Capital Structure means a combination of all long-term sources of finance. It includes Equity Share Capital, Reserves and Surplus, Preference Share capital, Loan, Debentures and other such long-term sources of finance. A company has to decide the proportion in which it should have its own finance and outsider’s finance particularly debt finance. Based on the proportion of finance, WACC and Value of a firm are affected. There are four capital structure theories for this, viz. net income, net operating income, traditional and M&M approach.

Net income

Net income approach and net operating income approach were proposed by David Durand. According to NI approach, there exists positive relationship between capital structure and valuation of firm and change in the pattern of capitalisation brings about corresponding change in the overall cost of capital and total value of the firm.

Thus, with an increase in the ratio of debt to equity overall cost of capital will decline and market price of equity stock as well as value of the firm will rise. The converse will hold true if ratio of debt to equity tends to decline.

This approach is based on three following assumptions:

(1) There are no taxes;

(2) Cost of debt is less than cost of equity;

(3) The use of debt does not change the risk perception of investors. This implies that there will be no change in cost of debt and cost of equity even if degree of financial leverages changes.

On the basis of the above assumptions, it has been held in the NI approach that increased use of debt will magnify the shareholders’ earnings (because cost of debt and cost of equity will remain constant) and thereby result in rise in share values of equity and so also value of the firm.

Thus, a firm can achieve optimal capital structure by making judicious use of debt and equity and attempt to maximise the market price of its stock.

According to NI approach a firm may increase the total value of the firm by lowering its cost of capital.

When cost of capital is lowest and the value of the firm is greatest, we call it the optimum capital structure for the firm and, at this point, the market price per share is maximised.

The same is possible continuously by lowering its cost of capital by the use of debt capital. In other words, using more debt capital with a corresponding reduction in cost of capital, the value of the firm will increase.

The same is possible only when:

(i) Cost of Debt (Kd) is less than Cost of Equity (Ke);

(ii) There are no taxes; and

(iii) The use of debt does not change the risk perception of the investors since the degree of leverage is increased to that extent.

Since the amount of debt in the capital structure increases, weighted average cost of capital decreases which leads to increase the total value of the firm. So, the increased amount of debt with constant amount of cost of equity and cost of debt will highlight the earnings of the shareholders.

Net Operating Income Approach (NOI):

According to Net Operating Income Approach which is just opposite to NI approach, the overall cost of capital and value of firm are independent of capital structure decision and change in degree of financial leverage does not bring about any change in value of firm and cost of capital.

The market value of the firm is determined by the following formula:

The crucial assumptions of the NOI approach are:

(1) The firm is evaluated as a whole by the market. Accordingly, overall capitalisation rate is used to calculate the value of the firm. The split of capitalisation between debt and equity is not significant.

(2) Overall capitalisation rate remains constant regardless of any change in degree of financial leverage.

(3) Use of debt as cheaper source of funds would increase the financial risk to shareholders who demand higher cost on their funds to compensate for the additional risk. Thus, the benefits of lower cost of debt are offset by the higher cost of equity.

(4) The cost of debt would stay constant.

(5) The firm does not pay income taxes.

Thus, under the NOI approach the total value of the firm as stated above is determined by dividing the net operating income (EBIT) by the overall capitalisation rate and market value of equity (S) can be found out by subtracting the market value of debt (B) from the overall value of the firm (V). In other words.

Now we want to highlight the Net Operating Income (NOI) Approach which was advocated by David Durand based on certain assumptions.

They are:

(i) The overall capitalisation rate of the firm Kw is constant for all degree of leverages;

(ii) Net operating income is capitalised at an overall capitalisation rate in order to have the total market value of the firm.

Thus, the value of the firm, V, is ascertained at overall cost of capital (Kw):

V = EBIT/Kw (since both are constant and independent of leverage)

(iii) The market value of the debt is then subtracted from the total market value in order to get the market value of equity.

S – V – T

(iv) As the Cost of Debt is constant, the cost of equity will be

Ke = EBIT – I/S

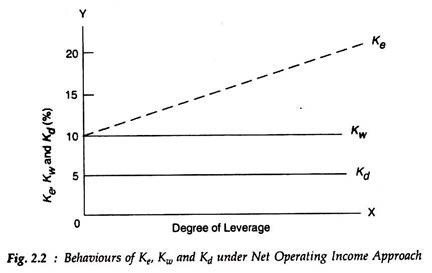

The NOI Approach can be illustrated with the help of the following diagram

Under this approach, the most significant assumption is that the Kw is constant irrespective of the degree of leverage. The segregation of debt and equity is not important here and the market capitalises the value of the firm as a whole.

Thus, an increase in the use of apparently cheaper debt funds is offset exactly by the corresponding increase in the equity- capitalisation rate. So, the weighted average Cost of Capital Kw and Kd remain unchanged for all degrees of leverage. Needless to mention here that, as the firm increases its degree of leverage, it becomes more risky proposition and investors are to make some sacrifice by having a low P/E ratio.

Traditional Approach:

While the above two approaches represent extreme views about the impact of financial leverage on value of firm and cost of capital, traditional approach offers an intermediate view which is a compromise between the NOI and NI approaches.

This approach resembles the NI approach when it argues that the value of the firm can be increased and cost of capital can be reduced by the judicious mix of debt and equity share capital but it does not subscribe to the view of NI approach that the value of the firm will increase and cost of capital will decrease for all the degrees of financial leverage.

Further, the traditional approach differs from the NOI approach because it does not hold the view that the overall cost of capital will remain constant whatever be the degree of financial leverage. Traditional theorists believe that up to certain point a firm can by increasing proportion of debt in its capital structure reduce cost of capital and raise market value of the stock.

