Nature and Scope of Marketing

Marketing is the process of creating, communicating, delivering, and exchanging offerings that have value for customers, clients, partners, and society at large. It involves understanding customer needs and wants, designing products or services to meet those needs, and promoting them effectively to the target audience. Marketing is not limited to selling or advertising—it encompasses market research, product development, pricing strategies, distribution, and relationship building.

In a broader sense, marketing is both an art and a science. It requires creativity to design appealing offerings and analytical skills to interpret market data and trends. The ultimate aim is to satisfy customers profitably while building brand trust and loyalty. In today’s competitive and dynamic environment, marketing also plays a role in anticipating future needs, adapting to technological changes, and delivering value in a socially responsible manner, ensuring long-term success for both businesses and their stakeholders.

Nature of Marketing:

-

Customer-Oriented Process

Marketing focuses primarily on identifying and satisfying customer needs and wants. It starts with understanding the target audience through market research and ends with delivering products or services that meet their expectations. This orientation ensures that all business activities revolve around providing value to customers. By prioritizing customer satisfaction, marketing helps build loyalty, trust, and repeat business. The success of any marketing effort is measured by how well it fulfills customer demands while creating mutual value for both the buyer and the seller. Without a customer-oriented approach, marketing loses its effectiveness and long-term impact.

-

Goal-Oriented Activity

Marketing is directed towards achieving specific organizational goals, such as increasing sales, maximizing profits, expanding market share, or building brand awareness. Every marketing activity—from product development to promotional campaigns—is planned to contribute to these objectives. Goal orientation ensures that marketing efforts are measurable and aligned with the company’s overall strategy. It provides direction, motivates employees, and helps allocate resources efficiently. Without clear goals, marketing activities may become uncoordinated and ineffective. Therefore, a results-driven approach is essential for ensuring that marketing not only attracts customers but also delivers tangible benefits to the business.

-

Continuous and Dynamic Process

Marketing is an ongoing process that evolves with changes in customer preferences, market trends, technology, and competition. It is not a one-time activity but a continuous cycle of research, planning, implementation, and evaluation. The dynamic nature of marketing demands flexibility and innovation to adapt strategies in response to market changes. For example, shifts in consumer behavior due to digitalization or economic fluctuations require businesses to adjust pricing, promotion, and distribution strategies. This adaptability ensures relevance in the market and helps businesses maintain a competitive advantage over time.

-

Value Creation and Satisfaction

At its core, marketing is about creating and delivering value to customers. Value refers to the perceived benefits a customer receives compared to the cost they pay. By offering high-quality products, unique features, and excellent service, businesses can enhance customer satisfaction and loyalty. This value creation goes beyond the product—it includes after-sales support, emotional connection, and brand experience. When customers feel that they receive more benefits than they pay for, they are likely to repurchase and recommend the brand. Thus, value creation is essential for sustainable growth and long-term business success.

-

Integrated Organizational Function

Marketing is not just the responsibility of the marketing department; it is a function that integrates all areas of a business. Production, finance, research, customer service, and logistics must work together to fulfill marketing objectives. This integration ensures that every department contributes to delivering value and maintaining customer satisfaction. For example, production must ensure quality, finance must manage pricing strategies, and logistics must ensure timely delivery. A coordinated approach strengthens the brand image and ensures consistent communication with customers. Integrated marketing helps avoid conflicts, reduces inefficiencies, and enhances the overall customer experience.

-

Mutual Benefit for Business and Society

Marketing creates value not only for businesses but also for society. By providing goods and services that meet consumer needs, marketing improves living standards and supports economic growth. It also fosters employment opportunities, encourages innovation, and promotes fair competition. Ethical marketing practices ensure that products are safe, environmentally friendly, and socially responsible. This balance between business goals and societal welfare builds trust and enhances a brand’s reputation. When marketing serves both business and society, it contributes to sustainable development and creates a positive impact beyond profit-making.

-

Influenced by External Environment

Marketing activities are significantly affected by external environmental factors, including economic conditions, cultural values, technological advancements, legal regulations, and competition. These factors are largely uncontrollable but must be closely monitored to adjust marketing strategies accordingly. For example, changes in government policies may affect pricing or distribution, while technological innovations may open new promotional channels. Understanding the external environment enables businesses to anticipate challenges, seize opportunities, and remain competitive. This adaptability to external influences ensures marketing strategies remain relevant and effective in achieving business objectives.

