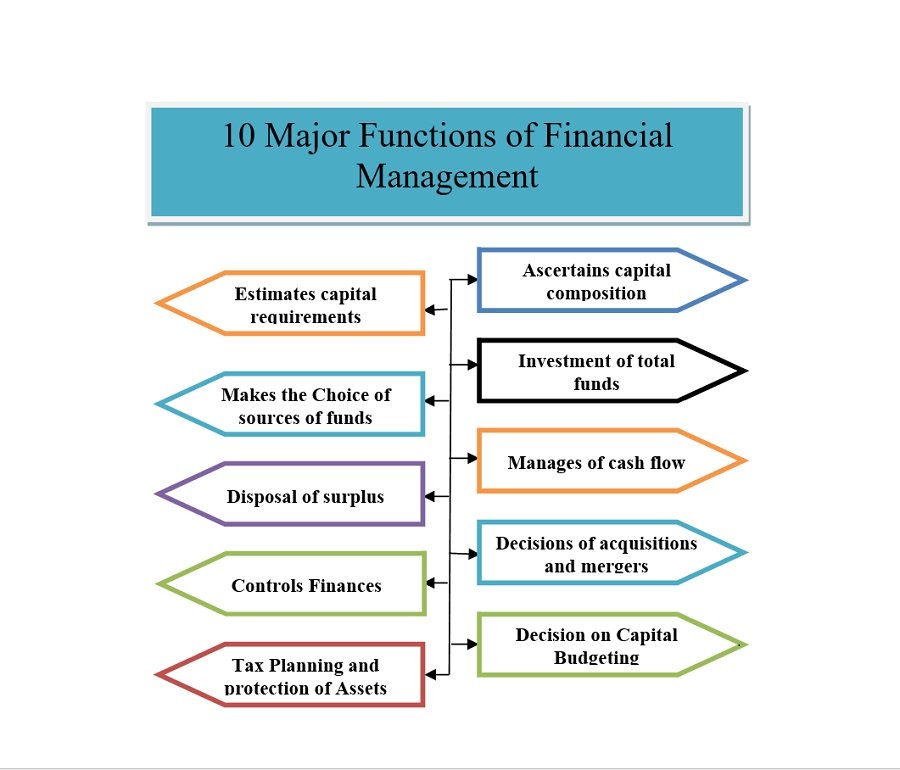

Financial management functions are vital for managing financial resources. Finance is referred to as the provision of funds at the time when it is needed for the business. Finance function involves the procurement of funds from a number of sources and their proper utilization in business concerns. The basic concept of finance comprises capital, funds, and amount. The core finance function is the process of acquiring and utilizing funds for a business. Finance functions are connected to the overall fund management of a business organization. The finance function is also concerned with the decisions such as business nature, size of the firm, type of machinery used, use of debt capital, liquidity position and so on. A brief discussion of major financial management functions is stated below:

-

Estimates the capital requirements of business

A financial manager firstly has to make the estimation with regards to overall capital requirements of the business. This will depend on several determinants like probable costs and expected profits and upcoming programs and policies of the company. Predictions have to be made in an adequate and concern manner which increases the earning capacity of business and which ensures proper use of financial resources. Thus financial management functions guide a financial manager to estimate organizational capital requirements.

-

Ascertains capital composition

Once the estimation of capital requirement has been made with the best effort, the capital structure of the enterprise has to be decided. This involves the analysis of short- term and long- term debt equity. This will depend on the proportion of possessed equity capital a company and other additional funds which have to be raised from outside parties through borrowing.

-

Makes the Choice of sources of funds

A financial manager needs to evaluate different sources of funds. A company has many choices for raising additional funds to be procured in the business like loans to be taken from banks and other financial institutions, issue of company shares and debentures, public deposits to be drawn like in form of bonds. Choice of a factor depends on the relative advantages and disadvantages of each source and financing period.

-

Investment of total funds

The finance manager has to decide how to allocate the total amount of funds into profitable ventures. He has to make sure that there is safety on investment and positive regular returns are possible. The capital should be invested in a wisely manner so that there is less possibility of losing funds or experience loses. For that, the manager can use different investment tools like portfolio analysis, net present value, internal rate of return, an average rate of return and so on.

-

Disposal of surplus

Financial manager calculates profits of business at the end of an accounting period. Then the net profits decision has to be taken by the finance manager of the company. This decision can be made in two ways. He can declare a dividend to the shareholders of a company where the ordinary shareholders will get the profits in the form of money or share or retain profits for some purposes like expansion, diversification or innovation of the business.

-

Manages of cash flow

Finance manager of a company has to make decisions regarding cash management. Cash is required for several purposes like payment of wages and salaries to the workers, payment to the creditors, payment of electricity and water bills, meeting current liabilities of the business, cost of maintenance of having enough stock, purchase of raw materials for daily production etc.

-

Controls Finances

The functions of a finance manager are not only to do a financial plan, procure fund and utilize the funds but he also has to control the finances involving in the business. This function can be done by many techniques like ratio analysis, forecasting of financials, cost analysis and control and profit distribution techniques etc.

-

Decisions regarding acquisitions and mergers

A business organization can either be expanded through acquiring other business or by entering into the business by mergers with other firms. While acquisition decision denotes a process of purchasing new or existing companies, the merger is a process where two or more companies join together in the formation of a new business. During such decision, a financial manager has to deal with many complex valuations of securities of each company.

-

Tax Planning and protection of Assets

It is the duty of a financial manager to lessen the tax liability of the business. This task should be performed wisely. It is very important that a finance executive properly examines various schemes and invest accordingly. He should also protect the assets engaged in the business to ensure the best use of the resources.

-

Decision on Capital Budgeting

Long-term decisions involve investing in share or bond, purchasing new equipment, building new plant etc. These decisions are called capital budgeting. In this decision making of the company financial managers faces many complicated situations. As the process requires a huge amount of capital, it is necessary that a financial manager identifies the investment opportunities and involved challenges.

The efficient use of financial management functions helps a company to maximize wealth. Financial management is a continuous and interrelated process which involves identifying the required amount of capital that is needed for running the business promptly, evaluating and selecting best alternative sources of funds, allocating the funds according to the need of business area and distributing earned profits.

2 thoughts on “Functions of Financial Management”