Fishers Ideal Index number

Fisher’s Index Number, named after the American economist Irving Fisher, is a composite index that combines elements of both the Laspeyres and Paasche indices to provide a more balanced measure of price changes. It is considered a comprehensive measure because it accounts for both base-period and current-period quantities, offering a more accurate reflection of price changes over time. Here’s an in-depth look at Fisher’s Index Number:

Concept and Purpose:

Fisher’s Index Number aims to address the limitations of the Laspeyres and Paasche indices, which are two commonly used methods for calculating price indices. The Laspeyres Index uses base-period quantities to weigh prices, while the Paasche Index uses current-period quantities. Fisher’s Index blends these approaches to mitigate their individual biases and provide a more accurate measure of price changes.

Calculation

Fisher’s Index Number is calculated as the geometric mean of the Laspeyres Index and the Paasche Index. The formula for Fisher’s Index Number (I_F) is:

I_F= √(L×P)

where:

- L is the Laspeyres Index

- P is the Paasche Index

-

Laspeyres Index

The Laspeyres Index measures the change in price relative to a base period, using base-period quantities for weighting. The formula is:

L = [ ∑(P1×Q0) / ∑(P0×Q0) ]× 100

where:

- P_1 = Price of the item in the current period

- P_0 = Price of the item in the base period

- Q_0 = Quantity of the item in the base period

-

Paasche Index

The Paasche Index measures the change in price relative to a base period, using current-period quantities for weighting. The formula is:

P = [ ∑(P1×Q1) / ∑(P0×Q1) ]× 100

where:

- Q_1 = Quantity of the item in the current period

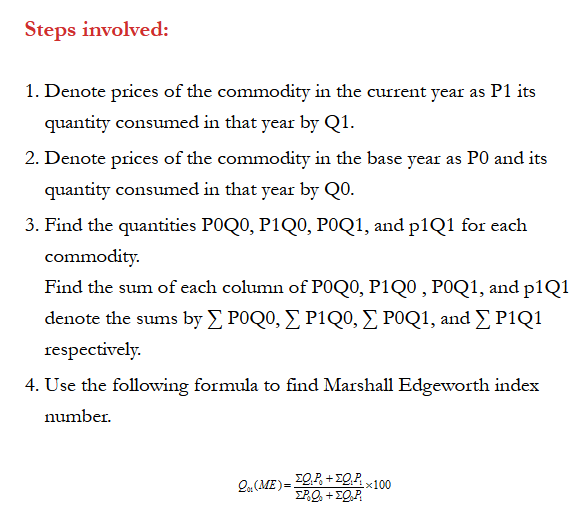

Steps to Calculate Fisher’s Index

- Compute the Laspeyres Index: Calculate the price index using base-period quantities to weight current prices.

- Compute the Paasche Index: Calculate the price index using current-period quantities to weight base prices.

- Calculate Fisher’s Index: Use the geometric mean of the Laspeyres and Paasche indices.

Applications:

-

Comprehensive Price Measurement:

Fisher’s Index provides a balanced approach to measuring price changes by incorporating both base-period and current-period quantities. This makes it a more accurate reflection of real price changes compared to Laspeyres or Paasche indices alone.

-

Inflation Analysis:

It is used to assess inflation by comparing changes in the cost of a fixed basket of goods over time, considering variations in both quantity and price.

-

Economic Research:

Economists and researchers use Fisher’s Index to study and compare price movements, making it a valuable tool for analyzing trends in economic data.

-

Cost of Living Adjustments:

It helps in adjusting wages, salaries, and benefits to keep up with changes in the cost of living by providing a more balanced view of price changes.

Advantages:

-

Balanced Measure:

Fisher’s Index avoids the biases inherent in using only base-period or current-period quantities, providing a more balanced view of price changes.

-

Accurate Reflection:

It offers a more accurate reflection of price movements by combining the strengths of both the Laspeyres and Paasche indices.

-

Geometric Mean:

Using the geometric mean ensures that the index does not overly emphasize one period’s data over another, offering a more neutral perspective.

Limitations:

- Complexity:

Fisher’s Index involves more complex calculations compared to Laspeyres and Paasche indices, which might be less intuitive and more resource-intensive to compute.

-

Data Requirements:

It requires detailed data on quantities and prices for accurate computation, which may not always be available.