Business analysis models – PESTEL (Political, Economic, Societal, Technological, Environmental and Legal)

Business analysis models are strategic tools used by organizations to understand, evaluate, and improve business operations, make informed decisions, and identify growth opportunities. These models provide structured frameworks for analyzing various aspects such as market dynamics, internal processes, financial performance, and competitive positioning. Common business analysis models include SWOT Analysis (assessing strengths, weaknesses, opportunities, and threats), PESTLE Analysis (examining macro-environmental factors), Porter’s Five Forces (analyzing industry competitiveness), and the Business Model Canvas (visualizing a company’s value creation). Additionally, Value Chain Analysis helps assess internal activities to identify cost-saving or value-enhancing opportunities. These models support decision-making, risk management, strategic planning, and resource allocation. By applying the right models, businesses can adapt to changing environments, enhance performance, and achieve sustainable growth. Effective use of these tools ensures that organizations remain competitive, customer-focused, and aligned with their long-term objectives in a dynamic business landscape.

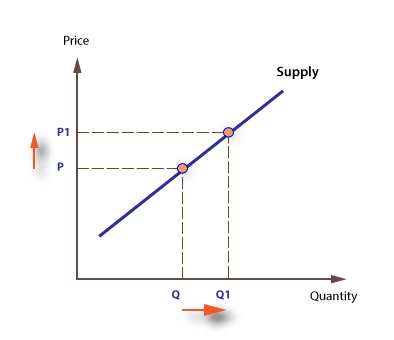

Environmental analysis is a strategic tool. It is a process to identify all the external and internal elements, which can affect the organization’s performance. The analysis entails assessing the level of threat or opportunity the factors might present. These evaluations are later translated into the decision-making process. The analysis helps align strategies with the firm’s environment.

Our market is facing changes every day. Many new things develop over time and the whole scenario can alter in only a few seconds. There are some factors that are beyond your control. But, you can control a lot of these things.

Businesses are greatly influenced by their environment. All the situational factors which determine day to day circumstances impact firms. So, businesses must constantly analyze the trade environment and the market.

PESTLE Analysis:

PESTLE analysis is a strategic management tool used to understand the external macro-environmental factors that can influence an organization or industry. The acronym PESTLE stands for Political, Economic, Social, Technological, Legal, and Environmental factors. It helps businesses identify potential threats and opportunities in the broader environment and adapt strategies accordingly. This analytical framework is especially useful in long-term planning, market entry decisions, and risk management. By examining these six categories, firms can gain insight into how external factors impact performance and operations. PESTLE analysis is widely used across industries and governments for scenario planning and forecasting. It encourages a holistic view of the environment, ensuring that organizations do not operate in isolation and are well-prepared for changes in their external surroundings.

Political Factors

Political factors refer to how government actions and political stability affect businesses. This includes taxation policies, trade restrictions, labor laws, tariffs, and government regulations. A politically stable environment encourages investment and smooth business operations, while political unrest or instability can deter foreign investment and disrupt supply chains. Governments may also change policies due to elections, resulting in uncertainty. Furthermore, foreign relations and international treaties significantly influence multinational companies. For example, a government might impose trade barriers to protect domestic industries, affecting imports and exports. Political lobbying and government subsidies can also impact market competition. Businesses must closely monitor the political environment to mitigate risks and adapt to regulatory changes. Political risks are especially critical in global business strategies where political dynamics vary greatly between countries and regions.

Economic Factors

Economic factors affect the purchasing power and economic environment in which businesses operate. These include interest rates, inflation, exchange rates, economic growth, and unemployment levels. A strong economy increases consumer spending, creating more business opportunities, while a weak economy can lead to reduced demand and tighter credit conditions. Fluctuations in currency values affect the cost of imports and exports, especially for companies involved in international trade. Inflation affects the cost of production, while high-interest rates can reduce borrowing capacity. Understanding economic indicators helps firms forecast demand, set pricing strategies, and manage capital efficiently. Additionally, government fiscal and monetary policies can either stimulate or restrain economic activity, influencing overall market conditions. A keen awareness of economic trends is essential for budgeting, forecasting, and investment planning in both domestic and global markets.

