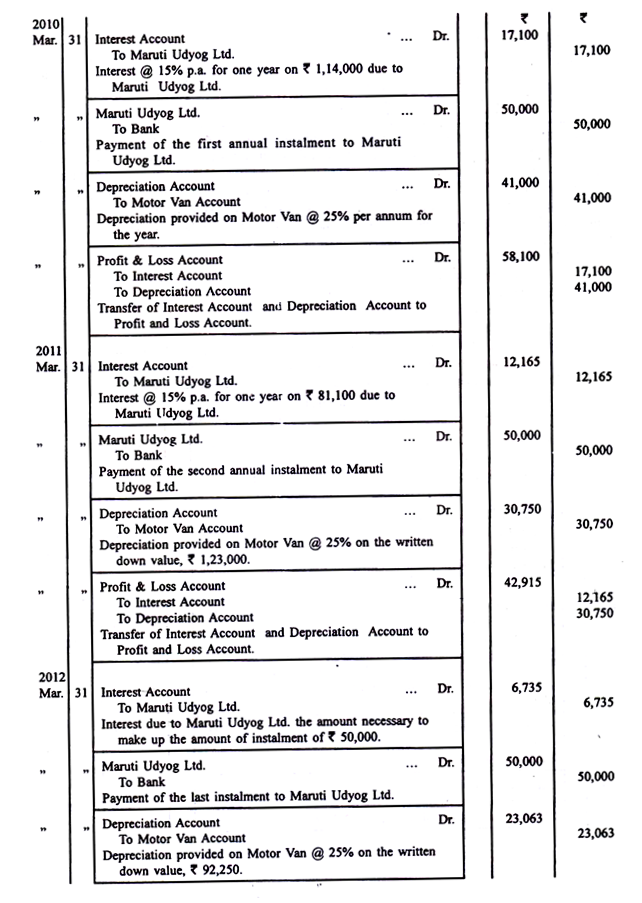

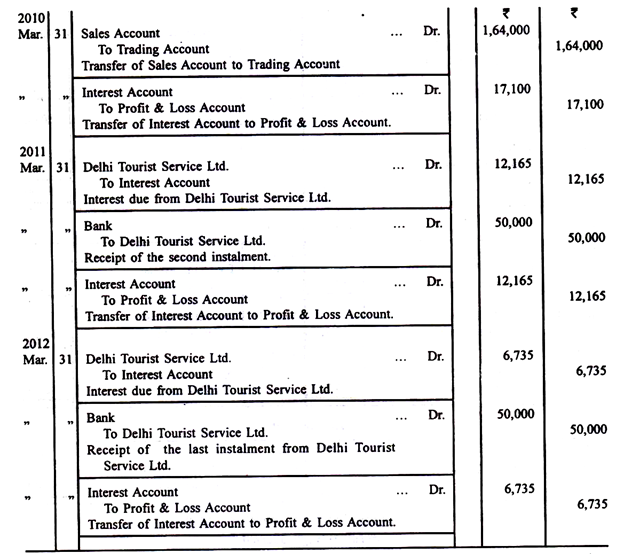

Journal entries are systematic records of business transactions made in the journal (or book of original entry), capturing the date, accounts involved, debit, and credit amounts. They ensure that every financial event is properly documented and aligned with the double-entry system, where total debits always equal total credits. Each entry reflects the nature of the transaction, such as rent payments, royalties, sales, purchases, or adjustments.

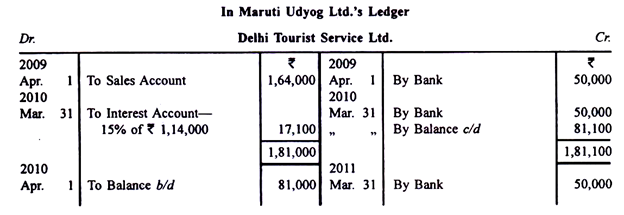

Once journal entries are recorded, they are posted to ledger accounts. A ledger is the principal book where transactions related to each account (like cash, sales, rent, royalties, minimum rent) are grouped, showing cumulative balances. This structured organization helps businesses track account-wise financial activities and prepare financial statements accurately.

Minimum Rent (also known as Dead Rent) is a guaranteed payment that the lessee (tenant) must make to the lessor (landlord) irrespective of the actual production or sales. If the actual royalty based on production or sales exceeds the minimum rent, the lessee will pay the higher amount. However, if the royalty is lower than the minimum rent, short workings occur, which may be recouped in future periods when the actual royalty exceeds the minimum rent.

