Elasticity of demand refers to the responsiveness or sensitivity of the quantity demanded of a good or service to changes in one of its determining factors, primarily its price, income of the consumer, or prices of related goods. In simpler terms, it measures how much the demand for a product changes when its price or other influencing factor changes.

The most common and widely used form is Price Elasticity of Demand (PED), which shows the extent to which the quantity demanded changes in response to a change in the price of the product. If a small change in price leads to a large change in quantity demanded, demand is said to be elastic. If a change in price results in little or no change in demand, it is inelastic.

Besides PED, there are other forms:

- Income Elasticity of Demand (YED): Measures demand responsiveness to changes in consumer income.

- Cross Elasticity of Demand (XED): Measures demand changes due to the price change of related goods (substitutes or complements).

Elasticity helps businesses make strategic decisions in pricing, marketing, taxation impact, and forecasting revenue. For instance, if a product is price elastic, lowering the price may increase total revenue. Conversely, if demand is inelastic, a firm can raise prices without a major drop in sales volume.

Understanding elasticity is crucial for firms, policymakers, and economists to predict consumer behavior and optimize resource allocation in response to changing economic variables.

Types of Elasticity:

Distinction may be made between Price Elasticity, Income Elasticity and Cross Elasticity. Price Elasticity is the responsiveness of demand to change in price; income elasticity means a change in demand in response to a change in the consumer’s income; and cross elasticity means a change in the demand for a commodity owing to change in the price of another commodity.

(a) Infinite or Perfect Elasticity of Demand

Let as first take one extreme case of elasticity of demand, viz., when it is infinite or perfect. Elasticity of demand is infinity when even a negligible fall in the price of the commodity leads to an infinite extension in the demand for it. In Fig. 1 the horizontal straight line DD’ shows infinite elasticity of demand. Even when the price remains the same, the demand goes on changing.

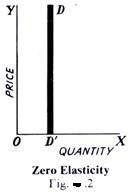

(b) Perfectly Inelastic Demand

The other extreme limit is when demand is perfectly inelastic. It means that howsoever great the rise or fall in the price of the commodity in question, its demand remains absolutely unchanged. In Fig. 2, the vertical line DD’ shows a perfectly inelastic demand. In other words, in this case elasticity of demand is zero. No amount of change in price induces a change in demand.

In the real world, there is no commodity the demand for which may be absolutely inelastic, i.e., changes in its price will fail to bring about any change at all in the demand for it. Some extension/contraction is bound to occur that is why economists say that elasticity of demand is a matter of degree only. In the same manner, there are few commodities in whose case the demand is perfectly elastic. Thus, in real life, the elasticity of demand of most goods and services lies between the two limits given above, viz., infinity and zero. Some have highly elastic demand while others have less elastic demand.

(c) Very Elastic Demand

Demand is said to be very elastic when even a small change in the price of a commodity leads to a considerable extension/contraction of the amount demanded of it. In Fig. 3, DD’ curve illustrates such a demand. As a result of change of T in the price, the quantity demanded extends/contracts by MM’, which clearly is comparatively a large change in demand.

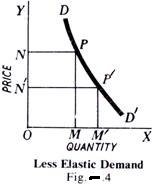

(d) Less Elastic Demand

When even a substantial change in price brings only a small extension/contraction in demand, it is said to be less elastic. In Fig. 4, DD’ shows less elastic demand. A fall of NN’ in price extends demand by MM’ only, which is very small.

Significance of Elasticity of Demand:

-

Determination of Output Level

For making production profitable, it is essential that the quantity of goods and services should be produced corresponding to the demand for that product. Since the changes in demand are due to the change in price, the knowledge of elasticity of demand is necessary for determining the output level.

-

Determination of Price

The elasticity of demand for a product is the basis of its price determination. The ratio in which the demand for a product will fall with the rise in its price and vice versa can be known with the knowledge of elasticity of demand.

If the demand for a product is inelastic, the producer can charge high price for it, whereas for an elastic demand product he will charge low price. Thus, the knowledge of elasticity of demand is essential for management in order to earn maximum profit.

-

Price Discrimination by Monopolist

Under monopoly discrimination the problem of pricing the same commodity in two different markets also depends on the elasticity of demand in each market. In the market with elastic demand for his commodity, the discriminating monopolist fixes a low price and in the market with less elastic demand, he charges a high price.

-

Price Determination of Factors of Production

The concept of elasticity for demand is of great importance for determining prices of various factors of production. Factors of production are paid according to their elasticity of demand. In other words, if the demand of a factor is inelastic, its price will be high and if it is elastic, its price will be low.

