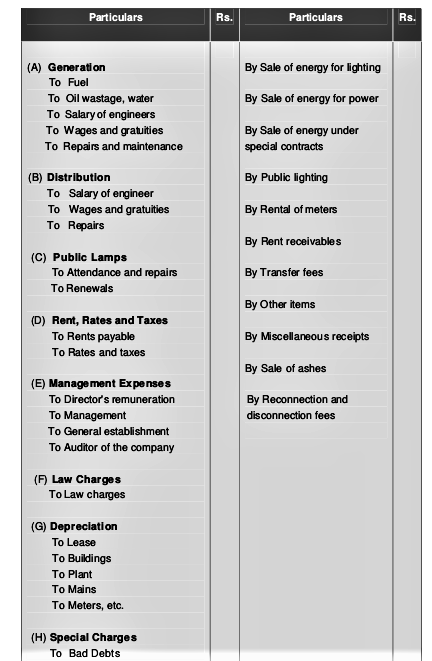

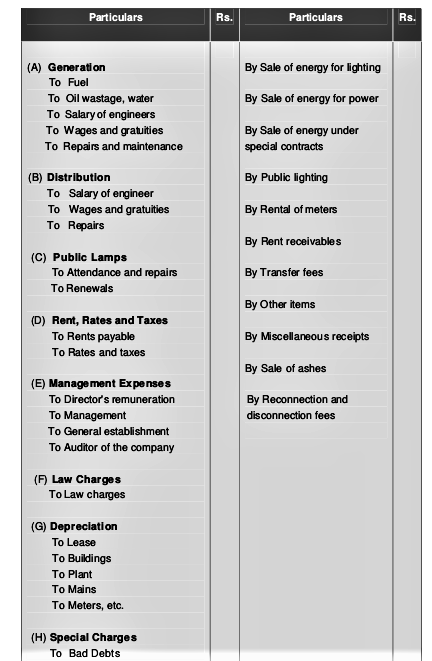

Revenue Account

This account is similar to the Profit and Loss Account of a trading or manufacturing concern. It is debited with various items of expenses and credited with various items of incomes. Depreciation on fixed assets is charged by debiting the Revenue Account and crediting the Depreciation Fund Account. Generally, expenses are shown under the following broad headings:

(A) Generation;

(B) Distribution;

(C) Public Lamps;

(D) Rent, Rates and Taxes;

(E) Management Expenses;

(F) Law Charges;

(G) Depreciation;

(H) Special Charges.

Similarly, incomes are grouped as:

(1) Sale of energy for lighting;

(2) Sale of energy for power;

(3) Sale of energy under special contracts;

(4) Public lightings;

(5) Rental of meters;

(6) Rent receivable; and

(7) Transfer fees, etc.Statutory Form of Revenue Account under Indian Electricity Act, 1910 is given below :

Revenue Account for the year ended ………………

Net Revenue Account

This is similar to the Profit and Loss Appropriation Account of a trading or manufacturing concern except the treatment of interest on debentures and loans.

In the Net Revenue Account, it is treated as appropriation of profits. However, In ordinary cases, such interest is treated as a charge against profits and shown in the Profit and Loss Account. The balance of the Net Revenue Account is shown in the General Balance Sheet.

The Statutory form of Net Revenue Account under the Indian Electricity Act,1910 is given below:

Net Revenue Account for the year ended ……………….

Capital Account (Receipts and Expenditure on Capital Account)

The main purpose of this account is to show total amount of capital raised and its application for acquisition of fixed assets for carrying on the business.As per the statutory forms (prescribed by the Indian Electricity Act, 1910) there are three columns on each side:

(i) one showing balance at the end of the previous year;

(ii) disclosing the amount received/spent during the year; and

(iii) balance at the end of the year. Statutory form of Capital Account under The Indian Electricity Act, 1910 is given below:

Receipts and Expenditure on Capital Account for the year ended………….

General Balance Sheet

In the General Balance Sheet, all the remaining assets and liabilities, like current assets, current liabilities, reserves, etc., are shown along with the total of receipts (on the liability side) and the total expenditure (on the asset side).

The Statutory Form of General Balance Sheet under Indian Electricity Act, 1910 is given below:

General Balance Sheet as on ………………………..