Specifically, in royalty agreements, the Minimum Rent Account comes into play when the agreed minimum rent or dead rent is higher than the actual royalty based on production or sales. The lessee is obligated to pay this minimum amount even if actual output is low. If the royalties fall short, the shortfall is recorded as a shortworkings expense, often carried forward for recoupment in future years.

Journal entries for such cases typically include:

-

Debit: Royalty Expense / Production Account

-

Debit (if applicable): Shortworkings Account

-

Credit: Minimum Rent Account or Landlord’s Account

Key Terms:

1. Minimum Rent (Dead Rent)

Minimum Rent, also known as Dead Rent, is the fixed minimum amount that a lessee (tenant or user) agrees to pay to the lessor (owner) under a royalty agreement, regardless of the actual level of production or sales. This concept is commonly used in mining leases, publishing contracts, or patents where the lessee uses a resource or intellectual property that generates royalties.

The idea behind minimum rent is to ensure that the lessor receives a guaranteed minimum income even if the lessee’s production or sales are low in a particular year. It acts as a safeguard for the lessor’s financial security, providing them with a fixed return for granting the lease or usage rights.

For example, if a mining company leases land to extract minerals, the owner wants assurance that even if the mining output is low, they will still receive a minimum payment. So, if the royalty based on production is less than the agreed minimum rent, the lessee must still pay the minimum rent amount.

2. Actual Royalty

Actual Royalty refers to the amount calculated and payable by the lessee (user) to the lessor (owner) based on the real quantity of production or sales during a specific period, according to the agreed royalty rate. It is the variable part of the payment in a royalty agreement and directly depends on how much the lessee produces, extracts, sells, or earns from the leased asset, property, or right.

For example, in a mining lease, the lessee agrees to pay the lessor a royalty of ₹50 per ton of coal extracted. If they extract 2,000 tons in a year, the actual royalty would be ₹100,000. Similarly, in a publishing agreement, an author may receive a royalty of 10% on book sales, so if ₹500,000 worth of books are sold, the actual royalty will be ₹50,000.

3. Short Workings

Short Workings refer to the excess amount paid by the lessee (tenant or user) to the lessor (owner) when the minimum rent (dead rent) payable under a royalty agreement exceeds the actual royalty earned during a given period. It represents the difference between the minimum rent and the actual royalty when actual production or sales fall short.

In simple terms, when a lessee is obligated to pay a guaranteed minimum amount (minimum rent) regardless of production, but their actual production or sales generate a smaller royalty, they still pay the minimum rent. This excess payment is known as short workings. Importantly, many contracts allow the lessee to recoup or recover these short workings in future years when actual royalties exceed the minimum rent.

Example

-

Minimum Rent: ₹150,000

-

Actual Royalty (based on production): ₹120,000

-

Short Workings = ₹150,000 – ₹120,000 = ₹30,000

The lessee pays ₹150,000 to the lessor but has an excess payment of ₹30,000, recorded as short workings. This amount may be recouped in future periods if actual royalty exceeds minimum rent, subject to the contract terms.

4. Recoupment of Short Workings

Recoupment of Short Workings refers to the process where a lessee (user) recovers the excess payments (short workings) made in earlier years under a royalty agreement when actual royalties fall below the minimum rent. This recovery is done in future periods when the actual royalty exceeds the minimum rent, allowing the lessee to adjust or offset the earlier shortfall.

In a typical royalty agreement, if the lessee pays more than the actual royalty (due to minimum rent obligations), the extra amount is recorded as short workings. Many agreements give the lessee a right to recoup these short workings within a specified period (usually 2–3 years). If, during that period, the lessee’s actual royalties rise above the minimum rent, the surplus can be used to recoup the past excess payments.

Example

-

Year 1: Minimum Rent ₹150,000, Actual Royalty ₹120,000 → Short Workings ₹30,000

-

Year 2: Minimum Rent ₹150,000, Actual Royalty ₹180,000 → Excess Royalty ₹30,000

In Year 2, the lessee can recoup ₹30,000 of short workings from Year 1 by adjusting it against the excess royalty. The lessee now pays only the minimum rent, as the extra royalty offsets the past shortfall.