Social Factors

Social factors encompass societal trends, demographics, culture, consumer attitudes, and lifestyle changes that influence demand for products and services. Factors like population growth, age distribution, education levels, and income patterns determine market potential. For example, an aging population increases demand for healthcare services, while growing health consciousness boosts the organic food industry. Social norms and cultural values also affect marketing strategies, product design, and branding. Businesses must align their offerings with prevailing social trends to remain relevant and appealing. Changing work patterns, such as the rise of remote work, also create new demands for technology and home-based services. Additionally, social media has amplified consumer voices, forcing businesses to be more transparent and responsive. By staying attuned to social dynamics, companies can better anticipate shifts in consumer behavior and adjust accordingly.

Technological Factors

Technological factors relate to innovations, technological advancements, R&D activity, automation, and the rate of technological change in an industry. These factors can create new business opportunities or make existing products/services obsolete. For example, the rise of artificial intelligence (AI), cloud computing, and blockchain technology has transformed how businesses operate. Technological disruptions can redefine competitive advantages, drive efficiency, and improve customer experiences. However, rapid technological changes also require businesses to invest continuously in upgrading systems and employee skills. Companies failing to adapt to new technologies risk falling behind competitors. Additionally, digital transformation and e-commerce have expanded global reach but also increased the need for cybersecurity. Businesses must monitor technological trends to innovate, optimize operations, and remain competitive in a rapidly evolving digital economy. Staying technologically agile is essential for sustainability and growth.

Legal Factors

Legal factors include laws and regulations that impact business operations, such as employment laws, health and safety regulations, consumer protection laws, environmental regulations, and competition laws. Compliance is essential to avoid fines, lawsuits, and reputational damage. Different industries are governed by specific legal frameworks, and multinational firms must navigate multiple jurisdictions. For example, data protection laws like GDPR significantly influence how companies collect and manage user information. Labor laws determine working conditions, wages, and employee rights. Failure to comply can result in legal penalties and loss of public trust. Intellectual property laws also play a critical role in protecting innovations and ensuring fair competition. Keeping up with legal changes helps firms manage risks and operate ethically. Legal audits and proactive compliance measures are key strategies to safeguard long-term business interests.

Objectives of PESTLE Analysis:

Business Environmental analysis has three basic objectives, which are as follows:

- Help understanding Existing Environment

It is important that one must be aware of the existing environment. Business Environment analysis should provide an understanding of current and potential changes taking place in the micro environment. Micro environment specifies the type of products to be offered, the technology to be adopted and the productive strategies to be used to face the global competition.

- Provision of Data for Strategic Decision-making

Business Environment analysis should provide necessary data for strategic decision-making. Mere collection of data is not adequate. The data so collected must be used for strategic decision-making.

- Facilitating Strategic Linking in Organizations

Business Environment analysis should facilitate and foster strategic linking in organizations.

Process of Business Environment Analysis:

The process of Business environment analysis involves many steps, which are as follows:

-

Collection of necessary Information

Collection of necessary information is the first stage in the process of business environment analysis. It involves the observation of various factors prevailing in a particular area also. If an environment is to be analyzed, written as well as the verbal information from various sources with regard to the elements of environment for that particular business is to be collected first.

-

Scanning and Searching of Information

Scanning and searching is an important technique of business environment analysis. Once the necessary information has been collected, it should be put to scanning. Besides, the search for other relevant information also continues. This technique gives results as to the hypothesis already established. This helps the analyst to know as to what are the conditions prevailing for a particular business at a time.

-

Getting Information by Spying

Spying is also one of the techniques of business environment analysis. When the activities of a particular business are to be analyzed and such information cannot be collected by traditional methods, the technique of spying is resorted to. This happens especially when business rivalry exists. Mostly, this technique is used to collect competitive information.

-

Forecasting the Conditions

Scanning provides a picture about the past and the present. However, strategic decision-making requires a future orientation. Forecasting is the scientific guesswork based upon some serious study. So it helps to know how a business in particular and conditions in society in general are going to take shape.

-

Observing the Environment

One can analyze a business environment by merely observing it. The observation reveals various conditions prevailing at a particular point of time. This is helpful in understanding the existing environment in its entirety so that suitable decisions can be taken.

-

Assessing

Assessment is made to determine implications for the organization’s current and potential strategies. Assessment involves identifying and evaluating how and why current and projected environmental changes affect or will affect strategic management of the organization.