Dissolution of firm means complete breakdown of the relation of partnership among all the partners. When all the partners resolve to dissolve the partnership, the dissolution of firm occurs, i.e. the firm is wound up.

If the business comes to an end, it is said that the firm has been dissolved. Dissolution of firm means the closing down of the business. Firm’s dissolution implies partnership dissolution but not vice versa.

That is dissolution of partnership does not mean dissolution of firm, but the dissolution of firm will be dissolved on any one of the following ways:

-

Dissolution by Agreement (Sec. 40)

A firm may be dissolved at any time with the consent of all partners. For instance, when a firm does not expect good prospects in the future, a firm can be dissolved by mutual consent of all partners.

-

Compulsory Dissolution (Sec. 41)

A firm is compulsorily dissolved by operation of law when all the partners except one become insolvent or when all the partners become insolvent or when business becomes illegal or when the number of partners exceeds twenty in case of ordinary business or ten in case of banking.

-

Dissolution on the Happening of Certain Contingencies (Sec. 42)

A firm is dissolved, in the absence of contrary, in the event of any of the following circumstances:

(i) The expiry of the term for which it was formed.

(ii) The completion of the venture for which the partnership was constituted.

(iii) The death of a partner

(iv) The adjudication of a partner as an insolvent.

-

Dissolution by Notice of Partnership at Will (Sec. 43)

Where a partnership is at will, the firm may be dissolved by any partner giving notice in writing to all the other partners of his intention to dissolve the firm.

-

Dissolution by the Court (Sec. 44):

The court is empowered to order the dissolution of a firm consequent on a suit by a partner in the following cases:

(i) When a partner becomes insane or unsound of mind.

(ii) When a partner becomes permanently incapable of performing his duties, be it mental or physical.

(iii) When a partner is proved guilty of misconduct which is likely to affect adversely the business of the firm.

(iv) When a partner conduct himself in such a way that it is not possible for the other partners to carry on partnership with him.

(v) When a partner transfers his interest or share to third party.

(vi) When the business cannot be carried out except at a loss. (It must be remembered that the object of partnership is to earn profits and if that object is not fulfilled, the firm can be dissolved).

(vii) When it appears to be just and equitable. For instance, continued quarrelling, deadlock in the management, refusal to attend matters of business, absence of cooperation etc. among the partners. (The court has wide discretionary powers).

Liability for Acts Done After Dissolution (Sec. 45)

When a firm is dissolved a public notice must be given of the dissolution. If it is not done, the partners continue to be liable as such to third parties for any act done by any of them after the dissolution, and in such a case, the act of a partner done after dissolution is deemed to be an act done before the dissolution.

Settlement of Accounts (Sec. 48)

As soon as a firm is dissolved, it ceases to transact normal business. The mode of settlement of accounts between partners after the dissolution of a firm is determined by the partnership agreement. In the absence of any specific agreement as to the mode of settlement of accounts after the dissolution of the firm, the Partnership Act laid down the following provisions (Sec. 48) for settlement of accounts.

(a) Losses, including deficiencies of capital, shall be paid first out of profit, next out of capital, and lastly, if necessary, by the partners individually in their profit-sharing ratio.

(b) The assets of the firm including any sums contributed by the partners to make up deficiencies of capital shall be applied in the following manner and order:

(i) In paying the debts of the firm to third parties.

(ii) In paying each partner rateably what is due to him from the firm for advances.

(iii) In paying to each partner rateably what is due to him on account of capital, and

(iv)The surplus, if any, will be divided among the partners in their profit sharing ratio.

Dissolution Accounts

When a business is discontinued, the firm is said to be dissolved. As a result, all the accounts be closed. It is, therefore, necessary to open Realisation Account, Cash or Bank Account and Partners Capital Accounts.

(i) Realisation Accounts is opened for all transactions relating to realisation of assets and payment of liabilities. That is, on dissolution, it is essential to make sale of assets of the firm, realize cash and paying off the liabilities.

Realisation of assets and settlement of liabilities are centred round the Realisation Account. It is a nominal Account. The transactions realisation and settlement are over, the difference, being gain or loss will be transferred to Capital Accounts.

(ii) Cash/Bank Account is opened to record all cash transactions. When the purpose is over the Cash Account shows a balance, which is equal to the amounts due to partners.

(iii) Capital Accounts are opened to make all entries connected with the partners’ accounts. Current Accounts, if any, are transferred to Capital Accounts. Finally the Capital Accounts are closed by receiving or paying cash.