Example Scenario:

- Minimum Rent: ₹100,000

- Actual Royalty for Year 1: ₹80,000 (Short Workings: ₹20,000)

- Actual Royalty for Year 2: ₹120,000 (Recoupment of Short Workings: ₹20,000)

Journal Entries in the Books of Lessee:

Year 1: Actual Royalty is Less than Minimum Rent (Short Workings)

| Date |

Particulars |

Debit (₹) |

Credit (₹) |

| Year 1 |

Royalty Account Dr. |

80,000 |

– |

|

To Lessor’s Account |

– |

80,000 |

|

(Being actual royalty payable to lessor) |

– |

– |

|

Minimum Rent Account Dr. |

100,000 |

– |

|

To Lessor’s Account |

– |

100,000 |

|

(Being minimum rent payable) |

– |

– |

|

Short Workings Account Dr. |

20,000 |

– |

|

To Minimum Rent Account |

– |

20,000 |

|

(Being short workings transferred) |

– |

– |

|

Lessor’s Account Dr. |

100,000 |

– |

|

To Bank Account |

– |

100,000 |

|

(Being payment made to the lessor) |

– |

– |

Year 2: Actual Royalty Exceeds Minimum Rent (Recoupment of Short Workings)

| Date |

Particulars |

Debit (₹) |

Credit (₹) |

| Year 2 |

Royalty Account Dr. |

120,000 |

– |

|

To Lessor’s Account |

– |

120,000 |

|

(Being actual royalty payable to lessor) |

– |

– |

|

Minimum Rent Account Dr. |

100,000 |

– |

|

To Lessor’s Account |

– |

100,000 |

|

(Being minimum rent payable) |

– |

– |

|

Short Workings Recouped Account Dr. |

20,000 |

– |

|

To Short Workings Account |

– |

20,000 |

|

(Being short workings recouped) |

– |

– |

|

Lessor’s Account Dr. |

120,000 |

– |

|

To Bank Account |

– |

120,000 |

|

(Being payment made to the lessor) |

– |

– |

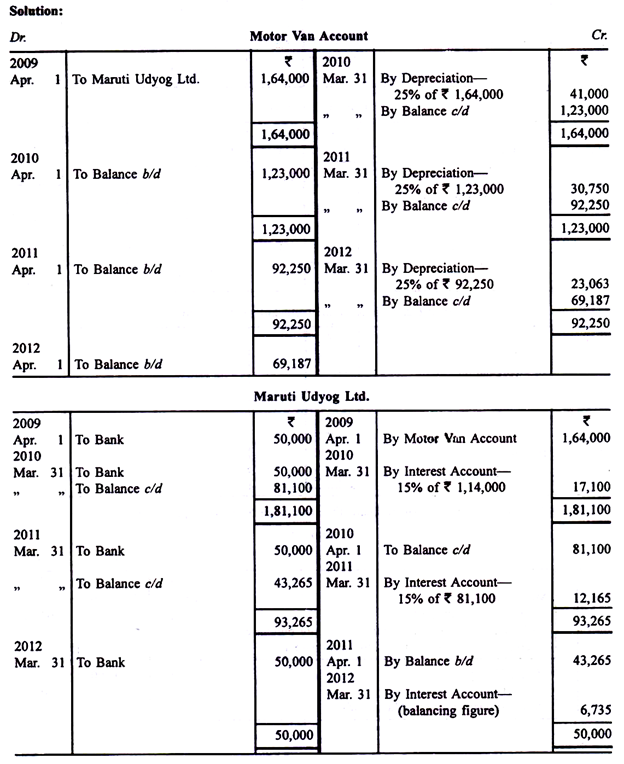

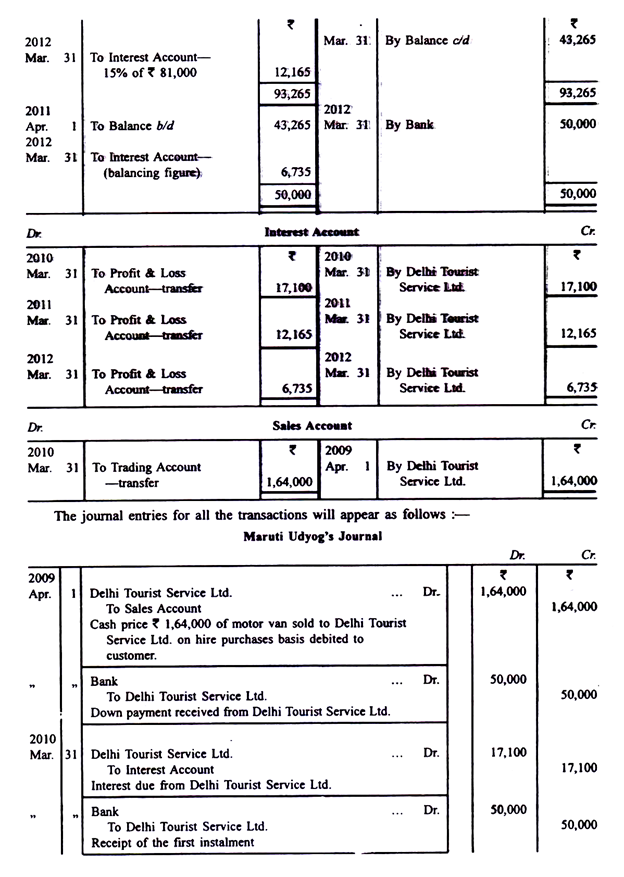

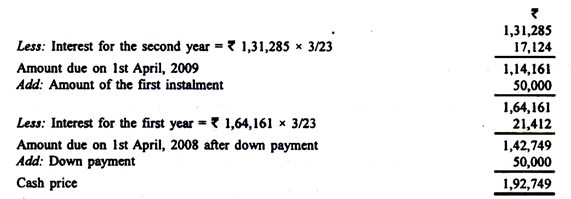

Ledger Accounts in the Books of Lessee:

1. Minimum Rent Account

| Date |

Particulars |

Debit (₹) |

Credit (₹) |

| Year 1 |

Lessor’s Account |

100,000 |

– |

| Year 1 |

Short Workings Account |

– |

20,000 |

| Year 2 |

Lessor’s Account |

100,000 |

– |

2. Royalty Account

| Date |

Particulars |