Treatment of Replacement of an Asset

Under the Single Account System when an asset is replaced, the Cash Account is debited and the Asset Account is credited, and the difference is transferred to the Profit and Loss Account (being profit or loss on sale of asset). The Asset Account is reduced by its written down value. Similarly, when an asset is purchased, the Asset Account is debited and the Cash or Bank Account is

credited and the Asset Account is increased by that amount. However, under the Double Account System when an asset is replaced, the original cost of the asset is not disturbed, instead it continues to appear in the Capital Account at the old figure. Under this system, the cost of replacement is treated in the books of accounts as under:

(i) When no Extension or Improvement is involved:

In this case, the entire amount of cost of replacement is treated as revenue expenditure and is debited to Revenue Account.

(ii) When Extension or Improvement is Involved:

In this case, an amount equal to the present cost of replacement of the old asset is treated as revenue expenditure and is charged to the Revenue Account. However, this chargeable amount is reduced by

(a) sale proceeds of scrap of the old asset

(b) value of materials of old asset used in rebuilding the new asset.

The total cost of replacement plus the value of materials of old asset used in rebuilding the new asset minus the present cost of replacement of the old asset is capitalised. Some Important Provisions

The students should note the following important matters which will affect the accounts of electricity companies as provided in the Sixth Schedule to The Electricity (Supply) Act. 1948.

These are as follows:

(a) Depreciation on fixed assets

(b) Fixed assets and their prescribed life

(c) Contingency reserve

(d) Development reserve

(e) General reserve

(f) Appropriation of profits

Depreciation on Fixed Assets

As per the provision of Sec. of The Electricity (Supply) Act, 1948, every fixed asset must be depreciation and for calculating depreciation, the life of each asset is to be taken as stated in the Seventh Schedule. Schedule VI provides for two methods of depreciation, viz:

(a) Compound Interest Method

(b) Strait Line Method.

Compound Interest Method

Under this method, such an amount should be set aside annually as depreciation throughout the prescribed life of the asset concerned, as would,with 4% p.a. compound interest, produced by the end of the prescribed period an amount equal to 90% of the original cost of the asset.

Straight Line Method

Under this method, the depreciation is calculated by dividing 90% of the original cost of the asset by the prescribed period in respect of such an asset.All sums credited to the Depreciation Reserve may be invested either in the business or may be utilised for repayments of loans not guaranteed under Section or for repayment of sums paid by the State Government under Guarantee Assets Written Down to 10% of Cost and No depreciation is allowed in respect of an asset which has been written-down to 10% (or less) of its original cost.

When a fixed asset is discarded or becomes obsolete it cannot be depreciated any more. In this case, the written-down value of such an asset is transferred to a special account. Any profit on sale of such assets is transferred to the Contingency Reserve Account.

Contingencies Reserve

Every electricity supply company is required to maintain a Contingencies Reserve. A sum equal to not less than 1/4% or not more than 1/2% of the original cost of fixed assets must be transferred from the Revenue Account to the Contingencies Reserve. The maximum amount in this account must not exceed 5% of the original cost of the fixed assets. The amount of Contingencies Reserve must be invested in trust securities. With the prior approval of the State Government, the Contingencies Reserve can be utilised for the following purposes :

( i ) For meeting expenses or loss of profit due to accident, strikes or circumstances beyond the control of the management;

(ii) For meeting expenses on replacement or removal of plant or works other than expenses required for normal maintenance or renewals;

(iii) For paying compensation under any law for the time being in force and for which no other provision has been made.

Development Reserve

An amount equal to income tax and super tax saved on account of Development Rebate allowed under Income Tax Act, 1961 has to be transferred to the Development Reserve Account. If, in any accounting year, the clear profit without considering special appropriations plus balance in the credit of Tariffs and Dividend Control Reserve is less than the required amount of Development Reserve, the shortfall may not be made good. In case of sale of the undertaking, this reserve should be handed over to the buyer.

General Reserve

Section of the Electricity Act, 1948 provides for the creation of the General Reserve by making appropriation from the Revenue Account after charging interest and depreciation. The amount of contribution shall be calculated @ 1/2% of the original cost of the fixed assets until the total of such reserve comes to 8% of the original cost of the fixed assets. Tariffs and Dividend Control Reserve

It is created out of the disposable surplus of the electricity company (explained below). This reserve can be utilised whenever the clear profit is less than reasonable return. At the time of sale of the undertaking, this reserve should be handed over to the buyer.

