Public expenditure is spending made by the government of a country on collective needs and wants such as pension, provisions (such as education, healthcare and housing), security, infrastructure, etc. Until the 19th century, public expenditure was limited as laissez faire philosophies believed that money left in private hands could bring better returns. In the 20th century, John Maynard Keynes argued the role of public expenditure in determining levels of income and distribution in the economy. Since then, government expenditures has shown an increasing trend. Sources of government revenue include taxes, and non-tax revenues.

In the 17th and the 18th centuries, public expenditure was considered a wastage of money. Thinkers believed government should stay with their traditional functions of spending on defense and maintaining law and order.

Causes of growth of public expenditure

There are several factors that have led to an enormous increase in public expenditure through the years

1) Defense expenditure due to modernization of defense equipment by the navy, army and air force to prepare the country for war or for prevention causes-for-growth-of-public-expenditure.

2) Population growth: It increases with the increase in population, more of investment is required to be done by government on law and order, education, infrastructure, etc. investment in different fields depending on the different age group is required.

3) Welfare activities: Welfare, mid-day meals, pension provisions etc.

- Provision of public and utility services: Provision of basic public goods given by government (their maintenance and installation) such as transportation.

- Accelerating economic growth: In order to raise the standard of living of the people.

- Price rise: Higher price level compels the government to spend an increased amount on purchase of goods and services.

- Increase in public revenue: With the rise in public revenue government is bound to increase the public expenditure.

- International obligation: maintenance of socio-economic obligation, cultural exchange etc. (these are indirect expenses of government)

4) Wars and social crises: Fighting amongst people and communities, and prolonged drought or unemployment, earthquake, hurricanes or tornadoes may lead to an increase in public expenditure of a country. This is because it will involve governments to re-plan and allocate resources to finance the reconstruction.

5) Creation of super national organizations: E.g., the United Nations, NATO, European community and other multinational organizations that are responsible for the provision of public goods and services on an international basis, have to be financed out of funds subscribed by member states, thereby adding to their public expenditure.

6) Foreign aid: Acceptance by the richer industrialized countries of their responsibility to help the poor developing countries has channelled some of the increased public expenditure of the donor country into foreign aid programmes.

7) Inflation: This is the general rise in the price level of goods and services. It increases the cost of all activities of the public sector and thus a major factor in growth in money terms of public expenditure.

Principle of maximum social advantage

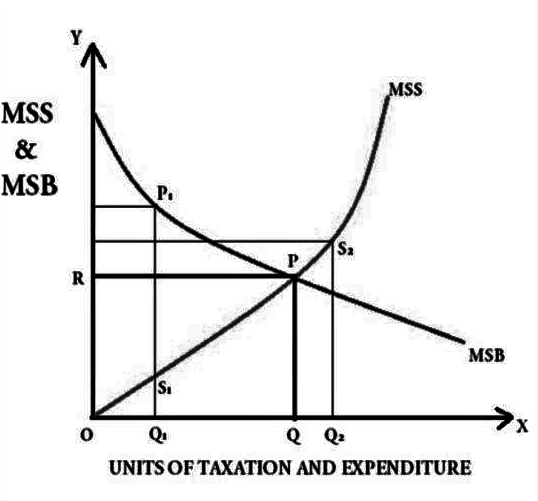

The criteria and pre-conditions for arriving at this solution are collectively referred to as the principle of maximum social advantage. Taxation (government revenue) and government expenditure are the two tools. Neither of excess is good for the society, it has to be balanced to achieve maximum social benefit. Dalton called this principle as “Maximum Social Advantage” and Pigou termed it as “Maximum Aggregate Welfare”.

Dalton’s Principle of Maximum Social Advantage maximum satisfaction should be yield by striking a balance between public revenue and expenditure by the government. Economic welfare is achieved when marginal utility of expenditure = marginal disutility of taxation. He explains this principle with reference to

- Maximum Social Benefit (MSB)

- Maximum Social Sacrifice (MSS)