According to the Chartered Institute of Management Accountants, cost is “the amount of expenditure (actual or notional) incurred on or attributable to a specified thing or activity.” Similarly, according to Anthony and Wilsch “cost is a measurement in monetary terms of the amount of resources used for some purposes.”

Cost has been defined by the Committee on Cost Terminology of the American Accounting Association as “the foregoing, in monetary terms, incurred or potentially to be incurred in the realization of the objective of management which may be manufacturing of a product or rendering of a service.”

From the above, it may be stated that cost means the total of all expenses incurred for a product or a service. Thus, cost of an article means the actual outgoings or ascertained changes incurred in its production and sale activities. In short, it is the amount of resources used up in exchange for some goods or services.

The so-called resources are expressed in terms of money or monetary units. What we stated above will not be a meaningful one until the same is used with an adjective only, i.e. when it communicates the meaning for which it is intended.

Thus, when we say Prime Cost or Works Cost or Fixed Cost etc., we want to explain a particular meaning which is essential while computing, measuring or analyzing the various aspects of cost.

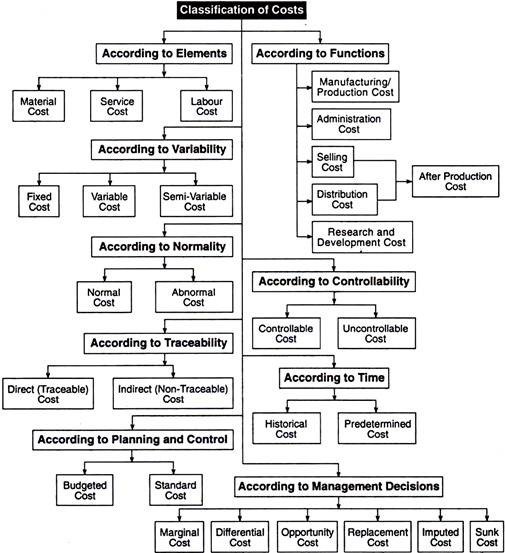

Classification of Cost

Classification of costs implies the process of grouping costs according to their common characteristics. A proper classification of costs is absolutely necessary to mention the costs with cost centres. Usually, costs are classified according to their nature, viz., material, labour, over-head, among others. An identical cost figure may be classified in various ways according to the needs of the firms.

The above classification may be outlined as:

The classification of cost may be depicted as given:

- According to Elements

Under the circumstances, costs are classified into three broad categories Material, Labour and Overhead. Now, further subdivision may also be made for each of them. For example, Material may be subdivided into raw materials, packing materials, consumable stores etc. This classification is very useful in order to ascertain the total cost and its components. Same classification may also be made for labour and overhead.

- According to Functions

The total costs are divided into different segments according to the purpose of the firm. That is why costs are grouped as per the requirements of the firm in order to evaluate its functions properly. In short, the total costs include all costs starting from cost of materials to the cost of packing the product.

It takes the cost of direct material, direct labour and chargeable expenses and all indirect expenses under the head Manufacturing/Production cost.

At the same time, administration cost (i.e. relating to office and administration) and Selling and Distribution expenses (i.e. relating to sales) are to be classified separately and to be added in order to find out the total cost of the product. If these functional classifications are not made properly, true cost of the product cannot accurately be ascertained.

- According to Variability

Practically, costs are classified according to their behaviour relating to the change (increase or decrease) in their volume of activity.

These costs as per volume may be subdivided into:

(i) Fixed Cost

(ii) Variable Cost

(iii) Semi-variable Cost

Fixed Costs are those which do not vary with the change in output, i.e., irrespective of the quantity of output produced, it remains fixed (e.g., Salaries, Rent etc.) up to a certain limit. It is interesting to note that if more units are product, fixed cost per unit will be reduced, and, if less units are produced, obviously, fixed cost per unit will be increased.

Variable Costs, on the other hand, are those which vary proportionately with the volume of output. So the cost per unit will remain fixed irrespective of the quantity produced. That is, there is no direct effect on the cost per unit if there is a change in the volume of output (e.g. price of raw material, labour etc.,).

On the contrary, semi-variable costs are those which are partly fixed and partly variable (e.g. Repairs of building).

- According to Controllability

Costs may, again, be subdivided into two broad categories according to the performance done by any member of the firm.

They are:

(i) Controllable Costs; and

(ii) Uncontrollable Costs.

