Special order, Addition, Deletion of Product and Services

Special Order refers to a one-time order that is outside the regular business operations or sales channels. It typically involves a request for a product or service at a price that may differ from the standard selling price. Special orders are usually considered when a customer requests a large quantity or specific customization that doesn’t align with the business’s regular market segment.

Key Considerations in Special Orders:

-

Pricing Decisions

Special orders often come with a lower price than the standard price. However, the organization must ensure that the price covers at least the variable cost of production and contributes to fixed costs. The goal is to avoid making a loss on the special order, even if the price is lower than the usual selling price.

-

Capacity and Resource Allocation

Before accepting a special order, businesses need to assess their production capacity. If the company is already operating at full capacity, it may need to evaluate whether fulfilling the special order would affect regular orders. Resource allocation becomes crucial, especially if fulfilling the special order involves reallocating production time, labor, or materials.

-

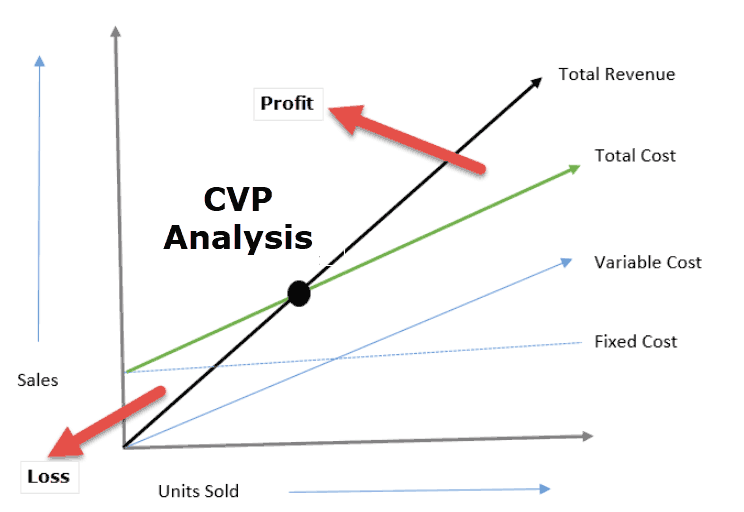

Contribution Margin

The contribution margin for the special order is a critical factor in decision-making. Since fixed costs typically remain the same, the contribution margin from the special order will help cover these fixed costs and improve the overall profitability.

-

Impact on Long-term Relationships

Special orders should be assessed for their long-term impact on the company’s market positioning and customer relationships. For instance, offering a lower price on a special order may set an undesirable precedent that could undermine the regular pricing structure.

-

Opportunity Costs

It is essential to consider opportunity costs before accepting a special order. The business must analyze whether the resources used for the special order could be more profitably employed in other areas, such as fulfilling regular orders or expanding business capacity.

Addition or Deletion of Products and Services

The decision to add or delete products or services is part of a company’s strategic planning process. It involves evaluating whether a product or service line is profitable and aligns with the business’s long-term goals. The addition of products or services can diversify the company’s offerings, while the deletion may streamline operations and improve focus on core competencies.

Addition of Products and Services:

When deciding to add new products or services, the company must evaluate various factors:

- Market Demand

The business must assess whether there is sufficient market demand for the new product or service. This involves market research to understand customer needs, preferences, and purchasing behavior.

- Cost of Development and Marketing

New products or services require investment in research and development (R&D), marketing, distribution, and customer support. The company must ensure that the expected returns from the new offerings justify these upfront costs.

- Fit with Existing Products

The new product or service should complement the existing product line and customer base. Offering something completely outside of the company’s current offerings could create challenges in terms of branding, marketing, and customer loyalty.

- Competitive Advantage

Adding a new product or service can help the company differentiate itself from competitors. The organization should ensure that it can achieve a competitive advantage in terms of quality, pricing, or customer service to make the new product a success.

Deletion of Products and Services:

Decreasing or eliminating certain products or services is often a difficult decision but may be necessary when resources need to be redirected to more profitable areas. The following considerations are important:

- Low Profitability

If certain products or services consistently perform poorly in terms of profitability, it might be wise to discontinue them. This could free up resources for more lucrative offerings.

- Declining Demand

If market trends show a significant drop in demand for a product or service, the business may need to cut it from the portfolio. Continuing to invest in declining products can result in resource waste and missed opportunities.

- Focus on Core Competencies

By deleting underperforming products or services, the company can focus on its core competencies and areas that offer the highest return on investment. This can lead to better operational efficiency and a clearer market positioning.

- Impact on Brand Image

The deletion of products or services should be carefully considered in terms of its impact on the company’s brand. For example, discontinuing a well-known product line could affect customer loyalty, while removing a low-demand item could improve the overall image.

- Cost Savings

Eliminating certain products or services can lead to cost savings, particularly if they are resource-intensive or require significant investment in production or marketing. These savings can then be redirected to more profitable or strategic areas.

- Customer Retention

When discontinuing products or services, it is important to communicate clearly with customers who may be affected. Providing alternatives, offering incentives, or gradually phasing out the offering can help maintain customer loyalty.

Key Decision-Making Criteria for Both Special Orders and Product Adjustments

- Profitability Analysis

The company must carefully analyze whether the decision to accept a special order or add/remove products will improve profitability in the long term.

- Resource Utilization

The effective use of resources is central to all these decisions. Efficient allocation of labor, capital, and time must be considered when assessing both special orders and changes to the product/service line.

- Strategic Fit

Both decisions must align with the company’s overall business strategy. For instance, the introduction of a new product must fit the company’s brand identity, and the deletion of a product should be in line with long-term objectives.

-

Market and Consumer Response

Understanding the market dynamics and consumer preferences is key to making informed decisions. Special orders and product/service additions or deletions should be based on clear market insights.