Exchange Rate

Exchange rate quotations can be quoted in two ways Direct quotation and indirect quotation. Direct quotation is when the one unit of foreign currency is expressed in terms of domestic currency. Similarly, the indirect quotation is when one unit of domestic currency us expressed in terms of foreign currency.

-

Direct Method

Under this method, the foreign exchange rate of a foreign currency is expressed as number of units of home currency (Local, domestic currency).

Under direct method, the number of units of foreign currency is kept constant (normally a unit, with exceptions, viz. Japanese Yen, in which Yen is taken as 100, if Yen is foreign currency) and any change in the exchange rate will be made by changing the value of local currency or home currency or domestic currency.

For example, US dollar 1.00 = Indian Rupees 46.86 (as on August 27th, 2010) would be a direct exchange rate for the US dollar in India, and US $ 1.00 = Japanese Yen 93.25 (as on March 31st, 2010) is a direct quote for Japan. The quotation of the exchange rate as found by Direct Method is known as “Direct Quotation” or “Direct Rate”.

Direct Quotation: Buy Low, Sell High

A trader, organization, business unit, banks, etc. are the various parties who contribute to the trade and commerce, through their manufacturing, trading in goods and/or providing of services. They do this kind of activities to earn profit. Though their prime motive might be different, but they need to make profit to sustain themselves.

In the same way, the banker buys the foreign currency at lower rate and sell at higher rate, which may result into margin, which help to cover his expenditures relating to the transaction, cost of storing the foreign currency, etc. and also a margin of profit. For having a practical idea, you may go to any of the Bank in your neighbourhood and inquire the rate of buying a foreign currency from them and of selling it.

You may see that there is some difference between them. In Layman’s words, the difference between the two rates is the profit of the banker; but in fact it is his margin, and he will earn profit after deducting all kinds of expenses relating to the transaction, or as per the method adopted by the bank.

For understanding this we can take an example, where a bank buys US $ from its customer for Rs. 44.94 (rate as on March 30th, 2010) and sell it to other customer at Rs. 45.14 (rate as on March 31st, 2010).

Thus under Direct method of Exchange rate the principle adopted by the bank is to buy at a lower price from customers and sell them at a higher price. This principle can be stated in the form of a maxim: ‘Buy Low, Sell High’.

-

Indirect Method

Under this method, the foreign exchange rate is quoted as number of units of foreign currency for a unit of local currency. Under the indirect method, the numbers of units of foreign currency are stated in exchange of a unit of local currency. Thus, in indirect method, the numbers of units of local currency are kept constant and the number of units of foreign currency changes.

Under indirect method, any change in the exchange rate is stated as a change in the number of units of foreign currency. For example, US dollar 2.2153 = Indian Rupees 100 (as on March 31st, 2010) would be the corresponding indirect quotation in India for the US dollar.

The method in which the foreign exchange rate is derived by keeping local or hone or domestic currency constant and the rate is expressed in number of units of foreign currency is known as Indirect Method.

It is also known as ‘Foreign Currency Quotation’ or ‘Indirect Quotation’ or simply ‘Currency Quotation’. Thus, under indirect method the change in exchange rate is shown by changing the number of units of foreign currency and keeping the home currency as constant.

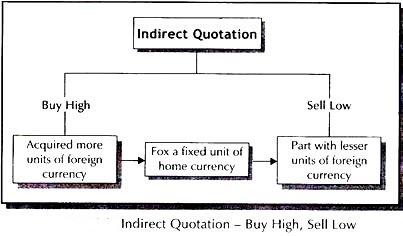

Indirect Quotation: Buy High; Sell Low

Buy more quantity and sell less quantity of commodities or goods or services at same amount of currency. Hypothesize the statement with respect to the quantity that a trader purchases and sells instead of the variation in prices.

For a fixed amount of investment, trader would acquire more units of the commodity when he purchases and for the same amount he would part with lesser units of the commodity when he sells. Taking the orange vendor as an example, if for Rs.100 he gets 50 oranges from his supplier and for the same amount of Rs.100 he sells 40 oranges, he would make profit.

Applying the same principle as discussed above in foreign exchange management we can state that the banker may also earn buying more quantity and selling less quantity of foreign currency at same rate. In indirect method, it is the number of units of foreign currency which vary and home currency remains the same.

For example, for Rs.100, the bank may quote a selling rate of US dollar 2.3000 and buying rate of US dollar 2.3100. The difference between US dollar 2.3100 and US dollar 2.3000 is the bank’s margin of profit. The position is summed up in the maxim

In India, Direct Quotation was prevalent till 1966. After devaluation of rupee in 1966, following the practice in London exchange market, indirect quotation was adopted. Effective from 2nd August 1993, India has switched over to direct method of quotation. The change has been introduced in order to simplify and establish transparency in exchange rates in India.

Trading banks offer a two-way quotation. If, in London, where the exchange rates are quoted indirectly, the US dollar is quoted at $ 1.6290-98, it means that while the quoting bank is willing to sell $ 1.6290 per pound, it will buy dollars at $ 1.6298. It will be readily appreciated that the selling rate for one currency is the buying rate for the other. The indirect rate system also yields the somewhat odd maxim namely “buy high and sell low”.

The “buy high and sell low” maxim refers only to the nominal rates no trader will make a profit if he buys at a higher cost than the yield on selling. In the direct quotation, bank buys at a lower price, and sells at a higher price.

In indirect quotation, for a fixed unit of home currency buy high (acquired more units of foreign currency), and sell low (part with lesser units of foreign currency). Exchange rate has to be quoted in four decimal points. In direct quotation, for a fixed unit of foreign currency buy low (pay lesser units of home currency) and sell high (receive more units of home currency).