’s economy.

In business decision-making, macroeconomics provides critical insights into market trends, consumer spending power, and the overall economic environment. This knowledge enables firms to anticipate changes, manage risks, and align their strategies with economic conditions. In summary, macroeconomics plays a vital role in shaping national policy and guiding both public and private sector decisions.

According to R. G. D. Allen:

“The term macroeconomics applies to the study of relations between broad economic aggregates such as total employment, income and production”.

In the words of Edward Shapiro:

“The major task of macroeconomics is the explanation of what determines the economy’s aggregate output of goods and services. It deals with the functioning of the economy as a whole”.

Professor K. E. Boudling is of the view that:

“Macroeconomics is that part of economics which studies the overall averages and aggregates of the economic system. It does not deal with individual incomes but with the I national income, not with individual prices but with the price level, not with individual output, but with national output”.

Objectives of Macro Economics:

One of the fundamental objectives of macroeconomics is to achieve and maintain full employment in an economy. Full employment refers to a situation where all individuals willing and able to work at the prevailing wage rate are employed, excluding those frictionally or voluntarily unemployed. Persistent unemployment leads to a waste of economic resources and lowers national output. Macroeconomic policies such as fiscal stimulus and interest rate cuts are often used to stimulate job creation and reduce unemployment levels across various sectors of the economy.

Maintaining price stability is crucial for economic confidence and sustainable growth. Price stability means avoiding both prolonged inflation (rising prices) and deflation (falling prices), which can distort consumption, savings, and investment decisions. Macroeconomics aims to keep inflation within a manageable range, ensuring that the purchasing power of money remains relatively stable. Central banks use tools like monetary policy, interest rate adjustments, and inflation targeting to control excessive price fluctuations and provide a predictable environment for households and businesses.

Macroeconomics seeks to promote long-term economic growth, which is the sustained increase in the production of goods and services in an economy. Growth is measured by rising real GDP and reflects improvements in living standards, income, and employment opportunities. Macroeconomic strategies such as investment in infrastructure, education, and innovation support growth. A growing economy can better support public services, reduce poverty, and strengthen national competitiveness. Stable growth reduces the risk of economic crises and promotes overall prosperity.

- Equitable Distribution of Income and Wealth

Another important objective of macroeconomics is to reduce income and wealth inequality within a country. While total economic output is essential, its distribution across the population also matters. Extreme disparities in income can lead to social unrest, reduced demand, and economic inefficiency. Macroeconomic tools such as progressive taxation, social welfare schemes, and subsidies are used to redistribute wealth more equitably. The goal is to ensure that the benefits of economic growth are shared across different segments of society.

- Balance of Payments Equilibrium

Macroeconomics aims to maintain equilibrium in a country’s balance of payments (BOP), which records all financial transactions made between residents of the country and the rest of the world. A persistent deficit can lead to a depletion of foreign reserves and dependency on external debt, while a surplus might indicate underconsumption or unfair trade practices. Policy measures such as exchange rate adjustments, trade policies, and import-export regulations are implemented to maintain a healthy external economic position.

Macroeconomics seeks to smoothen out the fluctuations in the business cycle—periods of economic expansion followed by contraction. Economic instability, characterized by booms and busts, leads to uncertainty in investment, employment, and income levels. Governments and central banks use counter-cyclical policies to reduce volatility by increasing spending or cutting interest rates during recessions and tightening during booms. Stability in macroeconomic conditions helps build investor confidence and fosters sustainable long-term growth and employment.

- Improving Standard of Living

Enhancing the standard of living for citizens is a key macroeconomic objective. This includes improving access to quality education, healthcare, housing, and employment, as well as increasing disposable income. Economic growth must be inclusive and sustainable to uplift the general well-being of the population. Macroeconomic policies are geared toward raising productivity, expanding infrastructure, and supporting human development. A higher standard of living indicates a prosperous society and reflects successful economic governance.

- Development of Infrastructure and Capital Formation

Macroeconomics emphasizes the creation of infrastructure and the accumulation of capital to drive economic development. This involves investments in roads, energy, transport, communication, and technology, which are essential for industrial and service sector expansion. Governments use fiscal policy tools like public investment programs and incentives to encourage private capital formation. Strong infrastructure enhances productivity, reduces transaction costs, and attracts foreign investment, which collectively contribute to robust economic progress and national development.

Scope of Macroeconomics:

- Theory of National Income

Macroeconomics includes the study of national income and its components such as Gross Domestic Product (GDP), Gross National Product (GNP), and Net National Income (NNI). It focuses on measuring a nation’s overall economic performance and tracking economic growth over time. The analysis of national income helps understand how resources are used, the output generated, and the income distributed among the population. It is essential for evaluating economic welfare, setting policies, and comparing performance across countries and time periods.

Another vital component of macroeconomics is the theory of employment, which studies how jobs are created and lost in an economy. It examines the factors that influence employment levels, such as investment, aggregate demand, labor productivity, and technology. The theory distinguishes between different types of unemployment—frictional, structural, cyclical, and seasonal—and aims to identify solutions to reduce joblessness. Full employment is a key macroeconomic goal, and understanding employment trends helps governments design effective labor market and economic policies.

