Factors influencing a Sound Financial plan

Financial Plan is a strategic blueprint that outlines an organization’s financial goals, resource allocation, investment strategies, and risk management measures. It ensures optimal fund utilization, profitability, and long-term stability. A well-structured financial plan includes budgeting, capital structure planning, cash flow management, and financial forecasting. It helps businesses make informed decisions, achieve financial sustainability, and adapt to changing economic conditions while maintaining liquidity and operational efficiency.

Factors Influencing a Sound Financial Plan:

-

Business Goals and Objectives

A sound financial plan must align with an organization’s short-term and long-term goals. Clear financial objectives help in resource allocation, investment planning, and risk management. Whether a company aims for expansion, market diversification, or profitability, the financial plan should support these goals. Without well-defined objectives, financial decisions may lack direction, leading to inefficiencies. Businesses must regularly evaluate and adjust their financial strategies to remain aligned with evolving objectives and market conditions, ensuring sustained growth and stability.

-

Economic Conditions

The overall economic environment significantly impacts financial planning. Inflation, interest rates, GDP growth, and economic cycles influence investment decisions, borrowing costs, and financial stability. During economic booms, businesses may adopt aggressive expansion strategies, whereas during recessions, they may focus on cost-cutting and liquidity management. A sound financial plan incorporates economic forecasts and market trends to mitigate risks and capitalize on opportunities. Monitoring macroeconomic indicators helps businesses adapt to changing conditions and maintain financial resilience.

-

Capital Structure

A balanced capital structure ensures financial stability and growth. The right mix of debt and equity financing impacts a company’s profitability, risk exposure, and cost of capital. Excessive reliance on debt increases financial risk due to high-interest obligations, while over-dependence on equity can dilute ownership and reduce returns. A sound financial plan carefully evaluates financing options to optimize capital costs. Businesses should maintain a capital structure that supports operational efficiency, investment capacity, and long-term sustainability.

-

Liquidity and Cash Flow Management

Maintaining adequate liquidity is essential for meeting financial obligations, operational expenses, and unforeseen contingencies. A sound financial plan ensures a steady cash flow through effective revenue management, timely payments, and efficient working capital control. Poor liquidity management can lead to financial distress, delayed payments, and operational disruptions. Businesses must forecast cash flows, maintain contingency reserves, and optimize fund utilization to avoid liquidity crises. Proper cash flow management ensures smooth business operations and financial stability.

-

Risk Management

Financial risks, including market volatility, credit risks, and economic uncertainties, must be addressed in financial planning. A sound financial plan incorporates risk assessment techniques such as diversification, hedging, and insurance to mitigate potential financial losses. Identifying and analyzing risks helps businesses develop contingency strategies to safeguard financial health. Without effective risk management, businesses may face financial instability, reduced profitability, and potential losses. A proactive risk management approach ensures long-term resilience and business sustainability.

-

Regulatory and Tax Compliance

Adhering to financial regulations and tax laws is crucial for a sound financial plan. Non-compliance can result in penalties, legal issues, and reputational damage. Businesses must consider corporate tax structures, GST regulations, financial reporting standards, and legal obligations while planning finances. Staying updated on regulatory changes ensures smooth financial operations and avoids legal risks. A well-planned tax strategy helps minimize liabilities and optimize profits while ensuring compliance with government policies and industry norms.

-

Investment Decisions

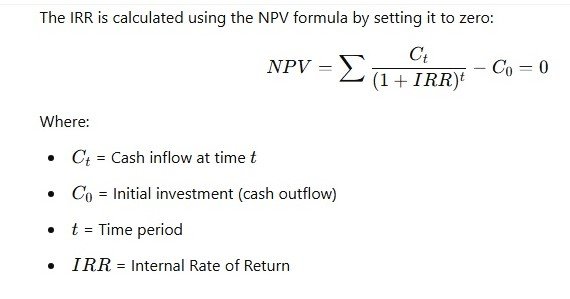

Strategic investment planning is a key component of a sound financial plan. Businesses must carefully analyze investment opportunities, expected returns, and associated risks. Investment decisions should align with long-term business objectives and financial capacity. A well-diversified investment portfolio minimizes risks and enhances financial security. Poor investment choices can lead to financial instability and losses. Evaluating investment feasibility, return on investment (ROI), and market trends ensures effective capital allocation and wealth maximization.

-

Market Competition and Industry Trends

Competitive market conditions and industry trends influence financial planning. Businesses must analyze competitors’ financial strategies, pricing models, and market positioning to remain competitive. A sound financial plan considers industry growth, technological advancements, and consumer preferences to make informed financial decisions. Adapting to market trends ensures business sustainability and profitability. Ignoring industry dynamics can lead to outdated financial strategies, loss of market share, and reduced profitability. Staying informed about market changes is essential for financial success.

-

Cost Control and Profitability

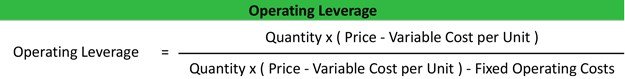

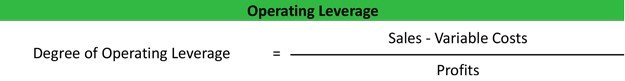

Efficient cost management enhances profitability and financial health. A sound financial plan focuses on reducing unnecessary expenses while maintaining quality and productivity. Businesses must analyze cost structures, implement cost-cutting measures, and optimize operational efficiency. Strategic budgeting and expense tracking ensure financial stability. Poor cost management can lead to reduced profitability, cash flow issues, and financial instability. Regular financial audits and performance reviews help businesses maintain a balance between cost efficiency and revenue generation.

-

Technological Advancements

Technology plays a crucial role in financial planning by improving efficiency, accuracy, and decision-making. Businesses use financial software, AI-driven analytics, and automated systems for budgeting, forecasting, and risk assessment. A sound financial plan incorporates technological advancements to streamline financial processes and enhance productivity. Ignoring technology can lead to inefficiencies and competitive disadvantages. Implementing modern financial tools ensures better data analysis, improved cash flow management, and enhanced financial decision-making.

-

Stakeholder Expectations

Financial planning must consider the expectations of stakeholders, including investors, shareholders, employees, and customers. A sound financial plan ensures transparency, accountability, and ethical financial management. Investors seek profitability and return on investment, while employees expect job security and growth opportunities. Aligning financial strategies with stakeholder interests fosters trust and long-term relationships. Failure to meet stakeholder expectations can result in decreased investor confidence, employee dissatisfaction, and reputational risks. Managing stakeholder expectations is essential for financial success.

-

Globalization and International Markets

Businesses operating in global markets must consider exchange rates, trade policies, and international financial regulations in their financial planning. Fluctuations in currency values, global economic trends, and geopolitical risks impact financial decisions. A sound financial plan includes strategies to manage foreign exchange risks, international investments, and cross-border transactions. Globalization offers growth opportunities, but financial planning must address associated risks. Ignoring international financial factors can lead to financial losses and instability in global operations.