Appropriation of Profits

The Electricity (Supply) Act, 1948 provides that an electricity company cannot charge any rate as they like. They are entitled to charge such rates which give them a reasonable return. They must so adjust the rate that the amount of clear profit in any year does not exceed the reasonable return by more than 20%.

Disposal of Surplus

The excess of clear profit over reasonable return to the extent of 20% of reasonable return has to be disposed of as under: (Any excess over 20% of reasonable return must be refunded to customers).

(i) 1/3 of the surplus (not exceeding 5% of reasonable return) at the disposal of the undertaking.

(ii) Of the balance, 1/2 is to be transferred to the Tariffs and Dividend Control Reserve.

(iii) The balance is to be transferred to the Consumer’s Rebate Reserve for reduction of rates or for special rebate.

Calculation of Clear Profit

The Clear profit is the difference between the total income and total expenditure plus specific appropriations. The Clear profit is calculated as follows:

(A) Income from

(i) Gross receipts from sale of energy, less discount

(ii) Rental of meters and other apparatus hired to customers

(iii) Sale and repair of lamps and apparatus

(iv) Rent, less outgoings not otherwise provided for

(v) Transfer fees

(vi) Interest on investments, fixed and calls deposits and bank balances

(viii) Other taxable general receipts

Total Income

(B)Expenditure

(i) Cost of generation and purchases of energy

(ii) Cost of distribution and safe of energy

(iii) Rent, rates and taxes (other than taxes on income profits)

(iv) Interest on load advanced by Board

(v) Interest on loan taken from organization or institutions approved by the State Government

(vi) Interest on debentures issued by the licencee

(vii) Interest on security deposits

(viii) Legal charges

(ix) Bed debts

(x) Auditor’s fees

(xi) Management expenses

(xii) Depreciation (as per Schedule Seventh)

(xiii) Other admissible expenses

(xiv) Contribution to Provident Fund; gratuity, staff pension and apprentice and other training schemes

(xv) Bonus paid to the employees of the Undertaking. In case of dispute, in accordance with the decision of the tribunal.

In any other case, with the approval of the State Government Total Expenditure

Balance (A – B)

Less : Specific Appropriations

(i) Past losses (i.e., excess of expenditure over income)

(ii) All taxes on income and profits

(iii) Amount written-off in respect of fictitious and intangible assets

(iv) Contribution to Contingency Reserve

(v) Contribution towards arrears depreciation (if any)

(vi) Contribution to Development Reserve

(vii) Other appropriation (special) permitted by the State Government Clear Profit

Reasonable Return: It means the sum of the following items:

(i) An amount calculated at (bank rate + 2%) on Capital Base as defined below.

(ii) Income from investments (except income from Contingency Reserve Investment).

(iii) An amount equal to 1/2% on loans advanced by the State Electricity Board.

(iv) An amount equal to 1/2% on the amounts borrowed from organisations or institutions approved by the State Government.

(v) An amount equal to 1/2% on the amount raised through issue of debentures.

(vi) An amount equal to 1/2% on the balance of Development Reserve.

(vii) Any other amount as may be permitted by the Central Government.

Capital Base : Capital Base means :

(i) Original cost of fixed assets available for use Less : Contribution, if any, made by the customers for construction of service lines

(ii) the cost of intangible assets

(iii) the amount of investments made compulsorily on account of contingencies reserve

(iv) the original cost of work-in-progress

(v) working capital which is equal to the sum of:

(a) 1/2 of the sum of stores, materials and supplies including fuel on hand at the end of each month of the accounting year;

(b) 1/ 2 of the sum of cash and bank balance and call and short term deposit at the end of each month of accounting year but does not exceed in aggregate an amount equal to 1/4 of the expenditure (already listed in previous page).

(i) Deduct

Accumulated deprecation on tangible assets and amounts written-off tangible assets Loan advanced by Electricity Board

(ii) Security deposits of customers held in cash.

(iii) Debentures issued by the undertaking

(iv) Amount standing to the credit of Tariffs and dividend control revenue.

(v) Loan borrowed from organisations or institutions approved by the State Government.

(vi) Balance of Development reserve.

(vii) Amount carried forward for distribution to consumers.

Capital Base

Like this:

Like Loading...