The theory of money in macroeconomics deals with the role of money in the economy, including its supply, demand, and value. It explores how money facilitates transactions, stores value, and serves as a standard for deferred payments. Macroeconomics analyzes how the central bank controls money supply through instruments like interest rates and reserve requirements. Changes in the money supply can influence inflation, investment, consumption, and overall economic activity. Thus, money theory plays a central role in monetary policy formulation.

Inflation, the persistent rise in the general price level of goods and services, is a crucial subject under macroeconomics. It studies the causes, effects, and control measures for inflation. Demand-pull, cost-push, and built-in inflation are some of the types analyzed. Inflation impacts purchasing power, savings, investments, and business operations. Macroeconomic policies aim to keep inflation at a moderate and stable level to ensure economic stability. Effective inflation management supports consumer confidence and promotes sustainable economic development.

- Theory of Business Cycles

Macroeconomics examines business cycles, which are periodic fluctuations in economic activity characterized by expansion, peak, contraction, and trough phases. Understanding these cycles is vital for predicting economic downturns and taking preventive measures. Business cycles affect employment, investment, production, and national income. Macroeconomic theory helps identify the reasons behind these fluctuations, such as changes in aggregate demand or external shocks, and guides government intervention through fiscal and monetary policies to stabilize the economy during these cycles.

Public finance deals with government income and expenditure and their effects on the economy. Macroeconomics studies taxation, public spending, budgeting, and public debt. It analyzes how fiscal policy influences aggregate demand, employment, and resource allocation. Government spending on infrastructure, health, and education affects overall economic growth. Macroeconomic understanding of public finance helps policymakers balance deficits and surpluses while ensuring equitable income distribution and efficient delivery of public goods and services.

- Theory of International Trade and Finance

This area covers how countries interact economically through trade, capital flows, and exchange rates. Macroeconomics examines the balance of payments, trade deficits, tariffs, foreign direct investment, and currency valuation. These interactions affect domestic economic conditions, including employment, inflation, and growth. A solid grasp of international macroeconomics helps in forming trade agreements, managing foreign reserves, and maintaining currency stability. It enables nations to participate effectively in the global economy and protect against external economic shocks.

- Theory of Economic Growth and Development

Economic growth refers to the increase in a country’s output over time, while development includes improvements in living standards, education, health, and infrastructure. Macroeconomics studies the long-term determinants of growth, such as capital formation, technological innovation, institutional quality, and human capital. It also focuses on development issues like poverty reduction and income inequality. By identifying constraints and enabling factors, macroeconomic theories guide national strategies for achieving sustainable and inclusive development across regions and populations.

Importance of macroeconomics:

- Understanding the Functioning of the Economy

Macroeconomics helps in understanding how an economy operates at a broad level by examining aggregated indicators like national income, output, employment, and inflation. It offers insights into how different sectors interact and how resources are allocated. By studying macroeconomic variables, policymakers and businesses can assess economic health and structure long-term strategies. This holistic understanding enables better planning, informed decision-making, and coordinated efforts to improve overall economic performance and national welfare.

- Formulation of Economic Policies

Governments rely on macroeconomic analysis to frame effective fiscal and monetary policies. For example, controlling inflation through interest rate adjustments or managing unemployment through public investment programs are outcomes of macroeconomic planning. These policies influence national priorities, stabilize the economy, and support growth. Without macroeconomic insights, policy measures could be misguided, leading to imbalances. Thus, macroeconomics is essential for designing policies that target stable prices, full employment, economic growth, and equitable distribution of income.

- Economic Growth and Development Planning

Macroeconomics provides the tools to measure economic growth through indicators such as GDP and helps identify the factors that contribute to or hinder development. It guides governments in making investment decisions in infrastructure, health, education, and technology. Macroeconomic analysis ensures that resources are allocated effectively for long-term development. It also identifies structural issues like poverty and unemployment, which need policy intervention. Thus, it is critical for promoting inclusive, sustainable, and balanced economic development.

- Inflation and Price Stability

Price stability is crucial for maintaining the purchasing power of money and ensuring financial security for individuals and businesses. Macroeconomics analyzes inflation trends and provides strategies to manage inflationary or deflationary pressures. Through tools like monetary policy and supply-side adjustments, macroeconomics helps control excessive price fluctuations. Stable prices reduce uncertainty, support investment, and maintain consumer confidence. Hence, macroeconomics plays a pivotal role in ensuring a stable economic environment by tackling inflation effectively.

Macroeconomics helps in identifying the causes of unemployment and suggesting remedies through demand management policies and labor market reforms. By analyzing employment data and economic trends, governments can implement programs to stimulate job creation. Macroeconomic strategies such as increased public spending, tax incentives, and interest rate reductions are designed to boost aggregate demand, which in turn encourages firms to hire more workers. Thus, macroeconomics aids in achieving the goal of full employment and improving living standards.

