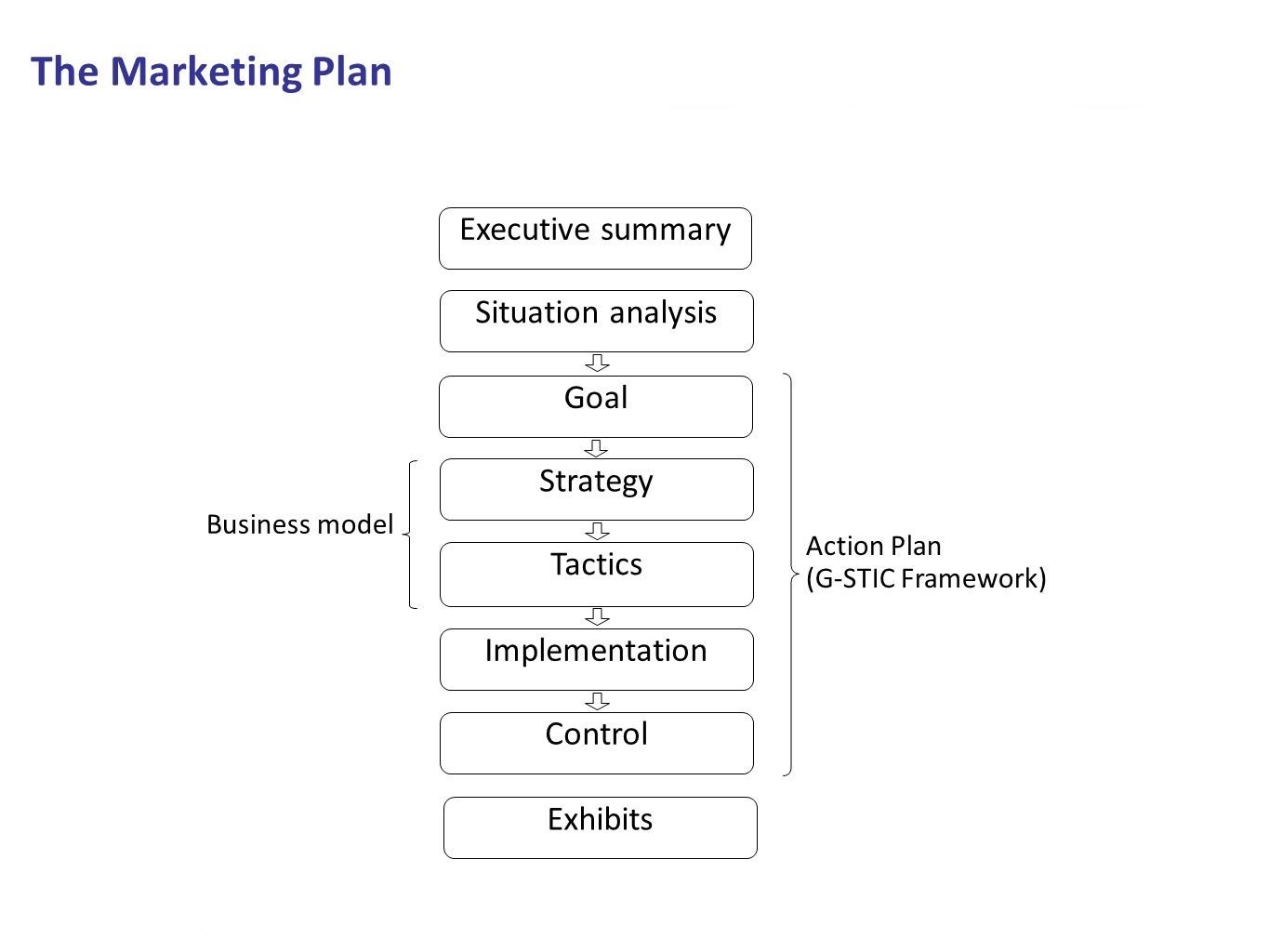

The G-STIC frame work for Marketing Planning: Goal-Strategy Tactics

Strategic Planning

Strategic planning is a buzz word that is thrown around a lot, but unless you know how to develop and implement a strategic plan, the term is useless. It’s important to understand that strategic plans will differ greatly among practices and therefore, a “Cookie cutter” approach will not be beneficial. In this post, I would like to offer a few tips to driving successful strategic planning and implementation.

