Basis risk in finance is the risk associated with imperfect hedging due to the variables or characteristics that affect the difference between the futures contract and the underlying “cash” position.

Basis risk is the financial risk that offsetting investments in a hedging strategy will not experience price changes in entirely opposite directions from each other. This imperfect correlation between the two investments creates the potential for excess gains or losses in a hedging strategy, thus adding risk to the position.

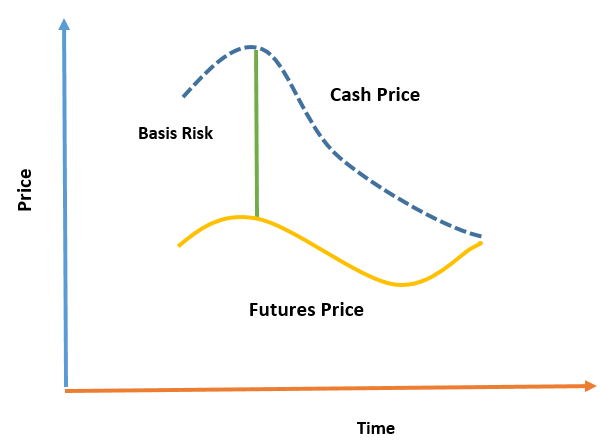

It arises because of the difference between the price of the asset to be hedged and the price of the asset serving as the hedge namely b = S – F, before expiration, any difference at expiration will be offset by arbitrage. Other examples of aspects that may cause basis risk to arise:

a) Quality: the hedge in place may have a different grade (which may not be perfectly correlated with the basis)

b) Timing: A mismatch between the expiration date of the hedge asset and the actual selling date of the asset

c) Location/Transportation Costs: Due to the difference in the location of the asset to be hedged and the asset serving as the hedge, an unforeseen rise in transportation costs may cost the producer who hedges more money.

- Basis risk is the potential risk that arises from mismatches in a hedged position.

- Basis risk occurs when a hedge is imperfect, so that losses in an investment are not exactly offset by the hedge.

- Certain investments do not have good hedging instruments, making basis risk more of a concern than with others assets.

Under these conditions, the spot price of the asset, and the futures price, do not converge on the expiration date of the future. The amount by which the two quantities differ measures the value of the basis risk. That is,

Basis = Futures price of contract − Spot price of hedged asset.

Basis risk is not to be confused with another type of risk known as price risk.

Some examples of basis risks are:

- Treasury bill future being hedged by two year Bond, there lies the risk of not fluctuating as desired.

- Foreign currency exchange rate (FX) hedge using a non-deliverable forward contract (NDF): the NDF fixing might vary substantially from the actual available spot rate on the market on fixing date.

- Over-the-counter (OTC) derivatives can help minimize basis risk by creating a perfect hedge. This is because OTC derivatives can be tailored to fit the exact risk needs of a hedger.

Components of Basis Risk

Risk can never be altogether eliminated in investments. However, risk can be at least somewhat mitigated. Thus, when a trader enters into a futures contract to hedge against possible price fluctuations, they are at least partly changing the inherent “price risk” into another form of risk, known as “basis risk”. Basis risk is considered a systematic, or market, risk. Systematic risk is the risk arising from the inherent uncertainty of the markets. Unsystematic, or non-systematic, risk, which is the risk associated with a specific investment. The risk of a general economic turndown, or depression, is an example of systematic risk. The risk that Apple may lose market share to a competitor is unsystematic risk.

Between the time a futures position is initiated and closed out, the spread between the futures price and the spot price may widen or narrow. As the visual representation below shows, the normal tendency is for the basis spread to narrow. As the futures contract nears expiration, the futures price usually converges toward the spot price. This logically happens as the futures contract becomes less and less “future” in nature. However, this common narrowing of the basis spread is not guaranteed to occur.

Different Types of Basis Risk

- Price basis risk: The risk that occurs when the prices of the asset and its futures contract do not move in tandem with each other.

- Location basis risk: The risk that arises when the underlying asset is in a different location from the where the futures contract is traded. For example, the basis between actual crude oil sold in Mumbai and crude oil futures traded on a Dubai futures exchange may differ from the basis between Mumbai crude oil and Mumbai-traded crude oil futures.

- Calendar basis risk: The selling date of the spot market position may be different from the expiry date of a futures market contract.

- Product quality basis risk: When the properties or qualities of the asset are different from that of the asset as represented by the futures contract.

One thought on “Basis & Basis Risk”