An economic system is a mechanism with the help of which the government plans and allocates accessible services, resources and commodities across the country. Economic systems manage elements of production, combining wealth, labour, physical resources and business people. An economic system incorporates many companies, agencies, objects, models, as well as for deciding procedures.

Capitalist Economy:

According to Gary M. Pickersgill and Joyce E. Pickersgill, “The capitalist system is one characterised by the private ownership of the means of production, individual decision making, and the use of the market mechanism to carry out the decisions of individual participants and facilitate the flow of goods and services in markets.”

In a capitalist system, the products manufactured are divided among people not according to what people want but on the basis of Purchasing Power which is the ability to buy products and services. This means an individual needs to have the money with him to buy the goods and services. The Low-cost housing for the underprivileged is much required but will not include as demand in the market because the needy do not have the buying power to back the demand. Therefore, the commodity will not be manufactured and provided as per market forces.

Two types of capitalism may be found in the economic system:

(1) The old laissez faire capitalism and

(2) The modern, regulated and mixed capitalism.

Characteristics of Capitalism:

The following are the basic characteristics of a ‘pure’ capitalism system:

- Private Property:

Every individual has a right to hold property. This means that every individual is free to consume his private property and every individual has a right to transfer his property to his successors after death. Individuals have their property rights protected and are usually free to use their property as they like as long as they do not infringe on the legal property rights of others.

Private property, however, is protected, controlled and enforced by law. Private property is necessary because it supplies the motive underlying economic activity. In a capitalist economy, the factors of production land, labour and capital are privately owned, and production occurs at private initiative.

- Free Enterprise:

Free enterprise, an essential feature of the capitalist system, is merely an extension of the concept of property rights. The term free enterprise implies that private firms are allowed to obtain resources, to organise production and to sell the resultant product in any way they choose. In other words, there will not be any government or other artificial restrictions on the freedom and ability of the private individuals to carry out any business.

- Price Mechanism:

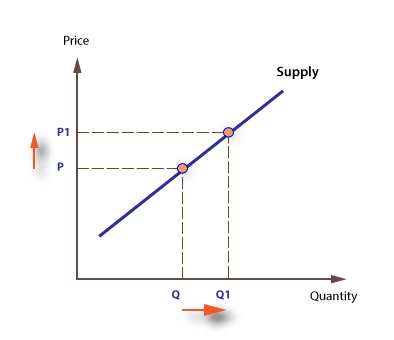

The price mechanism plays an important role in the production of goods and services. Under capitalism, the price is determined by the demand and supply.

- The Market System:

The market mechanism is the key factor that regulates the capitalist economy. A market economy is one in which buyers and sellers express their opinions about how much they are willing to pay for or how much they demand of goods and services. Prices guide the purchase decisions of the consumers.

At the same time, while they decide to buy or not to buy a product, consumers vote for or against the product by using their money. Thus, market prices, which reflect the desires of millions of consumers, provide guidance to investors and other business persons. The market system, also called the price system, may, therefore, be regarded as the organising force in a capitalist economy.

- Economic Freedom:

Another feature of capitalism is economic freedom.

This freedom implies three things:

(1) Freedom of enterprise,

(2) Freedom of contrast,

(3) Freedom to use one’s property.

Under the capitalism, everybody is free to take up any occupation that he likes, and to enter into agreements with fellow citizens in a manner most profitable to him.

In a capitalist economy, the individual is free to choose any occupation he is qualified for. This freedom of choice enables the worker to make the best possible bargain for his labour. This implies that the employers have to competitively bid for labour. Freedom of occupational choice, however, does not mean guarantee of the job a worker opts for; the choice is practically limited by the extent of availability of the jobs.

- Consumers’ Sovereignty:

Consumers’ sovereignty is at its best in the capitalist system where consumers have complete freedom of choice of consumption. Under capitalism, the consumer is the king. Consumers’ sovereignty means freedom of choice on the part of every consumer. The consumer buys whatever he likes and as much as he likes.

The money price which the consumer offers expresses his wish. The production decisions in the free-market economy are based on the consumer desires which are reflected in the demand pattern. Frederic Benham remarks- “Under capitalism, the consumer is the king.”