- International Economic Understanding

In an increasingly globalized world, macroeconomics facilitates an understanding of international trade, foreign exchange rates, and global financial markets. It analyzes how changes in one country’s economy can affect others through trade balances, capital flows, and currency valuation. Macroeconomic knowledge helps governments negotiate trade deals, manage foreign reserves, and implement policies to remain competitive. It also assists multinational companies in assessing risks and opportunities in global markets, making macroeconomics vital for international business and diplomacy.

Macroeconomic indicators like inflation, interest rates, exchange rates, and economic growth significantly impact business operations. Companies use macroeconomic analysis to forecast market trends, plan production, set pricing, and decide on expansion. For instance, during an economic boom, businesses may increase investment, while in a recession, they may cut costs. Understanding the macroeconomic environment helps businesses align strategies with national trends and remain resilient against external shocks, making macroeconomics essential for strategic business planning.

- Improving Standard of Living

Macroeconomic growth leads to higher income levels, better employment opportunities, and improved access to essential services like healthcare and education. By focusing on economic stability and equitable income distribution, macroeconomic policies aim to uplift the general population’s standard of living. Investments in infrastructure, social welfare, and public services are guided by macroeconomic planning. When effectively managed, the benefits of economic progress are shared broadly, contributing to a more prosperous and inclusive society.

Limitations of Macroeconomics:

There are, however, certain limitations of macroeconomic analysis. Mostly, these stem from attempts to yield macroeconomic generalisations from individual experiences.

- To Regard the Aggregates as Homogeneous

The main defect in macro analysis is that it regards the aggregates as homogeneous without caring about their internal composition and structure. The average wage in a country is the sum total of wages in all occupations, i.e., wages of clerks, typists, teachers, nurses, etc.

But the volume of aggregate employment depends on the relative structure of wages rather than on the average wage. If, for instance, wages of nurses increase but of typists fall, the average may remain unchanged. But if the employment of nurses falls a little and of typists rises much, aggregate employment would increase.

In Macroeconomic analysis the “fallacy of composition” is involved, i.e., aggregate economic behaviour is the sum total of individual activities. But what is true of individuals is not necessarily true of the economy as a whole.

For instance, savings are a private virtue but a public vice. If total savings in the economy increase, they may initiate a depression unless they are invested. Again, if an individual depositor withdraws his money from the bank there is no ganger. But if all depositors do this simultaneously, there will be a run on the banks and the banking system will be adversely affected.

- Indiscriminate Use of Macroeconomics Misleading

An indiscriminate and uncritical use of macroeconomics in analysing the problems of the real world can often be misleading. For instance, if the policy measures needed to achieve and maintain full employment in the economy are applied to structural unemployment in individual firms and industries, they become irrelevant. Similarly, measures aimed at controlling general prices cannot be applied with much advantage for controlling prices of individual products.

- Aggregate Variables may not be Important Necessarily

The aggregate variables which form the economic system may not be of much significance. For instance, the national income of a country is the total of all individual incomes. A rise in national income does not mean that individual incomes have risen.

The increase in national income might be the result of the increase in the incomes of a few rich people in the country. Thus, a rise in the national income of this type has little significance from the point of view of the community.

Prof. Boulding calls these three difficulties as “macroeconomic paradoxes” which are true when applied to a single individual but which are untrue when applied to the economic system as a whole.

- Statistical and Conceptual Difficulties

The measurement of macroeconomic concepts involves a number of statistical and conceptual difficulties. These problems relate to the aggregation of microeconomic variables. If individual units are almost similar, aggregation does not present much difficulty. But if microeconomic variables relate to dissimilar individual units, their aggregation into one macroeconomic variable may be wrong and dangerous.

Key differences between Microeconomics and Macroeconomics

| Aspect |

Microeconomics |

Macroeconomics |

| Scope |

Individual units |

Entire economy |

| Focus |

Demand & supply |

Aggregate variables |

| Objective |

Resource allocation |

Economic growth |

| Key Variables |

Price, cost |

GDP, inflation |

| Decision Level |

Firms/households |

Government/economy |

| Market Type |

Specific markets |

National/global |

| Approach |

Bottom-up |

Top-down |

| Time Frame |

Short-term |

Long-term |

| Tools Used |

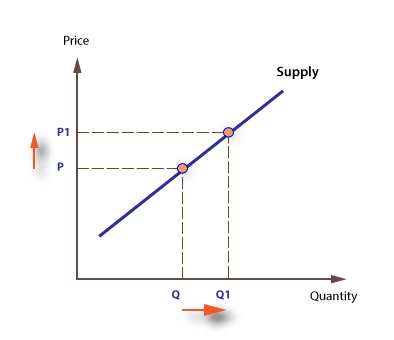

Demand/supply curves |

National income data |

| Issues Studied |

Pricing, output |

Unemployment, inflation |

| Policy Implication |

Market regulation |

Fiscal & monetary |

| Examples |

Pricing of goods |

Inflation control |

| Analysis Unit |

Individual choice |

Collective behavior |

Like this:

Like Loading...