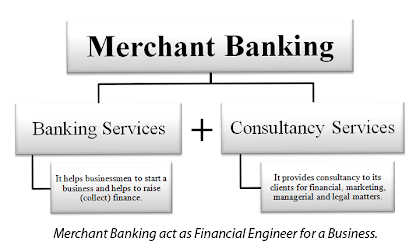

Merchant Banking is a combination of Banking and consultancy services. It provides consultancy to its clients for financial, marketing, managerial and legal matters. Consultancy means to provide advice, guidance and service for a fee. It helps a businessman to start a business. It helps to raise (collect) finance. It helps to expand and modernize the business. It helps in restructuring of a business. It helps to revive sick business units. It also helps companies to register, buy and sell shares at the stock exchange.

Functions of Merchant Banking

The functions of merchant banking are listed as follows:

- Raising Finance for Clients

Merchant Banking helps its clients to raise finance through issue of shares, debentures, bank loans, etc. It helps its clients to raise finance from the domestic and international market. This finance is used for starting a new business or project or for modernization or expansion of the business.

- Broker in Stock Exchange

Merchant bankers act as brokers in the stock exchange. They buy and sell shares on behalf of their clients. They conduct research on equity shares. They also advise their clients about which shares to buy, when to buy, how much to buy and when to sell. Large brokers, Mutual Funds, Venture capital companies and Investment Banks offer merchant banking services.

- Project Management

Merchant bankers help their clients in the many ways. For e.g. Advising about location of a project, preparing a project report, conducting feasibility studies, making a plan for financing the project, finding out sources of finance, advising about concessions and incentives from the government.

- Advice on Expansion and Modernization

Merchant bankers give advice for expansion and modernization of the business units. They give expert advice on mergers and amalgamations, acquisition and takeovers, diversification of business, foreign collaborations and joint-ventures, technology up-gradation, etc.

- Managing Public Issue of Companies

Merchant bank advice and manage the public issue of companies. They provide following services:

- Advise on the timing of the public issue.

- Advise on the size and price of the issue.

- Acting as manager to the issue, and helping in accepting applications and allotment of securities.

- Help in appointing underwriters and brokers to the issue.

- Listing of shares on the stock exchange, etc.

- Handling Government Consent for Industrial Projects

A businessman has to get government permission for starting of the project. Similarly, a company requires permission for expansion or modernization activities. For this, many formalities have to be completed. Merchant banks do all this work for their clients.

- Special Assistance to Small Companies and Entrepreneurs

Merchant banks advise small companies about business opportunities, government policies, incentives and concessions available. It also helps them to take advantage of these opportunities, concessions, etc.

- Services to Public Sector Units

Merchant banks offer many services to public sector units and public utilities. They help in raising long-term capital, marketing of securities, foreign collaborations and arranging long-term finance from term lending institutions.

- Revival of Sick Industrial Units

Merchant banks help to revive (cure) sick industrial units. It negotiates with different agencies like banks, term lending institutions, and BIFR (Board for Industrial and Financial Reconstruction). It also plans and executes the full revival package.

- Portfolio Management

A merchant bank manages the portfolios (investments) of its clients. This makes investments safe, liquid and profitable for the client. It offers expert guidance to its clients for taking investment decisions.

- Corporate Restructuring

It includes mergers or acquisitions of existing business units, sale of existing unit or disinvestment. This requires proper negotiations, preparation of documents and completion of legal formalities. Merchant bankers offer all these services to their clients.

- Money Market Operation

Merchant bankers deal with and underwrite short-term money market instruments, such as:

- Government Bonds.

- Certificate of deposit issued by banks and financial institutions.

- Commercial paper issued by large corporate firms.

- Treasury bills issued by the Government (Here in India by RBI).

- Leasing Services

Merchant bankers also help in leasing services. Lease is a contract between the lessor and lessee, whereby the lessor allows the use of his specific asset such as equipment by the lessee for a certain period. The lessor charges a fee called rentals.

- Management of Interest and Dividend

Merchant bankers help their clients in the management of interest on debentures / loans, and dividend on shares. They also advise their client about the timing (interim / yearly) and rate of dividend.

Services offered by Merchant Banks

Merchant Banks offers a range of financial and consultancy services, to the customers, which are related to:

- Marketing and underwriting of the new issue.

- Merger and acquisition related services.

- Advisory services, for raising funds.

- Management of customer security.

- Project promotion and project finance.

- Investment banking

- Portfolio Services

- Insurance Services.

Merchant Banker

Any person, indulged in issue management business by making arrangements with respect to trade and subscription of securities or by playing the role of manager/consultant or by providing advisory services, is known as a merchant banker. The activities carried out by merchant bankers are:

- Private placement of securities.

- Managing public issue of securities

- Satellite dealership of government securities

- Management of international offerings like Depository Receipts, bonds, etc.

- Syndication of rupee term loans

- Stock broking

- International financial advisory services.

Objectives

Provide funds to companies: This usually includes loans for startup companies. They decide how much money a company needs to function through proposals created by these companies. They also help their clients raise funds through the stock exchange and other activities. Merchant banks act as a foundation for small scale companies in terms of their finances.

Underwriting: This is like insurance where banks sign into documents that agree to provide financial payment to their clients in case of any damage or losses. This is very important for clients to ensure that the bank will help them gain more income. If not, in case they would incur losses, the bank will pay them for the losses.

Manage their portfolios: The bank will look into the companies’ assets and will do the computation of their credits and debits to ensure they are not incurring any losses. They also provide other kinds of services to check on the liquidation of assets to track the income made by these companies and study how they can make it better.

Offering corporate advisory: They offer advises specially to starting companies and those that would want to expand. This advice involves financial aid to ensure that the company will be successful and will not have any problems along the way.

Managing corporate issues: Help incorporate securities management; they also serve as an intermediary bank in transferring capitals.

Qualities of A Good Merchant Bankers

- Ability to analyse

- Abundant knowledge

- Ability to build up relationship

- Innovative approach

- Integrity

- Capital Market facilities

- Liaisoning ability

- Cooperation and friendliness

- contacts

- Attitude toward problem Solving

2 thoughts on “Merchant Banking and advisory services”