- Involve your entire staff

It is important that everyone in the practice be included in the process in some way. By collecting the insight of the people on the front lines, the plan will likely be more accurate, practical, and actionable. Also, by being inclusive, everyone will feel that they are an important part of a team and they will be more inclined to drive the implementation.

- Conduct a situation analysis

Begin by looking at internal and external factors. Internally, explore your operations, human resources, and finances budget, profits, revenues, and debt. Externally, look at your competitors, market condition, and the economy. Lastly, conduct a thorough SWOT analysis; Strengths, Weaknesses (internally), and Opportunities and Threats (externally). This assessment will be the basis for your strategic plan. Figure out what you do well and what needs to be improved to build your practice and create a sustainable competitive advantage.

- Develop business objectives

These goals should be SMART: Specific, Measurable, Actionable, Realistic, and Time-driven. Potential goals can be focused on sales, profits, growth, or image and positioning.

- Develop an overall strategy

Your strategy should support your objectives. These will drive your tactics and determine how you will execute. During this phase, you should examine the variables that may affect your strategy and determine if they are controllable or uncontrollable. Typically, the internal variables will be controllable and the external variables will be uncontrollable.

- Create control measures

Lastly, you will create key control measures that will measure the success of the initiative. It may help to think of this step in terms of who does what… when… and how. Implementing control measures will help keep strategic planning a process instead of simply a document.

The G-STIC Framework

Designing the Tactics

Tactics are the set of activities that are used to execute a specific strategy. These tactics are defined by seven elements, commonly referred to as the marketing mix. These are the key decisions that build on the marketing strategy.

- Product: It’s key functional characteristics. Implies transfer of ownership.

- Service: Also reflects functional characteristics, but does not transfer ownership. Services are inseparable from service providers.

- Brand: Create a unique set of associations that enhances the product/service value beyond simply the functional benefits.

- Price: The amount of money the business charges for the product/service

- Incentives: Tools used to enhance the value for customers, collaborators, and/or employees. Can be monetary or non-monetary.

- Communication: Informs current and potential clients about the offering. Can include elements from the other six marketing mix variables.

- Distribution: The channels by which the client receives the offering.

I: Defining the Implementation Plan

Implementation is the logistics of executing the offerings strategy and tactics. There are three main components.

Business Infrastructure: Refers to the organizational structure. Involves identifying the business unit in charge of the offering, and identifying key personnel and collaborators.

Business Processes: Depict the activities involved in designing and managing the offering (flow of information, goods, and money).

Implementation Schedule: Identifies the sequence and time frame for tasks to be performed.

C: Identifying Controls

Controls serve two functions: to evaluate a business’s progress toward its goals and to analyze the changes in the business’s environment.

- Performance Evaluation: Monitors the business’s progress toward reaching goals and maximizing performance.

- Environmental Analysis: Monitors the environment to be sure that the action plan remains optimal.

G: Setting a Goal

This is a pivotal part of the strategic planning process. Without a clearly defined goal, the other elements of the value creation process, and the overall success of the business, are doomed for failure.

There are two decisions involved with goal setting: identifying the focus of the businesses actions and setting specific benchmarks for measuring the business’s performance. The focus determines the key element of a business’s success and often includes elements such as net income, sales revenues, and market share. Benchmarking looks at the goal and defines its temporal and quantitative aspects.

S: Developing a Strategy

A strategy outlines the activities that are needed to accomplish the business’s goals. This element is characterized by two key decisions: Identifying target customers and developing a value proposition.

The markets in which a business’s offerings compete can be best illustrated by the 5-C framework.

- Customers: Potential buyers who have needs that the business’s offerings aim to fulfill

- Company: The business managing the offering

- Collaborators: Entities that work with the business to create value for target customers

- Competitors: Business’s whose offerings target the same customers

- Context: Relative aspects of the environment in which the business operates

Target Market

Identifying your target market involves two key decisions: Selecting which clients to serve and identifying actionable methods for reaching these clients. Selecting which clients to serve, also known as strategic targeting, is done based on the businesses ability to fulfill a client’s needs in a way that is beneficial to the client, business, and collaborators. Often, a client’s needs are not easy to see, so a business will need to identify observable characteristics that can be used to reach the client, also known as tactical targeting. These characteristics may include demographic, psychographic, geographic, and behavioral factors.