Controllable Costs are those costs which may be influenced by the decision taken by a specified member of the administration of the firm or, it may be stated, that the costs which at least partly depend on the management and is controllable by them, e.g. all direct costs, direct material, direct labour and chargeable expenses (components of Prime Cost) are controllable by lower management level and is done accordingly.

Uncontrollable Costs are those which are not influenced by the actions taken by any specific member of the management. For example, fixed costs, viz., rent of building, payment for salaries etc.

- According to Normality

Under this condition, costs are classified according to the normal needs for a given level of output for a normal level of activity produced for such output.

They are divided into:

(i) Normal Costs

(ii) Abnormal Costs

Normal Costs are those costs which are normally required for a normal production at a given level of output and which is a part of production.

Abnormal Costs, on the other hand, are those costs which are not normally required for a given level of output to be produced normally, or which is not a part of cost of production.

- According to Time

Costs may also be classified according to the time element in it. Accordingly, costs are classified into:

(i) Historical Costs

(ii) Predetermined Costs.

Historical Costs are those costs which are taken into consideration after they have been incurred. This is possible particularly when the production of a particular unit of output has already been made. They have only historical value and cannot assist in controlling costs.

Predetermined Costs, on the other hand, are the estimated costs. Such costs are computed in advanced on the basis of past experience and records. Needless to say here that it becomes standard cost if it is determined on scientific basis. When such standard costs are compared with the actual costs, the reasons of variance will come out which will help the management to take proper steps for reconciliation.

- According to Traceability

Costs can be identified with a particular product, process, department etc. They are divided into:

(i) Direct (Traceable) Costs

(ii) Indirect (Non-Traceable) Costs.

Direct/Traceable Costs are those costs which can directly be traced or allocated to a product, i.e. it includes all traceable costs, viz., all expenses relating to cost of raw materials, labour and other service utilised which can be traced easily.

Indirect/Non-Traceable Costs are those costs which cannot directly be traced or allocated to a product, i.e. it includes all non-traceable costs, e.g. salary of store-keepers, general administrative expenses, i.e. which cannot properly be allocated directly to a product.

- According to Planning and Control

Costs may also be classified into:

(i) Budgeted Costs

(ii) Standard Costs.

Budgeted Costs refer to the expected cost of manufacture computed on the basis of information available in advance of actual production or purchase. Practically, budgeted costs include standard costs, both are predetermined costs and their amount may coincide but their objectives are different.

Standard Costs, on the other hand, is a predetermination of what actual costs should be under projected conditions serving as a basis of cost control and, as a measure of product efficiency, when ultimately aligned actual cost. It supplies a medium by which the effectiveness of current results can be measured and the responsibility for derivations can be placed.

Standard Costs are predetermined for each element, viz., material, labour and overhead.

Standard Costs include

(i) The cost per unit is determined to make an estimated total output for the future period for:

(a) Material

(b) Labour

(c) Overhead.

(ii) The cost must depend on the past experience and experiments and specification of the technical staff.

(iii) The cost must be expressed in terms of rupees.

- According to Management Decisions

Under this, costs may also be classified as:

(a) Marginal Cost: Marginal Cost is the cost for producing additional unit or units by segregation of fixed costs (i.e., cost of capacity) from variable cost (i.e. cost of production) which helps to know the profitability. Moreover, we know, in order to increase the production, certain expenses (fixed) may not increase at all, only some expenses relating to materials, labour and variable expenses are increased. Thus, the total cost so increased by the production of one unit or more is the cost of marginal unit and the cost is known as marginal cost or incremental cost.

(b) Differential Cost: Differential Cost is that portion of the cost of a function attributable to and identifiable with an added feature, i.e. the change in costs as a result of change in the level of activity or method of production.

(c) Opportunity Cost: It is the prospective change in cost following the adoption of an alternative machine, process, raw materials, specification or operation. In other words, it is the maximum possible alternative earnings which might have been earned if the existing capacity had been changed to some other alternative way.

(d) Replacement Cost: It is the cost, at current prices, in a particular locality or market area, of replacing an item of property or a group of assets.

(e) Implied Cost: It is the cost used to indicate the presence of arbitrary or subjective elements of product cost having more than usual significance. It is also called notional cost, e.g., interest on capital although no interest is paid. This is particularly useful while decisions are taken regarding alternative capital investment projects.

(f) Sunk Cost: It is the past cost arising out of a decision which cannot be revised now, and associated with specialised equipment’s or other facilities not readily adaptable to present or future purposes. Such cost is often regarded as constituting a minor factor in decisions affecting the future.