Marginal analysis plays a crucial role in managerial economics, the study and application of economic concepts, to guide in making managerial decisions. The idea is to predict and measure the impact of per unit changes of an organization’s goals, ultimately identifying the optimal resource allocation given the constraints of the business.

The Value of Marginal Analysis for Management

Most of the microeconomic theory of marginalism was developed by Cambridge University professor and economist Alfred Marshall. He stated that production is only beneficial for a firm when marginal revenue exceeds marginal cost, and it is most beneficial when the difference is largest.

For instance, a toy manufacturer should only produce toys until marginal expense is equal to marginal benefit. By breaking down decisions into measurable, smaller pieces, the toy manager can optimize profits.

Marginal analysis has applicability well outside the range of for-profit production processes. Every resource allocation decision can benefit from marginal analysis as long as costs and benefits are identifiable.

Attaining the Highest Net Benefit

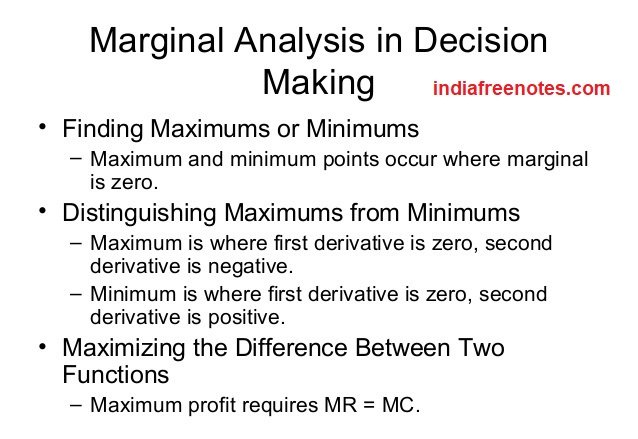

Suppose a company is able to measure the additional benefits and costs of extra economic activity. The theory of marginal analysis states that whenever marginal benefit exceeds marginal cost, a manager should increase activity to reach the highest net benefit. Similarly, if marginal cost is higher than marginal benefit, activity should be decreased.

Sunk costs, fixed costs, and average costs do not affect marginal analysis. They are irrelevant to future optimal decision-making. Marginal analysis can only address what happens if the firm hires one additional employee, produces one additional product, devotes additional space to research and so forth.

Marginal Analysis and Opportunity Cost

Managers should also understand the concept of opportunity cost. Suppose a manager knows that there is room in the budget to hire an additional worker. Marginal analysis tells the manager that an additional factory worker provides net marginal benefit. This does not necessarily make the hire the right decision.

Suppose the manager also knows that hiring an additional salesperson yields an even larger net marginal benefit. In this case, hiring a factory worker is the wrong decision because it is sub-optimal.

One thought on “Use of Marginal Analysis in Decision Making”