Debit (₹) |

Credit (₹) |

| Year 1 |

Lessor’s Account |

80,000 |

– |

| Year 2 |

Lessor’s Account |

120,000 |

– |

3. Short Workings Account

| Date |

Particulars |

Debit (₹) |

Credit (₹) |

| Year 1 |

Minimum Rent Account |

20,000 |

– |

| Year 2 |

Short Workings Recouped Account |

– |

20,000 |

4. Lessor’s Account

| Date |

Particulars |

Debit (₹) |

Credit (₹) |

| Year 1 |

Bank Account |

– |

100,000 |

| Year 1 |

Royalty Account |

80,000 |

– |

| Year 1 |

Minimum Rent Account |

100,000 |

– |

| Year 2 |

Bank Account |

– |

120,000 |

| Year 2 |

Royalty Account |

120,000 |

– |

| Year 2 |

Minimum Rent Account |

100,000 |

– |

5. Short Workings Recouped Account

| Date |

Particulars |

Debit (₹) |

Credit (₹) |

| Year 2 |

Short Workings Account |

20,000 |

– |

6. Bank Account

| Date |

Particulars |

Debit (₹) |

Credit (₹) |

| Year 1 |

Lessor’s Account |

– |

100,000 |

| Year 2 |

Lessor’s Account |

– |

120,000 |

Explanation of Journal Entries:

1. Year 1 (Short Workings)

-

- The Royalty Account is debited with the actual royalty amount (₹80,000), and the Lessor’s Account is credited.

- The Minimum Rent Account is debited with the guaranteed minimum rent (₹100,000), and the lessor is credited again.

- The shortfall of ₹20,000 (short workings) is recorded by debiting the Short Workings Account and crediting the Minimum Rent Account.

- The total amount due to the lessor is paid by debiting the Lessor’s Account and crediting the Bank Account.

2. Year 2 (Recoupment of Short Workings)

-

- The actual royalty exceeds the minimum rent, so ₹120,000 is debited to the Royalty Account and credited to the Lessor’s Account.

- The Minimum Rent Account is debited with ₹100,000, reflecting the minimum amount payable.

- The Short Workings Recouped Account is debited with ₹20,000 (the amount of short workings recouped), and the Short Workings Account is credited.

- Finally, the total payment of ₹120,000 is made to the lessor.

Like this:

Like Loading...