Operating Leverage refers to the extent to which a company uses fixed costs in its cost structure to magnify changes in operating profit (EBIT) relative to changes in sales revenue. A firm with high operating leverage has a larger proportion of fixed costs, meaning that a small increase in sales leads to a higher increase in EBIT, but a decline in sales can also result in greater losses. Companies with low operating leverage have more variable costs, making them less risky but with lower profit potential. Measuring Degree of Operating Leverage (DOL) helps in financial planning and risk assessment.

Formula

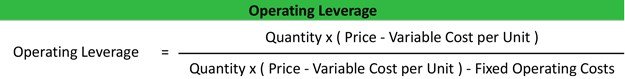

The operating leverage formula is calculated by multiplying the quantity by the difference between the price and the variable cost per unit divided by the product of quantity multiplied by the difference between the price and the variable cost per unit minus fixed operating costs.

DOL = [Quantity x (Price – Variable Cost per Unit)] / Quantity x (Price – Variable Cost per Unit) – Fixed Operating Costs

By breaking down the equation, you can see that DOL is expressed by the relationship between quantity, price and variable cost per unit to fixed costs. If operating income is sensitive to changes in the pricing structure and sales, the firm is expected to generate a high DOL and vice versa.

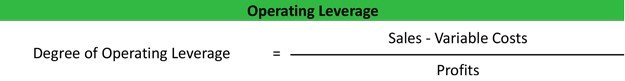

You can also rephrase this equation in more general terms like this:

Managers need to monitor DOL to adjust the firm’s pricing structure towards higher sales volumes as a small decrease in sales can lead to a dramatic decrease in profits.

Uses of Operating Leverage:

- Profit Maximization

Operating leverage helps companies maximize profits by utilizing fixed costs effectively. When sales increase, firms with high operating leverage experience a proportionally larger rise in EBIT (Earnings Before Interest and Taxes), as fixed costs remain constant while revenue grows. This leverage effect allows businesses to enjoy higher profit margins without incurring additional fixed costs. However, firms must carefully manage this leverage since a decline in sales could significantly impact earnings, making profit maximization a delicate balance of cost management and revenue growth strategies.

-

Cost Control and Efficiency

Understanding operating leverage enables firms to focus on cost control and efficiency. Businesses with high fixed costs must ensure that their production processes and operational workflows are optimized to achieve the best possible returns. By closely monitoring cost structures, companies can identify inefficiencies and take corrective actions to improve profitability. This approach also helps in deciding the optimal pricing strategy, ensuring that products are priced competitively while covering fixed costs and generating profits efficiently.

-

Decision-Making in Business Expansion

Operating leverage plays a crucial role in business expansion decisions. Companies with high fixed costs need to evaluate whether increasing production capacity or entering new markets would be financially viable. By analyzing the Degree of Operating Leverage (DOL), firms can predict how additional investments in fixed assets will affect profitability. If an expansion can lead to a significant increase in revenue without proportionally increasing fixed costs, it can be a profitable growth strategy.

-

Risk Assessment and Management

Companies use operating leverage as a tool for risk assessment and management. Businesses with high operating leverage are more sensitive to sales fluctuations, making them riskier in uncertain market conditions. By understanding their leverage position, firms can take measures to mitigate risks, such as diversifying revenue streams, adjusting pricing strategies, or implementing cost-saving measures. A well-managed operating leverage strategy helps in maintaining financial stability during economic downturns.

-

Investment Decision-Making

Investors analyze a company’s operating leverage to assess its profitability potential and financial stability. Firms with high operating leverage offer higher returns when sales increase but also pose greater risks during downturns. Investors evaluate the DOL ratio to determine if a company’s earnings are stable and whether it can generate consistent profits in varying economic conditions. Businesses with a balanced operating leverage approach are often considered safer investment options.

-

Competitive Advantage

Operating leverage helps firms establish a competitive advantage by allowing them to optimize production costs and maintain stable profit margins. Businesses that effectively manage fixed and variable costs can offer competitive pricing while maintaining profitability. This advantage is particularly useful in industries with price-sensitive customers, where companies need to reduce costs while delivering value. A strong operating leverage strategy can help firms outperform competitors and sustain long-term market growth.

-

Budgeting and Financial Planning

Operating leverage is essential in budgeting and financial planning, as it helps businesses forecast profitability under different sales scenarios. Financial managers use operating leverage analysis to prepare budgets that ensure fixed costs are covered even in low-revenue periods. This planning approach helps in making informed decisions regarding cost allocation, production adjustments, and capital investments, ensuring that the company maintains a stable financial position over time.

-

Pricing and Sales Strategy

Companies leverage operating leverage insights to develop effective pricing and sales strategies. High fixed costs require firms to achieve higher sales volumes to break even and generate profits. By understanding their cost structure, businesses can set optimal pricing levels that attract customers while covering operational expenses. Additionally, firms with high operating leverage can implement aggressive marketing and sales strategies to drive revenue growth, ensuring profitability even in competitive markets.

3 thoughts on “Operating Leverage, Formula, Uses”