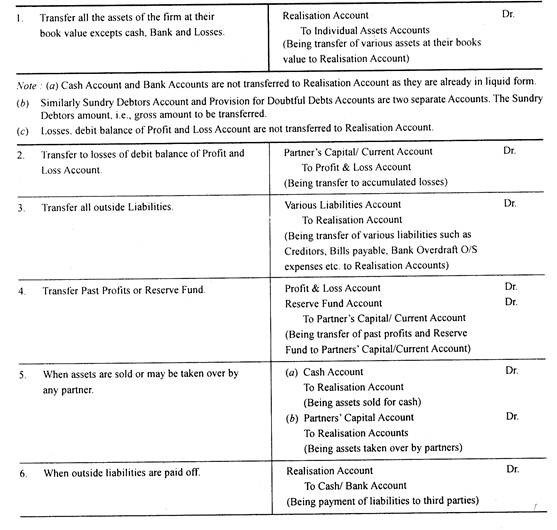

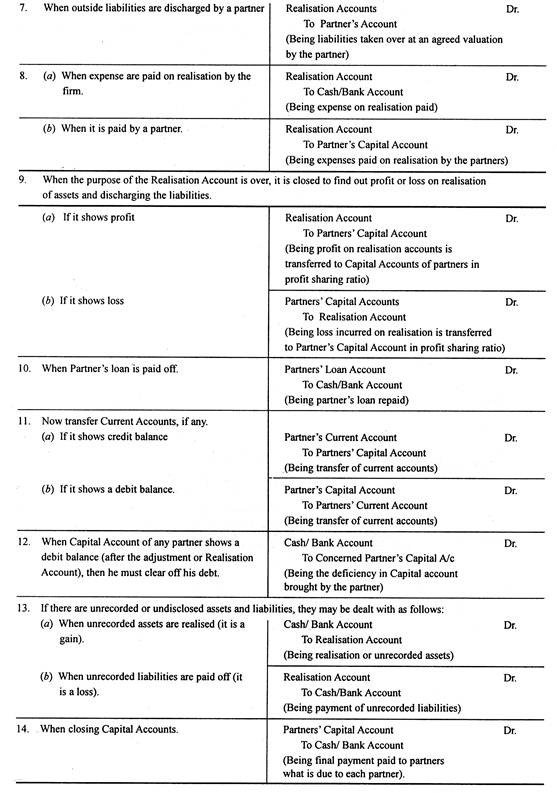

The following steps are taken to close the books of accounts:

To sum up, when all the assets are realized and the liabilities are paid off, the balance of cash or Bank must be equal to the amount due finally to the partners’ capital account, after transferring the current account, if any. Sometimes, the capital account shows a debit balance, representing the amount due to the firm by the concerned partner.

The principle of unlimited liability is applied, that is, the partner, whose capital account shows a debit balance, should bring the amount to clear off the debit balance in his capital account. Then the cash in hand plus the amount so received, is applied in paying off all the partners whose accounts show credit balances. Thus, all the accounts of assets, liabilities, partners’ capital, and cash are closed.

The above method of preparation of Realisation Account is called Total Method. Alternatively, there is another method, known as Balance Method to prepare the Realisation Account.

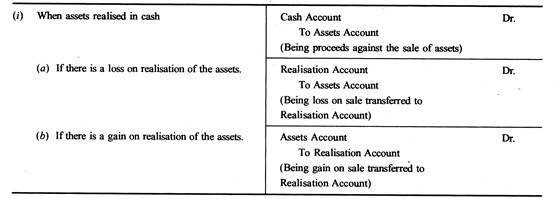

Under the Balance Method, the assets appearing in the Balance sheet are not transferred to Realisation Account at their book value. But, only the difference between the Book Value of Assets and the amount realized by their sale is transferred to Realisation.

The sales proceeds are not taken through Realisation Account. The liabilities too are not transferred to Realisation Account but only the difference between the book value and payments paid is transferred to Realisation Accounts.

For instance, consider the following:

Note: Return of Premium on Premature Dissolution:

Where a partner has paid a premium on entering into partnership for a fixed term, and the firm is dissolved before the expiration on the term otherwise than by the death of a partner, he shall be entitled to repayment of the premium or of such part thereof as may be reasonable unless the dissolution is mainly due to his own misconduct, or the dissolution is in pursuance of an agreement containing no provision for the return of the premium or any part of it.

2 thoughts on “Dissolution Expenses”