Sales Performance

Sales performance is the measurement of sales activity against the goals outlined in your sales plan. The simplest method of tracking sales performance is to establish sales goals for your team and for individual team members and then evaluate performance, either monthly or quarterly. You can then improve performance using new processes and sales tools.

Even world-class products and services don’t sell themselves. Sales and marketing are particularly important for startups that don’t have the established reputation of Microsoft, McDonald’s or the Mayo Clinic. A business can fail if it has the wrong product, but even the right product needs someone to sell it.

Unless you’re gifted at sales yourself, your business team needs at least one member who knows and understands selling. Lay down the basic sales plan for the company:

- How will the sales team generate leads?

- How should the salespeople approach customers?

- What’s the appropriate conduct and manner for the team? If you’re selling sports equipment, customers may expect a different demeanor than if you’re selling funeral plots.

- How can the sales team identify qualified customers as opposed to those who are never going to close the deal?

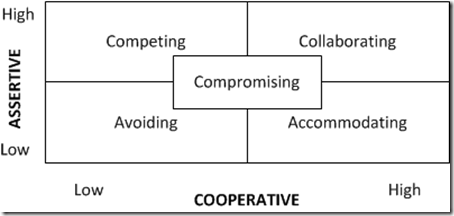

- What customer demands can the salespeople accept? Which demands are negotiable? Which ones are complete deal breakers?

- How does the team close deals?

Sales is a teachable skill. You or your sales executive can share the basics of good sales performance with your employees so your company has the best chance of a successful launch.

Evaluating Sales Performance

It’s important to know if your team’s sales performance is adequate, but it’s not easy to measure. If your sales revenue is good, that could be because of your sales team or in spite of your sales team. Revenue doesn’t tell you if they’re delivering peak performance or if it’s possible to increase sales.

To judge sales performance, you need KPI, or key performance indicators. These are metrics that measure your team’s success and help you identify areas of improvement for sales reps:

- How much time does the sales team put in on the job?

- How is their time spent? Do they spend most of their time pitching clients or hunting for leads to potential customers? Do they waste a lot of their time?

- How quickly does your sales force respond to leads? If someone calls and asks to meet, they’re probably looking to buy. If a salesperson doesn’t move fast, the lead may turn to some other company.

- How many presentations actually lead to a sale?

- How many potential customers are in the pipeline to be pitched? A good sales team needs lots of leads because they won’t all result in sales.

- How much time and money does it take to close each sale?

- How much money do customers generate after the initial sale?

- How much does your company spend on sales, including salary and benefits? Is it more than the team is bringing in?

- How much sales revenue does the team generate?

It’s important to choose the sales performance metrics that work for you. If your business strategy calls for steady sales growth over time or prioritizes repeat business, those goals should shape your KPI.

Sales Performance Management

Sales performance management involves monitoring your team’s performance, evaluating KPI and finding ways to increase sales. It’s easier than it used to be, as various software can do a lot of the monitoring for you, but it also takes judgment. Good management involves knowing when your salespeople are screwing up and when there’s nothing they could have done to close.

- Good sales performance management requires a transparent sales process: You know how many leads team members have, how they’re generating them and how individual sales efforts are going.

- Accurate sales performance projections give you benchmarks against which to measure your team. Projections need to be ambitious but realistic. Setting them unattainably high gives you a distorted view of sales performance.

- Motivation drives sales, as it does most other parts of business. Keeping your team motivated may require competition, showing them how they compare to each other or offering added incentives for those who increase sales the most.

- Keep accurate sales figures. Even if you rely on spreadsheets, one error can give a salesperson too much or too little commission.

Incentives to Increase Sales

Offering incentives is a time-honored way to increase sales. Commissions based on how much sales revenue an individual generates are a common incentive, as are bonuses. However, an incentive plan can easily turn into a disincentive plan, discouraging the team from giving its best effort.

- If you value teamwork, setting bonuses and rewards based on total sales team success is the way to go. Focusing on individual or competitive incentives could actually discourage the team from pulling together.

- Take some time to learn what your team wants for rewards. Cash is fine for some, but less-tangible rewards might appeal to others.

- If you have a strategic shift, such as increasing the pursuit of new customers, you need to adjust your incentives to suit the new goals.

Sales Improvement Plan

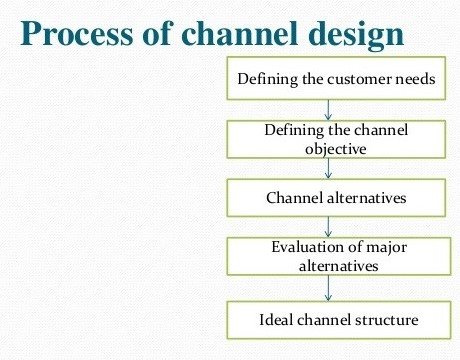

Suppose you review your sales KPI and discover the team is lagging. Sales aren’t keeping up with your forecasts, or they’ve been good but started dropping recently. To prevent a slight drop from becoming a free fall, you may need to draw up a sales improvement plan to increase sales once again.

- If you don’t have a sales plan for the team setting goals, objectives and strategies, then draw one.

- Use software for your team to track leads, contacts and opportunities.

- See whether your KPIs and your incentives are doing the job or need adjustment.

- Meet regularly with the team. This could include weekly meetings with the team as a whole and individual chats with each member. The meetings let you focus on the team’s energy and hear from them on problems about which you may not be aware.

- Find ways to get the team better leads for sales calls.

- Train the team to make better cold calls on new prospects.

- Word of mouth by satisfied customers is a great way to bring in new business. Encourage your sales team to make this a priority, such as giving customers their contact information and saying they’d welcome a referral.

- Have the team members work to improve their sales pitch.

- Is your team running into the same objections from prospects over and over? Work with your salespeople on finding ways to get around the common objections they hear.

- Keep an eye on your customers and potential customers. If there’s a change of management at a steady customer, you might contact them and renew the relationship. If it’s a potential customer to whom you haven’t sold, the change may offer a fresh opportunity to pitch them.

- Keep an eye out for underlying issues. It may be that the problem with sales performance isn’t the team but instead is new competition or software that doesn’t meet their needs.

Success and Failure

A sales improvement plan can’t work if you’re unrelentingly negative about sales performance. If your sales team is doing good work, celebrate that even as you ask them to do better. Present your plan as a way to do better, not an attempt to point fingers or treat them like losers.

If you do see them making serious mistakes, don’t look away. Talk to your team about their failures and discuss what lessons you can learn and how the team can improve for the future. As long as the team trusts you to help them move past their mistakes, they’re less likely to sweep failure under a rug.