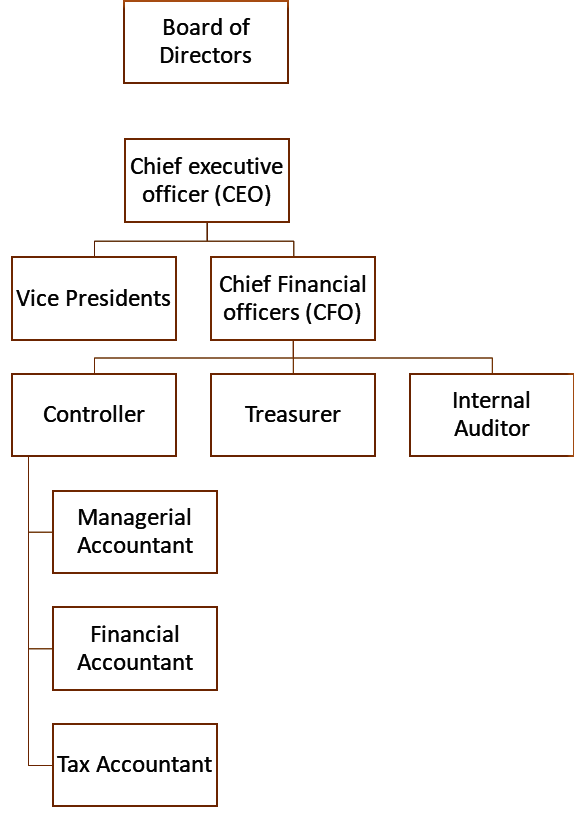

“A Typical Organization Chart” is a typical organization chart; it shows how accounting and finance personnel fit within most companies. The personnel at the bottom of the chart report to those above them. For example, the managerial accountant reports to the controller. At the top of the chart are those who control the company, typically the board of directors (who are elected by the owners or shareholders). Review Figure 1.1 “A Typical Organization Chart” before moving on to the detailed discussion of each important finance and accounting position.

Represents vice presidents of various departments outside of accounting and finance such as production, personnel, and research and development.

In addition to reporting to the chief financial officer, the internal auditor typically reports independently to the board of directors and/or the audit committee (made up of select members of the board of directors).

Chief Financial Officer

The chief financial officer (CFO) is in charge of all the organization’s finance and accounting functions and typically reports to the chief executive officer.

Controller

The controller is responsible for managing the accounting staff that provides managerial accounting information used for internal decision making, financial accounting information for external reporting purposes, and tax accounting information to meet tax filing requirements. The three accountants the controller manages are as follows:

- Managerial accountant. The managerial accountant reports directly to the controller and assists in preparing information used for decision making within the organization. Reports prepared by managerial accountants include operational budgets, cost estimates for existing products, budgets for new product lines, and profit and loss reports by division. (Note that some people use the term cost accountant interchangeably with managerial accountant. Others consider cost accounting a specific function of managerial accounting that focuses on measuring costs. In this text, we use the term managerial accountant and assume that cost accountants focus on measuring costs.)

- Financial accountant. The financial accountant reports directly to the controller and assists in preparing financial information, in accordance with U.S. GAAP, for those outside the company. Reports prepared by financial accountants include a quarterly report filed with the Securities and Exchange Commission (SEC) that is called a 10Q and an annual report filed with the SEC that is called a 10K.

- Tax accountant. The tax accountant reports directly to the controller and assists in preparing tax reports for governmental agencies, including the Internal Revenue Service.

Treasurer

The treasurer reports directly to the CFO. A treasurer’s primary duties include obtaining sources of financing for the organization (e.g., from banks and shareholders), projecting cash flow needs, and managing cash and short-term investments.

Internal Auditor

An internal auditor reports to the CFO and is responsible for confirming that the company has controls that ensure accurate financial data. The internal auditor often verifies the financial information provided by the managerial, financial, and tax accountants (all of whom report to the controller and ultimately to the CFO). If conflicts arise with the CFO, an internal auditor can report directly to the board of directors or to the audit committee, which consists of select board members.

Note: Not All Organization follow the Same Hierarchy

One thought on “Organization Structure of Finance Department”