- Unplanned Economy:

As is clear from the features mentioned above, the capitalist system is essentially characterised by the absence of a central plan. No central economic planning is done in a capitalist economy.

There are no rules and regulations framed by the central agency. The productive function is the result of decision taken by a large number of entrepreneurs. Freedom of enterprise, occupation and property rights rule out the possibility of a central plan. Resource allocation and investment decisions in a free market economy are influenced by market forces rather than by the State.

- Freedom to Save and Invest:

The freedom to save is implied in the freedom of consumption, for savings depend on income and consumption. The term saving implies the sacrifice of consumption. As George Halm observes- “The right to save is supported by the right to transmit wealth, so that the choice between present and future consumption is not limited to the adult life of one person. The freedom to save, inherit, and accumulate wealth is, therefore, a right which is perhaps more typical for the private enterprise system than is free choice of consumption and occupation.”

- Economic Inequalities:

Another feature of capitalism is the existence of glaring inequalities in income, wealth and economic power. The existence of big monopolies results in the concentration of not only income and wealth but also of economic power in the hands of a few people.

- Motive of Profit:

Profit is an important element of capitalism Investment tends to take the direction in which there is more possibility of profit. If the producers feel that they can obtain greater profit by the production of comfortable goods they will be inclined to do so without caring what people actually need.

- Competition:

Competition among sellers and buyers is an essential feature of an ideal capitalist system. Competition reduces market imperfections and associated problems. Therefore, in a free market economy, a sufficient amount of competition is considered necessary if the whole production and distribution process is to be regulated by market forces.

Competition is necessary in a private enterprise economy to keep initiative constantly on alert, to protect the consumer, and to maintain a sufficiently flexible price system.

- Limited Role of Government:

The absence of a central plan does not mean that the government does not play any role in a private enterprise economy. Indeed, government intervention is necessary to ensure some of the essential features and smooth functioning of the capitalist system. For example, government interference is necessary to define and protect property rights, ensure freedom of entry and exit, enforce contractual agreements among private entrepreneurs, ensure the satisfaction of certain community wants, etc. However, government interference in the system is comparatively very limited.

The pure capitalist system described above is highly idealised system. There is hardly any pure capitalist or free enterprise system in the real world today. The capitalist economies of today are characterised by state regulation in varying degrees. As a matter of fact, the modern capitalist economies are mixed or regulated systems.

Such regulated capitalist or market economies include the United States, Canada, Australia, the United Kingdom, France, Italy, the Federal Republic of Germany, Japan, Spain, New Zealand, the Netherlands, Belgium, Denmark, Sweden, Switzerland, Norway, etc.

Merits of Capitalism:

- Automatic Working: Capitalism is controlled by the profit motive and price mechanism. Thus, there is coordination under capitalism. The whole activity is automatic in capitalism.

- Capital Formation: Capitalist economy encourages formations of capital in the society. New industrial and commercial institutions are set up with the objective of profits and also encourage income and savings.

- Maximum Satisfaction: In capitalism, production is carried on, keeping in view the needs and tastes of the consumer. This provides maximum satisfaction to the consumer who is a king in a capitalist economy.

- Reward according to Capacity: In capitalism people are rewarded according to their capacity, to work and labour. The more people have the spirit of daring adventure, the more they are rewarded.

- Efficiency: Under capitalism there is wide competition among the producers. In the competitive race it is the able producer who wins the race. An efficient producer produces the best goods at cost of production. Thus, capitalism encourages efficiency.

Demerits of Capitalism:

- Economic Inequality: Capitalism gives complete freedom of private property, occupation and profession and is controlled by price mechanism. This leads to economic inequalities. The rich become richer and the poor become poorer.

- Inefficiency in Working: The efficiency of the capitalistic system depends on the existence of free competition and the mobility of factors of production. But the existence of social, economic and legal issues hampers free competition with the result that the factors of production often lie idle.

- Neglect of National Interest: The capitalists are mainly oriented towards self-interest of maximisation of profits and for this purpose they complete each of the formalities. They neglect the social interest. They do not complete their activities, keeping in view the national interest.

