Steps in Capital Budgeting Process

Capital budgeting is a critical process that involves evaluating and selecting long-term investment projects to ensure they align with a company’s strategic goals and provide a positive return on investment. This process requires careful analysis and decision-making, as the investments typically involve substantial financial commitments and have long-term implications. Here are the key steps in the capital budgeting process:

-

Project Identification:

The first step in capital budgeting is to identify potential investment opportunities. This can come from various sources, including internal research and development, market demand, technological advancements, or the need to replace or upgrade existing assets. The goal is to identify projects that contribute to the company’s growth and profitability.

-

Project Generation:

Once potential projects are identified, a systematic process is followed to generate a pool of investment proposals. This involves input from various departments within the organization, including operations, marketing, finance, and research and development. Ideas are often brainstormed, and project proposals are submitted for evaluation.

-

Project Evaluation:

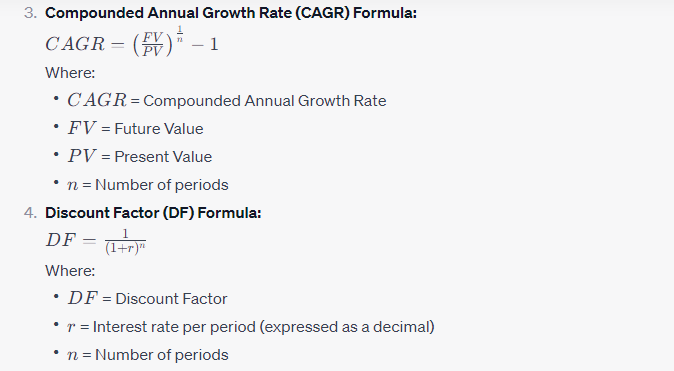

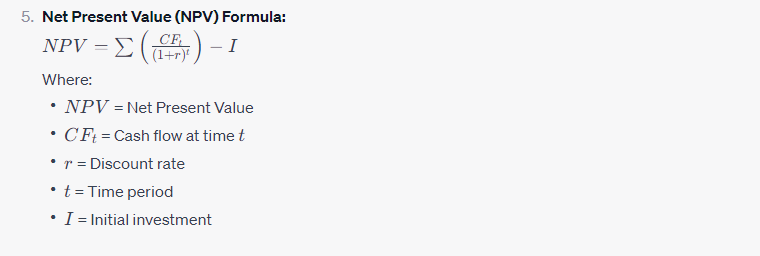

Each project undergoes a comprehensive evaluation to assess its feasibility and potential financial impact. This involves both quantitative and qualitative analyses. Quantitative methods include techniques like Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, and Profitability Index. Qualitative factors, such as strategic alignment, risk assessment, and market conditions, are also considered.

-

Cost Estimation:

Accurate cost estimation is crucial in the capital budgeting process. The costs associated with a project include initial investment costs, operating costs, maintenance costs, and any potential salvage value. Estimating costs helps determine the total investment required and contributes to the calculation of financial metrics used in the evaluation process.

-

Cash Flow Projections:

Cash flow projections involve estimating the cash inflows and outflows associated with a project over its expected life. This includes revenue generation, operating expenses, taxes, and any salvage value at the end of the project’s life. Cash flow projections are fundamental to calculating financial metrics like NPV and IRR.

-

Risk Analysis:

Risk assessment is a critical step to identify and analyze potential risks associated with each investment project. Risks can include market volatility, changes in interest rates, technological obsolescence, regulatory changes, and more. Sensitivity analysis and scenario analysis are often used to understand the impact of various risk factors on the project’s financial viability.

-

Capital Rationing:

Capital rationing involves setting limits on the total amount of capital that can be allocated to different projects. This step is crucial when there are budget constraints or limitations on available funds. Companies must prioritize projects based on their expected returns and strategic importance.

-

Project Ranking:

After evaluating and estimating the financial impact of each project, they are ranked based on predetermined criteria. Ranking allows for a systematic comparison of projects and helps in the selection of projects that align most closely with the company’s objectives. Financial metrics, such as NPV, IRR, and Payback Period, are often used for this purpose.

-

Decision Making:

Based on the evaluation and ranking of projects, management makes decisions on which projects to accept, reject, or modify. The goal is to choose projects that maximize shareholder value and contribute to the company’s long-term success. In some cases, a combination of projects may be selected to create a well-balanced portfolio.

-

Approval and Authorization:

Approved projects move to the authorization stage, where formal approval is sought from top management or the board of directors. This approval includes the allocation of funds, commitment of resources, and the initiation of the project. The authorization stage marks the formal commencement of the selected investment projects.

-

Implementation:

The approved projects move into the implementation phase, where the necessary resources are mobilized, and the project plan is executed. This involves coordinating various activities, including procurement, construction, training, and any other steps required to bring the project to fruition.

-

Monitoring and Control:

Throughout the implementation phase, projects are closely monitored to ensure they stay on track in terms of timelines, budgets, and expected outcomes. Any deviations from the plan are addressed promptly, and adjustments may be made to mitigate risks or capitalize on opportunities.

-

Post-Implementation Review:

After a project is completed, a post-implementation review is conducted to assess its performance against the initial projections. This involves comparing the actual outcomes with the estimated cash flows, returns, and other relevant metrics. The review provides insights for continuous improvement in future capital budgeting decisions.

-

Portfolio Management:

Portfolio management involves overseeing the collection of approved projects as a whole to ensure they collectively contribute to the company’s overall strategic objectives. It includes ongoing evaluation, reallocation of resources, and adjusting the portfolio in response to changing market conditions or company priorities.

-

Continuous Improvement:

Capital budgeting is an iterative process that benefits from continuous improvement. Organizations analyze the outcomes of previous projects, learn from successes and failures, and apply these lessons to enhance future capital budgeting practices. This includes refining evaluation techniques, risk assessment processes, and decision-making criteria.