Combined Leverage, Significance, Formula

Combined Leverage refers to the total impact of both operating leverage and financial leverage on a company’s earnings. It measures how changes in sales affect Earnings Per Share (EPS) by considering both fixed operating costs and fixed financial costs (interest on debt). A firm with high combined leverage experiences significant changes in net income when sales fluctuate, making it riskier but potentially more profitable. The Degree of Combined Leverage (DCL) is calculated as the product of the Degree of Operating Leverage (DOL) and the Degree of Financial Leverage (DFL), helping firms assess their overall risk and return potential.

Example:

It should be observed that the leverage is ascertained from a particular sales point. When different levels of sales are adopted, different degrees of composite leverages are obtained. When the volume of sales increases, fixed expenses remains same, the degree of leverage falls. This happens because of existence of fixed charges in the cost structure.

Significance of Combined Leverage

-

Measures Total Risk Exposure

Combined leverage helps assess a company’s overall risk by considering both operating and financial leverage. It indicates the extent to which a firm’s fixed costs (both operational and financial) impact earnings. A higher combined leverage suggests greater sensitivity of Earnings Per Share (EPS) to changes in sales, making it a crucial measure for risk assessment. Companies with high combined leverage must be cautious during economic downturns as small declines in revenue can lead to significant losses, affecting financial stability and investor confidence.

-

Aids in Decision-Making on Capital Structure

Businesses use combined leverage to determine an optimal capital structure by balancing debt and equity. A firm with high operating leverage should maintain low financial leverage to minimize financial risk, whereas firms with low operating leverage may take on more debt. This evaluation helps finance managers decide how much debt financing is suitable while ensuring the firm can cover both operating and financial costs, leading to sustainable growth and profitability.

-

Helps in Profitability Forecasting

By understanding combined leverage, companies can forecast how changes in sales volume will impact their profitability. Since combined leverage magnifies the effect of revenue changes on net income, firms can use this analysis to predict earnings fluctuations and take proactive measures to stabilize cash flows. This is particularly useful for investors and financial analysts in estimating future EPS and making informed investment decisions based on risk and return expectations.

-

Indicates Business Stability and Risk

A firm with high combined leverage is more vulnerable to economic fluctuations, as both high fixed operating costs and high financial obligations increase financial strain. This makes combined leverage an essential indicator of business stability. Companies with lower combined leverage are seen as financially stable since they have more flexibility to manage downturns. Investors and lenders use this measure to assess a company’s ability to withstand economic cycles and make strategic financial decisions accordingly.

-

Assists in Financial Planning

Financial managers use combined leverage to design effective financial strategies that align with the company’s growth objectives. By analyzing leverage levels, businesses can plan for capital expenditures, debt financing, and profit distribution more effectively. A well-balanced leverage structure ensures that firms maximize returns on investment while keeping financial risk at manageable levels. Proper financial planning based on combined leverage helps maintain long-term financial health and stability.

-

Enhances Shareholder Value

Combined leverage plays a crucial role in maximizing shareholder wealth by ensuring a balance between risk and return. A well-structured capital mix enhances earnings per share (EPS) while minimizing financial distress. If managed correctly, combined leverage can lead to higher profitability, attracting more investors and increasing the firm’s market valuation. However, excessive leverage may pose risks, making it essential for firms to maintain a balanced financial structure that supports both growth and stability.

-

Helps in Managing Cost Structure

Businesses must maintain a balance between fixed and variable costs to ensure financial sustainability. Combined leverage helps identify whether a company is relying too much on fixed costs, which could become burdensome during low sales periods. By understanding the proportion of fixed and variable costs, firms can take strategic steps to reduce financial risk, such as renegotiating debt terms, adjusting pricing strategies, or optimizing resource utilization to maintain a competitive edge.

-

Supports Business Expansion Strategies

Companies planning for growth and expansion must carefully evaluate their leverage levels to ensure financial sustainability. High combined leverage can indicate potential constraints on raising additional funds, while lower leverage may signal opportunities for expansion through debt financing. Understanding combined leverage allows businesses to strategically plan expansion without overburdening themselves with excessive debt, ensuring smooth operations and long-term success.

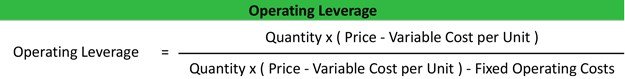

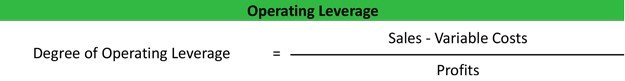

Formula:

Combined leverage considers both financial leverage and operating leverage to assess the overall risk and impact on a company’s earnings. The combined leverage can be calculated using the degree of combined leverage (DCL) or the combined leverage ratio.

-

Degree of Combined Leverage (DCL):

DCL = DOL × DFL

Where:

- DOL is the Degree of Operating Leverage.

- DFL is the Degree of Financial Leverage.

The degree of combined leverage provides a measure of how sensitive a company’s earnings per share (EPS) is to changes in sales.

-

Combined Leverage Ratio:

Combined Leverage Ratio = % Change in EPS / % Change in Sales

The combined leverage ratio is another way to express the combined impact of operating and financial leverage on earnings per share.

These formulas help assess how changes in sales can affect a company’s profitability, factoring in both its operating structure (operating leverage) and financing structure (financial leverage). A higher degree of combined leverage means that a company’s earnings are more sensitive to changes in sales, both positively and negatively.

It’s important to note that while leverage can enhance returns, it also introduces additional risk. Therefore, understanding the combined leverage is crucial for effective risk management and financial decision-making. Companies need to strike a balance between leveraging to maximize returns and maintaining financial flexibility to navigate potential challenges.