- Lack of Coordination: Under capitalism the central government has no control over the activities of the businessmen and producers. The decisions pertaining to production mostly depend on the producers. The leads to irregularities, excess production and trade cycles. Thus there is a lack of coordination under capitalism.

- Unemployment: Some of the economists are of the view that under a capitalist system full employment situation cannot be brought due to the lack of central economic planning. As a result, optimum use of resources cannot be possible. This brings up the situation of unemployment.

Evaluation of Capitalism:

Pure capitalism is an idealised system. It is very difficult to realise the avowed virtues of a free enterprise economy in the real world. There is no invisible hand that ensures the smooth functioning of the capitalist system.

Unregulated capitalism suffers from the following drawback:

- In capitalism investment allocation is guided by only profitability criterion, sufficient investment may not take place in areas where profitability is low, however essential they may be. Profitability would be generally high in sectors which cater to the needs of the upper income strata.

A large part of the resources of the nation may, therefore, be utilised for the satisfaction of the needs of the well-to-do. Resource allocation under pure capitalism will not, therefore, be optimal.

- The right to property and freedom of enterprise are likely to lead to concentration of income and wealth and the widening of inter-personal income disparities.

- Though, according to the theory, there will be free competition, in the real world the large firms are likely to gain an advantageous position which would eventually lead to monopolies.

- The operation of free market mechanism in the long run is detrimental to the lower and middle level of society. It creates imbalances in the standard of living also.

On the basis of the demerits of capitalism H.D. Dickinson writes, “Capitalism … is fundamentally blind, purposeless, irrational and is incapable of satisfying many of the urgent human needs.”

Socialist Economy:

According to Webbs, “A socialised industry is one in which the national instruments of production are owned by public authority or voluntary association and operated not with a view to profit by sale to other people, but for the direct service of those whom the authority or association represents.”

In the words of H.D. Dickinson, “Socialism is an economic organisation of society, in which the material means of production are owned by the whole community according to a general economic plan, all members being entitled to benefit from the results of such socialist plant production on the basis of equal rights.”

This economy system acknowledges the three inquiries in a different way. In a socialist society, the government determines what products are to be manufactured in accordance with the requirements of society. It is believed that the government understands what is appropriate for the citizen of the country, therefore, the passions of individual buyers are not given much attention. The government concludes how products are to be created and how the product should be disposed of. In principle, sharing under socialism is assumed to be based on what an individual needs and not what they can buy. A socialist system does not have a separate estate because everything is controlled by the government.

Characteristics of Socialism:

The important characteristics of socialism are as follows:

- Government Ownership:

In socialist economy the means of production are either owned by the government or their use is controlled by the government. The state holds the ownership on the means of production and they are utilised for the welfare of the society. There is no private property in respect of the means of production.

In communist countries like the USSR and China, the means of production are mostly owned by the state. In some socialist economies, the private sector also plays a very important role. In such cases, the government directs and regulates investment allocation and production pattern in accordance with national priorities.

In some countries, such as India, some of the basic sectors, including a major part of institutional finance, are in the public sector so that the resource allocation and investment pattern of the private sector may be regulated by regulating the flow of the basic inputs to the private sector.

When the state owns almost the whole of the means of production, it is much easier to achieve the desired pattern of resource allocation. State capitalism, of course, has its own defects and limitations.

- Central Planning:

Under socialism, the central planning authority or a Planning Commission formulates an overall plan for the entire economy according to certain objectives and priorities. The socialist economies generally have a central authority like the central planning agency to formulate the national plan for development and to direct resource mobilisation, allocation and investment to achieve the plan targets.

In the word of Dickinson, “Economic planning is the making of measured economic decisions, what and how much is to be produced, and to whom this is to be allocated by the conscious decision of determinate authority, on the basis of comprehensive survey of the economic systems as a whole.”

Socialist economies are sometimes called command economies because the central planning authority commands the pattern of resource utilisation and development. They are also called centrally planned economies. Centrally planned economies include the USSR, China, the German Democratic Republic (East Germany), Poland, Romania, etc.

