Cost can be classified into (i) fixed, (ii) variable and (iii) mixed costs, in terms of their variability or changes in cost behaviour in relation to changes in output, or activity or volume. Activity may be indicated in any forms such as units of output, hours worked, sales, etc.

The classification of cost behaviour has been explained below:

-

Fixed Cost

Fixed cost is a cost which does not change in total for a given time period despite wide fluctuations in output or volume of activity. The ICMA (U.K.) defines fixed cost as “a cost which tends to be unaffected by variations in volume of output. Fixed costs depend mainly on the affluxion of time and do not vary directly with volume or rate of output.” These costs, also known as standby costs, capacity costs or period costs, arise primarily because of the provision of facilities, physical and human, to carry on business operations.

Fixed costs enable a business firm to do a business, but they are not purely incurred for manufacturing. Examples of fixed costs are rent, property taxes, supervising salaries, depreciation on office facilities, advertising, insurance, etc. They accrue or are incurred with the passage of time and not with the production of the product or the job. This is the reason why fixed costs are expressed in terms of time, such as per day, per month or per year and not in terms of unit. It is totally illogical to say that a supervisor’s salary is so much per unit.

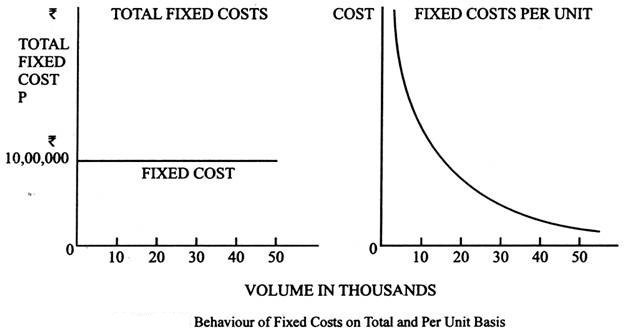

By nature, the total fixed costs are constant which means that the fixed costs per unit will vary. Shows the behaviour of fixed costs in total and on a per unit basis. When a greater number of units are produced, the fixed cost per unit decreases. On the contrary, when a lesser number of units are produced, the fixed cost per unit increases. This variability of fixed cost per unit creates problems in product costing. The cost per unit depends on the number of units produced or the level of activity achieved.

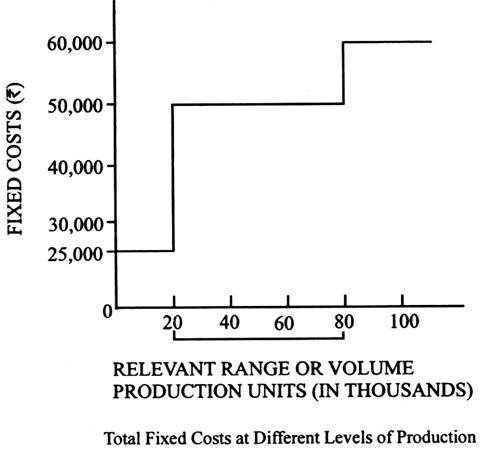

However, it should be improper to say that total fixed costs never change in amount. Rents, insurance, rates, taxes, salaries and other similar items may go up or down depending on the circumstances. The basic concept is that the term “fixed” refers to fixity (non-variability) related to specific volume (or relevant range); the term does not imply that there will be no changes in fixed cost. This characteristics of fixed cost has been shown in below.

According to Exhibit. 2.4, the following are the fixed costs at different levels of production:

(a) Rs 50,000 fixed cost between 20,000 and 80, 000 units of production.

(b) Rs 60,000 fixed cost in excess of 80,000 units. This assumes that increases in production after a certain level (80,000 units) requires increase in fixed expenses which have been fixed earlier, e.g., additional supervision, increase in quality control costs.

(c) Rs 25,000 fixed cost from zero units (shut down) to 20,000 units. This explains that if the level of activity comes to less than 20,000 units, some fixed costs may not be incurred. For example, if the plant is shut down or production is reduced, many of the fixed costs, such as costs on accounting functions, supplies, staff, will not be incurred. However, if laying off of staff and personnel, etc. is not possible, then the fixed cost will remain at Rs 50,000.

-

Variable Cost

Variable costs are those costs that vary in total amount directly and proportionately with the output. There is a constant ratio between the change in the cost and change in the level of output. Direct material cost and direct labour cost are the costs which are generally variable costs. For example, if direct material cost is Rs 50 per unit, then for producing each additional unit, a direct material cost of Rs 50 per unit will be incurred.

That is, the total direct material cost increases in direct proportion to increase in units manufactured. However, it should be noted that it is only the total variable costs that change as more units are produced; the per unit variable cost remains constant. Variable cost is always expressed in terms of units or percentage of volume; it cannot be stated in terms of time. Fig. shows behaviour of variable costs in total and on a per unit basis.

Fig. shows graphically the behaviour pattern of direct material cost. For the every increase in the units produced there is a proportionate increase in the cost when production increases in direct proportion at the constant rate of Rs 50 per unit. The variable cost line is shown as linear rather than curvilinear. That is, on a graph paper, a variable cost line appears as unbroken straight line in place of a curve. Variable cost per unit is shown by constant.

-

Mixed Costs

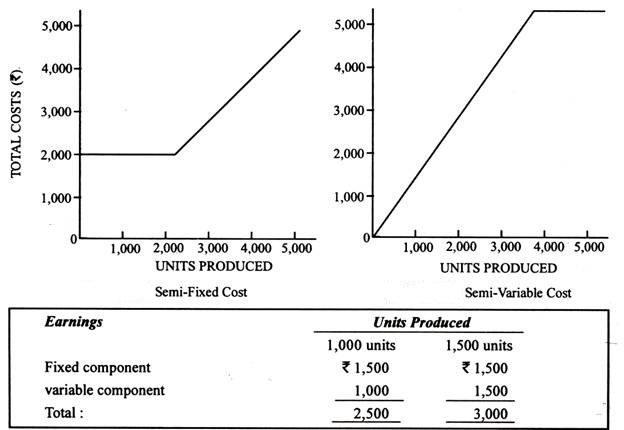

Mixed costs are costs made up of fixed and variable elements. They are a combination of semi- variable costs and semi-fixed costs. Because of the variable component, they fluctuate with volume; because of the fixed component, they do not change in direct proportion to output. Semi-fixed costs are those costs which remain constant upto a certain level of output after which they become variable as shown in fig.

Semi-variable cost is the cost which is basically variable but whose slope may change abruptly when a certain output level is reached as shown in fig. An example of a mixed cost is the earnings of a worker who is paid a salary of Rs 1,500 per week (fixed) plus Re. 1 for each unit completed (variable). If he increases his weekly output from 1,000 units to 1,500 units, his earnings increase from Rs 2500 to Rs 3,000.

An increase of 50% in output brings only a 20% increases in his earnings.

Mathematically, mixed costs can be expressed as follows:

Total Mixed Cost = Total Fixed Cost + (Units x Variable Cost per Unit)

One thought on “Measurement of Cost Behaviour”