Beyond the point further induction of debt will lead the cost of capital to rise and market value of the stock to fall. Thus, through a judicious mix of debt and equity a firm can minimise overall cost of capital to maximise value of stock. They opine that optimal point in capital structure is one where overall cost of capital begins to rise faster than the increase in earnings per share as a result of application of additional debt.

Traditional view regarding optimal capital structure can be appreciated by categorizing the market reaction to leverage in following three stages:

Stage I:

The first stage starts with introduction of debt in the firm’s capital structure. As a result of the use of low cost debt the firm’s net income tends to rise; cost of equity capital (Ke) rises with addition of debt but the rate of increase will be less than the increase in net earnings rate. Cost of debt (Ki,) remains constant or rises only modestly. Combined effect of all these will be reflected in increase in market value of the firm and decline in overall cost of capital (K0).

Stage II:

In the second stage further application of debt will raise costs of debt and equity capital so sharply as to offset the gains in net income. Hence the total market value of the firm would remain unchanged.

Stage III:

After a critical turning point any further dose of debt to capital structure will prove fatal. The costs of both debt and equity rise as a result of the increasing riskiness of each resulting in an increase in overall cost of capital which will be faster than the rise in earnings from the introduction of additional debt. As a consequence of this market value of the firm will tend to depress.

The overall effect of these stages suggests that the capital structure decision has relevance to valuation of firm and cost of capital. Up to favorably affects the value of a firm. Beyond that point value of the firm will be adversely affected by use of debt.

The traditional view of optimal structure is set forth graphically in figure 14.3.

It may be noted from figure 14.3 that the cost of capital curve (Ke) is saucer shaped where an optimal range is extended over the range of leverage. But cost of capital curve need not always be saucer shaped. It is possible that stage 2 may not exist at all and instead of optimal range we may have optimal point in capital structure. This possibility is shown in figure 14.4.

Thus, cost of capital curve may be V shaped which yudecdes that applications of additional debt in capital structure beyond a point will result in an increase in total cost of capital and fall in market value of the firm. This is an optimal level of debt and equity mix which every firm must endeavour to attain.

Modigliani-Miller (M-M) Approach:

Modigliani-Miller’ (MM) advocated that the relationship between the cost of capital, capital structure and the valuation of the firm should be explained by NOI (Net Operating Income Approach) by making an attack on the Traditional Approach.

The Net Operating Income Approach, supplies proper justification for the irrelevance of the capital structure. In Income Approach, supplies proper justification for the irrelevance of the capital structure.

In this context, MM support the NOI approach on the principle that the cost of capital is not dependent on the degree of leverage irrespective of the debt-equity mix. In the words, according to their thesis, the total market value of the firm and the cost of capital are independent of the capital structure.

They advocated that the weighted average cost of capital does not make any change with a proportionate change in debt-equity mix in the total capital structure of the firm.

The same can be shown with the help of the following diagram

Proposition:

The following propositions outline the MM argument about the relationship between cost of capital, capital structure and the total value of the firm:

(i) The cost of capital and the total market value of the firm are independent of its capital structure. The cost of capital is equal to the capitalisation rate of equity stream of operating earnings for its class, and the market is determined by capitalising its expected return at an appropriate rate of discount for its risk class.

(ii) The second proposition includes that the expected yield on a share is equal to the appropriate capitalisation rate of a pure equity stream for that class, together with a premium for financial risk equal to the difference between the pure-equity capitalisation rate (Ke) and yield on debt (Kd). In short, increased Ke is offset exactly by the use of cheaper debt.

(iii) The cut-off point for investment is always the capitalisation rate which is completely independent and unaffected by the securities that are invested.

Assumptions:

The MM proposition is based on the following assumptions:

(a) Existence of Perfect Capital Market It includes:

(i) There is no transaction cost;

(ii) Flotation costs are neglected;

(iii) No investor can affect the market price of shares;

(iv) Information is available to all without cost;

(v) Investors are free to purchase and sale securities.

(b) Homogeneous Risk Class/Equivalent Risk Class:

It means that the expected yield/return have the identical risk factor i.e., business risk is equal among all firms having equivalent operational condition.

(c) Homogeneous Expectation:

All the investors should have identical estimate about the future rate of earnings of each firm.

(d) The Dividend pay-out Ratio is 100%:

It means that the firm must distribute all its earnings in the form of dividend among the shareholders/investors, and

(e) Taxes do not exist:

That is, there will be no corporate tax effect (although this was removed at a subsequent date).

Interpretation of MM Hypothesis:

The MM Hypothesis reveals that if more debt is included in the capital structure of a firm, the same will not increase its value as the benefits of cheaper debt capital are exactly set-off by the corresponding increase in the cost of equity, although debt capital is less expensive than the equity capital. So, according to MM, the total value of a firm is absolutely unaffected by the capital structure (debt-equity mix) when corporate tax is ignored.

Proof of MM Hypothesis: The Arbitrage Mechanism:

MM have suggested an arbitrage mechanism in order to prove their argument. They argued that if two firms differ only in two points viz. (i) the process of financing, and (ii) their total market value, the shareholders/investors will dispose-off share of the over-valued firm and will purchase the share of under-valued firms.

Naturally, this process will be going on till both attain the same market value. As such, as soon as the firms will reach the identical position, the average cost of capital and the value of the firm will be equal. So, total value of the firm (V) and Average Cost of Capital, (Kw) are independent.

2 thoughts on “Introduction to Capital Structure Theories”