- Social Welfare:

Another feature of socialism is that the means of production are operated with the object of promoting and serving the good of the community rather than for the benefit of few persons. Under socialism, the productive resources of the community are diverted to the production of goods and services which maximise social welfare rather than earn the largest profits.

- Lack of Competition:

Since there is governmental control over means of production, government has a hand in the matter of the kind of product to be produced, the quantity to be produced and determination of its price. There is no scope for competition.

- Restriction on Consumption:

In communist countries, there is no consumer sovereignty because the state decides what may be made available to consumers, unlike in the market economies where the consumers have the freedom to choose from a wide variety. The consumers in a communist system, thus, have to content themselves with what the state thinks is sufficient for them.

- Restriction on Occupation:

The freedom of occupation is absent or restricted in socialist countries. An individual may not have the freedom to choose any occupation he is qualified for. Similarly, individual freedom of enterprise is absent or restricted.

- Fixation of Wages and Prices by the Government:

The wage rates and prices in a communist economy are fixed by the government and not by market forces. Non-communist socialist countries may also fix wages and prices or regulate them by certain means.

- Equitable Distribution of Income:

An equitable distribution of income is an important feature of the socialist system. This does not mean, however, that socialist systems aim at perfect equality in income distribution. Wage differentials, depending on the nature and requirements of the job, are recognised in socialist countries.

The objective of equitable income distribution maybe achieved by fixing the wage rates and other economic rewards or by means of fiscal and other appropriate measures.

The traditional socialism emphasised government ownership of factors of production. But a number of today’s socialist systems are based on government control of the means of production rather than pure state capitalism. Even the Euro-communism shows a more liberal view than the Russian and Chinese systems. The recent changes in USSR and India are its best example.

Merits of Socialism:

- Economic Equality: Under socialism, there is control of government over production, there is no scope for centralisation of wealth. Wealth is distributed among all the people. This avoids economic inequalities.

- Production Planning: Under the socialist economy, the object is to serve the real demands and to fulfill the real needs of the people. For this purpose it arranges plant productions.

- Economic Stability: Under socialism the government establishes coordination between the demand for production and supply of various goods. Thus there is a little likelihood of over-production and under-production. As a result, there is economic stability in a socialist economy.

- Proper use of National Resources: Under capitalism, the central planning authority is better equipped than a capitalist market in locating price output fluctuations. The state uses the means of production for optimum welfare of the society.

Demerits of Socialism:

- Difficulties of Management: In a socialist system all production setup is based on government planning, wherein the government officials have to shoulder all responsibilities. As a result, the government officials are heavily burdened with the work and it makes proper management difficult.

- Lack of Freedom: In a socialist economy, it is a government which controls the economy. The workers are not free to choose occupation according to their choice. The government controls on all the activities of human life hinder developments.

- Lack of Consumer’s Sovereignty: In a socialist setup proper attention is not paid towards the likes and dislikes of the consumer. The government machinery determines the nature and quantity of production. Thus, the consumer is not a king in a socialist economy.

- Lack of Rational Calculation of Cost: The economists are of the view that in socialist system, there is lack of rational calculation of cost in production process. Efficient production becomes impossible in the absence of rational calculation of cost. The reason is the state ownership of the sources of production.

Evaluation of Socialism:

Socialism has become a very appealing and flexible concept. It has been aptly remarked that socialism is a cap that has lost its shape because so many different people have worn it. Indeed, there is a large variety of socialism today.

Democratic socialism strives to achieve a trade-off between the free enterprise system and state capitalism. Communism and state capitalism, however, suffer from a number of drawbacks.

Some of the important among these are the following:

- Civil liberties are suppressed under communism: Under communism; man is a mere cog in the machine. If a free and fair election is conducted in the totalitarian countries, it is doubtful if people will vote for the status quo.

- There is no consumer sovereignty in totalitarian systems. The state decides what and how much the people shall consume.

- The central planning authority commands the resource allocation, investment and development pattern. But the views of the authority need not always be the right ones. As criticism is hardly tolerated, there is a limited scope for accommodating different views and making critical evaluations.