-

Demand Forecasting

The elasticity of demand is the basis of demand forecasting. The knowledge of income elasticity is essential for demand forecasting of producible goods in future. Long- term production planning and management depend more on the income elasticity because management can know the effect of changing income levels on the demand for his product.

- Dumping

A firm enters foreign markets for dumping his product on the basis of elasticity of demand to face foreign competition.

-

Determination of Prices of Joint Products

The concept of the elasticity of demand is of much use in the pricing of joint products, like wool and mutton, wheat and straw, cotton and cotton seeds, etc. In such cases, separate cost of production of each product is not known.

Therefore, the price of each is fixed on the basis of its elasticity of demand. That is why products like wool, wheat and cotton having an inelastic demand are priced very high as compared to their byproducts like mutton, straw and cotton seeds which have an elastic demand.

- Determination of Government Policies

The knowledge of elasticity of demand is also helpful for the government in determining its policies. Before imposing statutory price control on a product, the government must consider the elasticity of demand for that product.

The government decision to declare public utilities those industries whose products have inelastic demand and are in danger of being controlled by monopolist interests depends upon the elasticity of demand for their products.

- Helpful in Adopting the Policy of Protection

The government considers the elasticity of demand of the products of those industries which apply for the grant of a subsidy or protection. Subsidy or protection is given to only those industries whose products have an elastic demand. As a consequence, they are unable to face foreign competition unless their prices are lowered through subsidy or by raising the prices of imported goods by imposing heavy duties on them.

- Determination of Gains from International Trade

The gains from international trade depend, among others, on the elasticity of demand. A country will gain from international trade if it exports goods with less elasticity of demand and import those goods for which its demand is elastic.

In the first case, it will be in a position to charge a high price for its products and in the latter case it will be paying less for the goods obtained from the other country. Thus, it gains both ways and shall be able to increase the volume of its exports and imports.

Price Elasticity of Demand (PED):

Price Elasticity of Demand measures how much the quantity demanded of a product changes in response to a change in its price. It is calculated using the formula:

PED=% change in quantity demanded% change in price\text{PED} = \frac{\%\text{ change in quantity demanded}}{\%\text{ change in price}}

If PED > 1, demand is elastic (responsive to price changes). If PED < 1, demand is inelastic (not responsive). If PED = 1, demand is unitary elastic. For example, if the price of a luxury car drops and sales rise significantly, the demand is elastic. However, for necessities like salt or milk, even a big price rise may not reduce demand much, indicating inelastic demand.

Understanding PED helps businesses set pricing strategies. If demand is inelastic, firms can raise prices to increase total revenue. If it’s elastic, they may lower prices to attract more buyers and increase sales volume. Government agencies also consider PED when imposing taxes.

Income Elasticity of Demand (YED):

Income Elasticity of Demand measures how sensitive the quantity demanded of a good is to a change in consumers’ income. The formula is:

YED=% change in quantity demanded% change in income\text{YED} = \frac{\%\text{ change in quantity demanded}}{\%\text{ change in income}}

If YED > 1, the product is a luxury good, and demand increases more than proportionally with income. If 0 < YED < 1, it’s a normal good, and demand rises with income but at a slower rate. If YED < 0, it is an inferior good, and demand falls as income rises.

For example, as income increases, people may shift from public transport (inferior good) to personal vehicles (normal or luxury goods). Firms use YED to predict sales trends during economic growth or recession. High-income elasticity indicates sales will rise rapidly in prosperous times, while a low or negative elasticity means demand could fall during downturns.

Cross Elasticity of Demand (XED):

Cross Elasticity of Demand measures how the quantity demanded of one good responds to a price change of another related good. It is used to understand the relationship between substitute and complementary goods. The formula is:

XED=% change in quantity demanded of Good A% change in price of Good B\text{XED} = \frac{\%\text{ change in quantity demanded of Good A}}{\%\text{ change in price of Good B}}

If XED > 0, the goods are substitutes (e.g., tea and coffee); a price rise in one increases demand for the other. If XED < 0, the goods are complements (e.g., printers and ink cartridges); a price rise in one reduces demand for the other. If XED = 0, the goods are unrelated.

Businesses analyze XED to predict how a competitor’s price change can impact their own sales. For example, a soft drink company may monitor price changes of rival products to anticipate changes in their own demand. It’s also valuable in pricing bundled products or forming strategic alliances with producers of complementary goods.