Value Proposition

As you have probably noticed, mutually beneficial value is a major theme in almost all discussions about marketing. True business success is achieved if a business creates a product offering that provides a client with more value than the competition’s offering in a way that creates value for the business and the collaborators. The value proposition is simply a definition of the value that the offering creates. This value proposition includes all of the benefits and costs associated with the offering. The next step is to define the positing strategy, which highlights the most important benefit of the offering. The most important benefit should be poignant and serve to differentiate the product in the mind of the client.

Implementation & Control

Implementation control is aimed at assessing whether the plans, progammes and policies are actually guiding the organization towards its predetermined objectives or not.

If the resources that are committed to a project at any point of time would not benefit an organization as envisaged, corrective steps should be undertaken immediately.

Implementation control is designed to assess whether the overall strategy should be changed in light of unfolding events and results associated with incremental steps and actions that implement the overall strategy.”

Strategic implementation control does not replace operational control. Unlike operations control, strategic implementation control continuously questions the basic direction of the strategy.

Types of Implementation Control

The two basis types of implementation control are:

- Monitoring strategic thrusts (new or key strategic programs)

Two approaches are useful in enacting implementation controls focused on monitoring strategic thrusts:

- One way is to agree early in the planning process on which thrusts are critical factors in the success of the strategy or of that thrust

- The second approach is to use stop/go assessments linked to a series of meaningful thresholds (time, costs, research and development, success, etc.) associated with particular thrusts.

- Milestone Reviews

Milestones are significant points in the development of a programme, such as points where large commitments of resources must be made. A milestone review usually involves a full-scale reassessment of the strategy and the advisability of continuing or refocusing the direction of the company. In order to control the current strategy, must be provided in strategic plans.

Implementation Control Measures

As you begin to implement a business strategy, you must use implementation control measures to assess whether or not your plan needs adjustment. Common types of implementation control include setting performance standards, measuring actual performance, analyzing the reasons your staff failed to meet specific performance standards, and developing a plan to correct performance deviations. Implementation control also includes things such as budgets, schedules, and milestones that the company is trying to achieve.

The process of the implementation of the marketing plan

During the process of the implementation of the marketing plan managers must ensure efficient use of capital, human and marketing resources of the company. Selection of the strategy has a significant impact on the subsequent functioning of the company, because its organizational structure must be adapted to strategy. Strategic marketing effectiveness largely depends on the level of involvement of executive leadership in the implementation of marketing tasks. In the implementation of the marketing plan very important factor are the skills, attitudes and behaviours of the staff.

Quality of management depends on:

- Leadership: Top management involvement in the planning process,

- Coordination: To ensure harmonious cooperation between the organizational units,

- Communication: Vertical and horizontal information flows,

- Human resources: Personnel selection, training and evaluation,

- Organizational resources: IT systems, buildings, management methods,

- Motivating: The creation of incentive climate in which staff undertake actions to achieve the purpose of the company,

- Organizational structure: Relations between organizational units, processes, and formalization,

- Organizational culture: Market focus, values, customer orientation of personnel,

Marketing plan control process

Marketing plan control process includes the following phases:

- Setting the values of indicators, which are the subject of observation and measurement (e.g. sales volume, market share, stock rotation, etc.)

- Determining the tolerance ranges from planned values,

- Measurement of the values of indicators,

- Comparison of planned values to actual values, to determine deviations and give explanation of their causes,

- Formulation of proposals to eliminate the detected deviations or change of values of indicators.

Types of controls in marketing plan implementation

The essential types of marketing control are:

- Control of the annual plan: Performed by mid-level management (method: analysis of sales, market share, financial indicators, etc.)

- Control of profitability: Performed by marketing controller (method: the profitability of the product, area, customer segment, etc.)

- Control of efficiency: Performed by marketing executives, line managers and HR departments (method: the effectiveness of the sales staff, advertising, sales, promotion, distribution)

- Strategic control: Performed by top management or marketing auditor (method: ranking of the effectiveness of marketing, marketing audit, evaluation of marketing excellence, an overview of the ethical and social responsibility of the enterprise)

Problems with implementation and evaluation of effective control systems are often caused by:

- High cost of implementation (IT software and hardware, data acquisition, human costs),

- Strict control may reduce motivation, decrease creativity and innovation.