Mixed Economic:

According to J.D. Khatri, “A mixed economic system is that in which the public sector and private sector are allotted their respective roles in promoting the economic welfare of all sections of the community.”

According to J.W. Grove, “One of the pre-suppositions of a mixed economy is that private firms are less free to control measure decisions about production and consumption than they would be under capitalist free enterprise, and that public industry is free from government restraints than it would be under centrally directed socialist enterprise.”

Mixed systems have characteristics of both the command and market economic systems. For this purpose, the mixed economic systems are also called dual economic systems. However, there is no sincere method to determine a mixed system. Sometimes, the word represents a market system beneath the strict administrative control in certain sections of the economy.

Characteristics of Mixed Economy:

- Division of Public and Private Sector: In mixed economy, public and private sectors are divided into two parts. In one part are the industries, the responsibility for the development of which is entrusted to the state and they are owned and managed by the state. In the second part, the consumer goods industries, small and cottage industries, agriculture, etc., are given to the private sector. It may be noted that the government does not work against the private sector.

- Government Control: Mixed economy cannot function without exercising control over the private enterprises in the public interest. This control is necessary for the government to introduce and implement its policies.

- Protection of Labour: Under mixed economy, government protects the weaker sections of society, especially labour, that is, it saves labour from exploitation by the capitalist. Minimum wages and the working hours have been fixed. The government takes a number of steps to prevent industrial disputes.

- Reduction of Economic Inequalities: In mixed economy the government takes necessary steps for the reduction of inequalities of income and wealth. In the democratic system, the governments try to reduce economic inequalities for promoting social justice, social welfare and increasing production for all.

Merits of Mixed Economy:

- Economic Freedom: Under mixed economy the consumers are free to act according to their choice. There is complete freedom for people to choose their profession. Economic liberty is available to people.

- Control on Monopolistic Activities: In a mixed economy, both public and private sector co-exist and the private sector gets the opportunity to develop. There is a restriction on monopolistic activities for which the government enacts various rules and regulations.

- Social Welfare: Under this system, the capitalist organisations are controlled by government. The industrial, economic and financial policies of government are based on the concept of social welfare.

- Planning and Proper Use of Resource: Under mixed economy the attention is given to planning. After proper survey all the resources are distributed into different sectors of the economy. This leads to proper and efficient utilisation of resources.

Demerits of Mixed Economy:

- Temporary Economic System: Mixed economy cannot be maintained as permanent economic system. At the very early stage of development this system was found suitable but later on, its principles went on diminishing.

- Danger to Democracy: It is possible that with the passage of time socialism may become powerful. In such condition the whole economic system would go under the control of government. Thus, there might be danger to democracy.

- Imbalance in the Economy: The mixed economy cannot provide proper development as the government wants to maintain a balance between the private and public sector. The policies of the government are not clear; with the result there exists presence of imbalance in the economy.

India is regarded as the best example of a mixed economy. The evaluation of such an economy in India is based on values as embodied in the Directive Principles of State Policy in the Indian Constitution. According to these Directive Principles it is obligatory on the part of the state to have a democratic form of government and within the framework of democracy to bring about a rapid economic development of the Indian economy in order to raise the national income and the standard of living of the masses.

The Directive Principles of the Indian Constitution lay down that the Slate strives “to promote the welfare of the people by securing and protecting as effectively as it may, social order in which justice social, economic, and political shall inform all the institutions of national life.” In the economic sphere, the state is to direct its policy to secure a better distribution of ownership and control of the material resources of the community and to prevent concentration of wealth in the hands of a few and the exploitation of labour.

It would be impossible for the state to attain the ends implied in the directive unless it enters the field of production and distribution. How can the state raise the level of national income and standards of living of the toiling masses in India unless it promotes rapid industrialisation through its own participation?

In India, therefore, the state is pledged to the establishment of a socialist order of society in which the present glaring inequalities of wealth would be reduced to the minimum. But then, the state would not be prepared to eliminate the system of private enterprise, which, in spite of many mistakes and obvious handicaps, has been doing a good job in the field of production and distribution.

