Time preference of money, also known as the time value of money, is a fundamental concept in finance that recognizes the idea that a sum of money available today is considered more valuable than the same amount of money in the future. The principle is based on the premise that individuals prefer to receive a certain amount of money sooner rather than later due to the opportunity to invest or earn a return on that money over time.

Components of the Time preference of Money:

-

Future Value:

Future value refers to the value of money at a specified future point in time, taking into account compound interest or investment returns. Future value calculations help assess the potential growth of an investment.

-

Present Value:

Present value is the current worth of a sum of money to be received or paid in the future, discounted at a specific interest rate. It is a way of determining the current value of future cash flows.

-

Discounting:

Discounting is the process of adjusting the future value of money to its present value. It involves applying a discount rate to account for the time value of money. The discount rate reflects the opportunity cost of not having the money available today.

-

Opportunity Cost:

Opportunity cost represents the potential benefits foregone by choosing one investment or course of action over another. Time preference recognizes that having money today provides the opportunity to invest or earn a return, thus incurring an opportunity cost on funds deferred to the future.

-

Compounding:

Compounding refers to the process by which an investment earns interest not only on its initial principal but also on the accumulated interest from previous periods. Compounding is a key factor in understanding the growth of investments over time.

-

Risk and Uncertainty:

Time preference is influenced by the inherent risk and uncertainty associated with future cash flows. Individuals may prefer the certainty of money today over the uncertainty of receiving the same amount in the future.

Understanding the time preference of money is crucial in various financial decisions, including investment analysis, capital budgeting, and financial planning. It provides the basis for comparing cash flows occurring at different points in time and aids in making informed decisions about the allocation of resources.

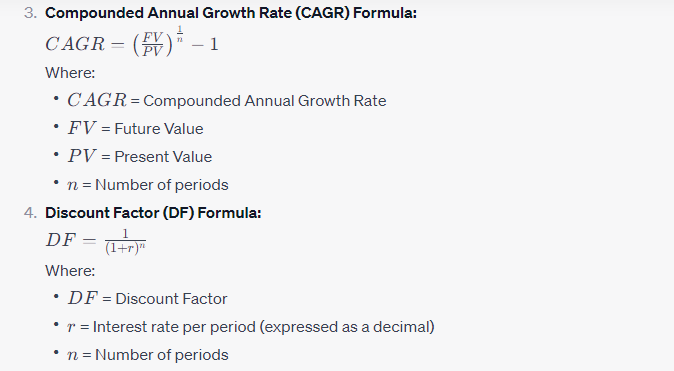

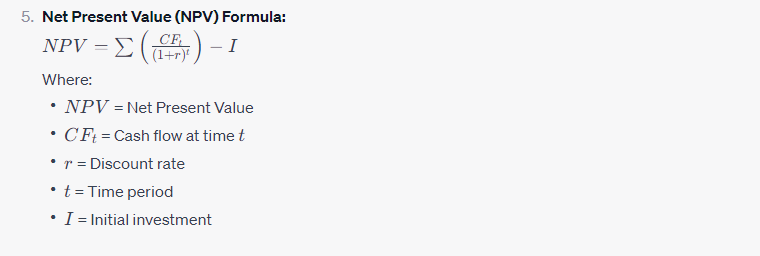

Financial formulas, such as the present value and future value formulas, are widely used to quantify the time value of money in practical applications. By considering the time preference of money, individuals and businesses can make more informed choices about saving, investing, borrowing, and evaluating the true value of financial transactions over time.

Formulas

Pros of Time Preference / Value of Money:

-

Informed Decision-Making:

Understanding the time value of money helps individuals and businesses make more informed decisions about saving, investing, and borrowing. It allows for better planning and allocation of financial resources.

-

Comparative Analysis:

The time value of money provides a framework for comparing cash flows occurring at different points in time. This is essential for evaluating investment opportunities, financial projects, and alternative financing options.

-

Accurate Valuation:

By discounting future cash flows to their present value, financial analysts can accurately assess the true value of an investment or financial transaction. This contributes to more accurate financial reporting and decision-making.

-

Risk Management:

Recognizing the time preference of money helps in assessing and managing risks associated with future cash flows. It allows individuals and businesses to consider the impact of uncertainty and make risk-adjusted decisions.

-

Optimal Resource Allocation:

Time value of money principles assist in determining the optimal allocation of financial resources. This is particularly important in capital budgeting, where decisions about long-term investments impact a company’s future financial health.

-

Financial Planning:

Individuals can use the concept of time preference to plan for future financial needs, such as retirement or major expenses. By understanding the impact of inflation and the potential for investment returns, individuals can set realistic financial goals.

Cons of Time Preference/Value of Money:

-

Simplifying Assumptions:

Time value of money calculations often involve simplifying assumptions, such as a constant interest rate. In reality, interest rates may fluctuate, and financial markets can be dynamic, leading to a degree of uncertainty.

-

Subjectivity:

The choice of an appropriate discount rate in time value of money calculations can be subjective. Different individuals or organizations may use different rates, leading to variations in present value or future value calculations.

-

Assumption of Rationality:

Time value of money assumes that individuals are rational and will always prefer to have a sum of money today rather than in the future. However, human behavior is complex, and individual preferences may not always align with this assumption.

-

Neglect of External Factors:

Time value of money calculations may neglect external factors that can influence financial decisions, such as changes in economic conditions, technological advancements, or unforeseen events. These factors can impact the accuracy of projections.

-

Overemphasis on Short-Term Gains:

The time preference of money can lead to an overemphasis on short-term gains, potentially neglecting the long-term sustainability of investments or projects. This bias may be counterproductive in situations where long-term strategic planning is crucial.

-

Difficulty in Predicting Future Variables:

Predicting future interest rates, inflation rates, and other variables used in time value of money calculations can be challenging. Variability in these factors can introduce uncertainty into financial decision-making.