Although management actions differ from organization to organization, they generally follow a four-stage management process. As illustrated at the beginning of this chapter and in the chapters that follow, the four stages of this process are:

- Planning

- Performing

- Evaluating

- Communicating

Management accounting is essential in each stage of the process as managers make business decisions.

- Planning

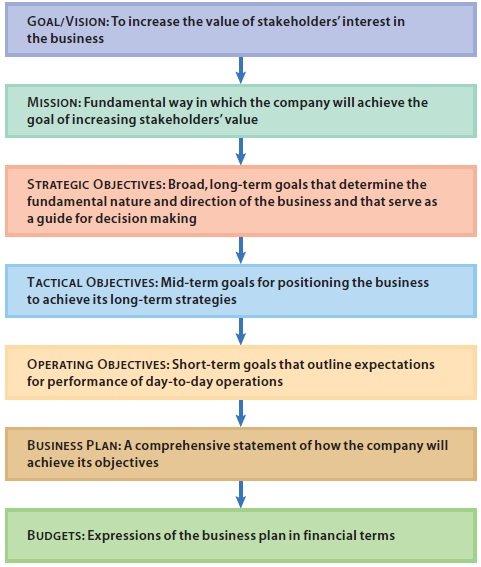

Diagram below shows the overall framework in which planning takes place. The overriding goal of a business is to increase the value of the stakeholders’ interest in the business. The goal specifies the business’s end point, or ideal state. For example, Wal-Mart’s end point is “to become the worldwide leader in retailing.”

A company’s mission statement describes the fundamental way in which the company will achieve its goal of increasing stakeholders’ value. It also expresses the company’s identity and unique character.

The mission statement is essential to the planning process, which must consider how to add value through strategic objectives, tactical objectives, and operating objectives.

Strategic objectives are broad, long-term goals that determine the fundamental nature and direction of a business and that serve as a guide for decision making. Strategic objectives involve such basic issues as what a company’s main products or services will be, who its primary customers will be, and where it will operate.

Tactical objectives are mid-term goals that position an organization to achieve its long-term strategies. These objectives, which usually cover a three to five-year period, lay the groundwork for attaining the company’s strategic objectives.

Operating objectives are short-term goals that outline expectations for the performance of day-to-day operations. Operating objectives link to performance targets and specify how success will be measured.

To develop strategic, tactical, and operating objectives, managers must formulate a business plan. A business plan is a comprehensive statement of how a company will achieve its objectives. It is usually expressed in financial terms in the form of budgets, and it often includes performance goals for individuals, teams, products, or services

- Performing

Planning alone does not guarantee satisfactory operating results. Management must implement the business plan in ways that make optimal use of available resources in an ethical manner. Smooth operations require one or more of the following:-

- Hiring and training personnel

- Matching human and technical resources to the work that must be done

- Purchasing or leasing facilities

- Maintaining an inventory of products for sale

- Identifying operating activities, or tasks, that minimize waste and improve the quality of products or services

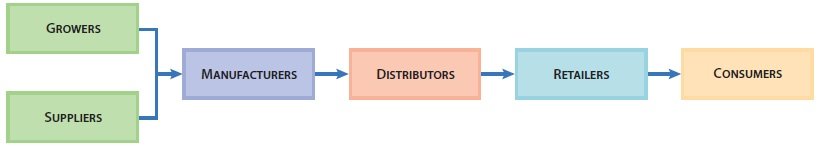

Critical to managing any retail business is a thorough understanding of its supply chain. The supply chain is the path that leads from the suppliers of the material to its final consumers. The supply chain expresses the links between businesses growers to vendors to the business to their customers.

- Evaluating

When managers evaluate operating results, they compare the organization’s actual performance with the performance levels they established in the planning stage. They earmark any significant variations for further analysis so that they can correct the problems. If the problems are the result of a change in the organization’s operating environment, the managers may revise the original objectives. Ideally, the adjustments made in the evaluation stage will improve the company’s performance.

- Communicating

Whether accounting reports are prepared for internal or external use, they must provide accurate information and clearly communicate this information to the reader. Inaccurate or confusing internal reports can have a negative effect on a company’s operations. Full disclosure and transparency in financial statements issued to external parties is a basic concept of generally accepted accounting principles, and violation of this principle can result in stiff penalties.