Our mixed economy, therefore, is the result of our devotion to democracy and also to socialism. The result has been a growing state sector side by side with a growing private sector.

The Indian economy is a mixed economy characterised by the co-existence of private, public, joint and cooperative sectors and cottage, tiny, small, medium and large industries. Though there are overlapping in a number of areas, certain areas are specifically earmarked for different sectors, or some sectors are ruled out of some areas with a view to achieving certain socio-economic objectives.

The first important characteristic of a mixed economy is the existence of both private and public sectors. In a sense, both capitalist and socialist economies may be regarded as mixed economies, because as has been mentioned before, public sector will definitely exist in a capitalist economy and a small private sector will exist in a socialist economy.

The existence of a small public or private sector in a capitalist or socialist economy will not convert them into mixed economies. The important thing is that the government should follow a definite policy and should declare through the legislature its determination to allow the coexistence of the two sectors. Through law, the scope of each is clearly marked out.

Secondly, a mixed economy is necessarily a planned economy. The mixed economy does not mean simply a controlled economy in which the government interferes in economic matters through fiscal and monetary policies, but it is an economy in which the government has a clear and definite economic plan.

The government has operated according to certain planning and to achieve certain social and economic goals. But the government cannot leave the private sector to develop in its own unorganised manner, and therefore, it will have to prepare an integrated plan in while the private sector has well defined place.

Thirdly, the mixed economy has the salient features of capitalism and also of socialism very clearly and cleverly incorporated together. For instance, the private sector enterprises are based on self-interest and profit motive. Individual initiative is given full scope and the system of private property is respected. Individual freedom and competition are allowed to exist.

At the same time, it is not free or laissez faire capitalism but it is controlled capitalism since the scope of free enterprise and initiative, the driving forces of self-interest of society. Either they are restricted to certain industries or they are controlled through legislative and other measures. On the other hand, the public sector industries are managed and operated on the basis of welfare of the community.

Here private property and profit motive have no place. Competition is avoided and so too are the possible wastes of competition. The advantages of planning and relative equality of incomes are harmonised with the advantages of private initiative and profit motive.

The ideal of a mixed economic system has been adopted because it has been found to be the best system for the realisation of the goal of democratic socialism. A properly balanced system, where each of the sectors has a specific role to play, can make a significant contribution to growth with social justice.

The mixed system is a via media between the free enterprise economy and state capitalism or communism. Such a mixed economy harnesses and harmonises the resources and skills of both the private and public sectors for national development. It is expected to have the positive effects of the free enterprise and state capitalism without their negative effects.

With a view of effectively regulating the private sector, not only is the private sector subject to a number of checks and controls, but the public sector has acquired control over the commanding heights of the economy. However, the private sector is given positive support for growth and development in the areas in which it is expected to function.

There is no denying the fact that the public, private, joint and cooperative sectors have made their own contributions to the economic development of the country, though each suffers from some drawbacks and deficiencies, the mixed economic system has assisted in the acceleration of the pace of development, for it has facilitated the augmentation of the productive resources and their channelisation and utilisation in accordance with policy.

This is not to say that there have not been distortions or improper developments. But such distortions are the result of defective implementation rather than that of a defective policy.

The mixed economic system, no doubt, is best suited for a vast developing country like India. Our development experience since independence bears testimony to this. Had not the public, private and other sectors played their respective roles, it would not have been possible for India to achieve whatever growth and diversification it has attained.

The regulation of the private sector and the dominance of the public sector in certain areas are necessary for the attainment of the objective of the prevention of concentration of economic power in a few hands to the common detriment, to check the economic dominance and power of the private sector against social interest, and to promote social justice.

At the same time the pace of development has been accelerated by allowing the private sector to function in a number of areas. A lot of resources, including skills, would otherwise have gone unutilised.

The joint sector is an attempt at utilising the resources and talents of both the public and private sectors, with social orientation to achieve development in the desired direction. The co-operative sector, which involves the operation of the democratic spirit, has been encouraged in a number of areas to augment the resources of the common man and to facilitate their greater involvement in the development process.

Like this:

Like Loading...