Scope of Marketing:

-

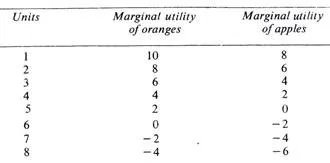

Study of Consumer Needs and Wants

The scope of marketing begins with identifying and understanding the needs and wants of consumers. This involves conducting market research to gather insights into buyer behavior, preferences, and purchasing patterns. By analyzing this data, businesses can design products and services that match customer expectations. The process includes segmentation, targeting, and positioning to serve the right market effectively. Without a clear understanding of consumer needs, marketing strategies may fail to attract or retain customers. Thus, studying customer needs forms the foundation for all marketing decisions and helps in developing products that deliver genuine value.

-

Product Planning and Development

Product planning is a key part of the marketing scope, involving the creation or improvement of goods and services to meet market demands. This includes determining product features, quality standards, packaging, branding, and after-sales service. Development may involve introducing completely new products or upgrading existing ones to suit changing preferences and technological advancements. Effective product planning ensures that offerings remain competitive and relevant. It also considers factors such as design, innovation, and sustainability. Since products are the core of any marketing strategy, careful planning and development directly impact customer satisfaction and business profitability.

-

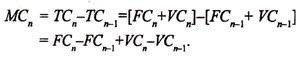

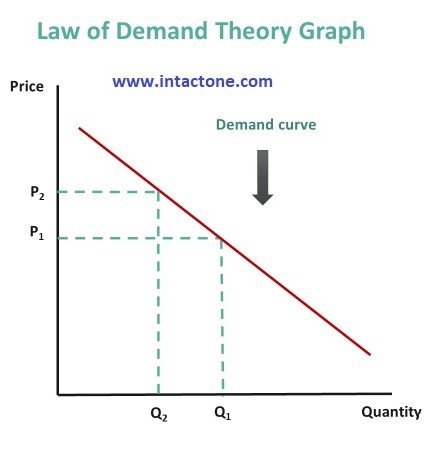

Pricing Decisions

Pricing is a critical element of marketing, as it directly affects sales, revenue, and profitability. The scope of marketing includes setting prices that reflect product value, match market conditions, and meet consumer expectations. Pricing strategies may vary based on factors like competition, cost, demand, and government regulations. Marketers may use approaches such as penetration pricing, skimming pricing, or value-based pricing to achieve business goals. The right pricing decision ensures competitiveness without sacrificing profitability. It must also consider psychological aspects, as customers often associate price with quality, making it a key factor in brand positioning.

-

Promotion and Communication

Promotion refers to all activities that inform, persuade, and remind customers about products and services. It includes advertising, personal selling, sales promotions, public relations, and digital marketing. Communication plays a crucial role in creating awareness, generating interest, and building brand loyalty. Marketers must design effective messages and choose suitable media channels to reach their target audience. The scope of promotion extends to creating emotional connections with customers and maintaining consistent brand identity. In today’s digital era, social media and online campaigns have become vital tools for promotional success, ensuring wider reach at lower costs.

-

Distribution (Place) Decisions

Distribution is the process of making products available to customers at the right place, time, and quantity. It involves selecting suitable channels such as wholesalers, retailers, e-commerce platforms, or direct sales. The scope of marketing includes designing efficient distribution networks, managing logistics, warehousing, and transportation. The goal is to ensure product accessibility and customer convenience. Choosing the right distribution strategy can improve market coverage and customer satisfaction. Factors like product type, target market, and cost efficiency influence these decisions. In modern marketing, online distribution has become increasingly important for reaching global audiences quickly.

-

After-Sales Service

After-sales service is a vital part of marketing, especially for products that require installation, maintenance, or repair. It helps in building customer trust and loyalty by ensuring continued satisfaction even after purchase. Services may include warranties, customer support, training, and complaint handling. The scope of marketing recognizes after-sales service as a competitive advantage, as it enhances brand reputation and encourages repeat purchases. Effective after-sales programs also generate positive word-of-mouth, which can attract new customers. In industries like electronics, automobiles, and machinery, after-sales service often determines long-term customer relationships and overall business success.

-

Market Research

Market research involves collecting and analyzing data to support marketing decisions. It helps businesses understand customer behavior, market trends, competition, and potential opportunities. This scope of marketing ensures that strategies are based on facts rather than assumptions. Research may include surveys, focus groups, observation, and data analytics. The insights gained guide product development, pricing, promotion, and distribution. Market research also helps in identifying emerging trends and minimizing risks. In a competitive environment, continuous research is essential for adapting to changes, staying ahead of competitors, and meeting evolving customer needs effectively.