Time Value of Money (TVM) is a financial principle that recognizes the value of money changes over time due to its earning potential. A sum of money today is worth more than the same amount in the future because it can be invested to earn interest or generate returns. TVM forms the foundation of various financial decisions, including investment appraisals, loan calculations, and savings growth. It relies on concepts like present value (PV), future value (FV), discounting, and compounding to quantify the impact of time on money’s worth, ensuring sound financial planning and resource allocation.

Need of Time Value of Money (TVM):

-

Investment Decision-Making

TVM is critical for evaluating investment opportunities by comparing the present value of future returns. Investors need to determine if the returns from an investment justify the risk and time involved. Concepts like Net Present Value (NPV) and Internal Rate of Return (IRR) are used to assess the profitability of projects based on future cash flows.

-

Loan and Mortgage Calculations

When obtaining loans or mortgages, TVM helps calculate the equated monthly installments (EMIs), interest, and principal repayments over time. Financial institutions use TVM principles to structure loan terms and interest rates that balance affordability and profitability.

-

Retirement Planning

Planning for retirement requires estimating how much to save today to meet future financial needs. TVM helps in calculating the future value of current savings and determining the present value of future retirement expenses, ensuring adequate funds are available during retirement.

-

Inflation Adjustment

Inflation erodes the purchasing power of money over time. TVM accounts for inflation by discounting future cash flows to reflect their real value. This adjustment ensures accurate financial planning and investment decisions that consider the changing economic environment.

-

Business Valuation

TVM is essential for valuing businesses and their assets. Future cash flows generated by a business are discounted to determine their present value, providing insights into the company’s worth. This is crucial for mergers, acquisitions, and investor decision-making.

-

Capital Budgeting

Organizations use TVM to assess the feasibility of long-term projects. By discounting future costs and benefits, companies can prioritize projects that offer the highest returns relative to their initial investment, ensuring efficient allocation of resources.

-

Savings and Wealth Accumulation

TVM aids individuals in understanding the growth potential of their savings through compounding. By starting to save or invest early, individuals can take advantage of compound interest to maximize wealth accumulation over time.

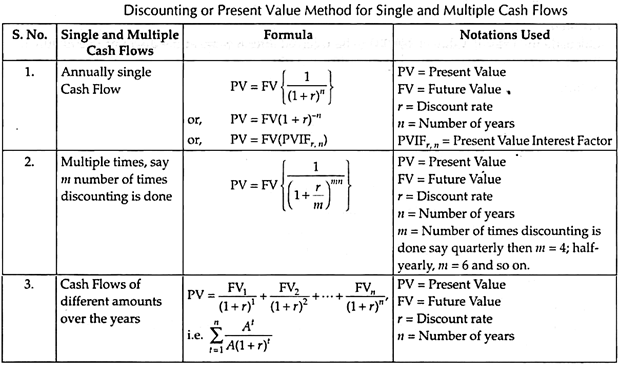

Discounting or Present Value Method

The current value of an expected amount of money to be received at a future date is known as Present Value. If we expect a certain sum of money after some years at a specific interest rate, then by discounting the Future Value we can calculate the amount to be invested today, i.e., the current or Present Value.

Hence, Discounting Technique is the method that converts Future Value into Present Value. The amount calculated by Discounting Technique is the Present Value and the rate of interest is the discount rate.

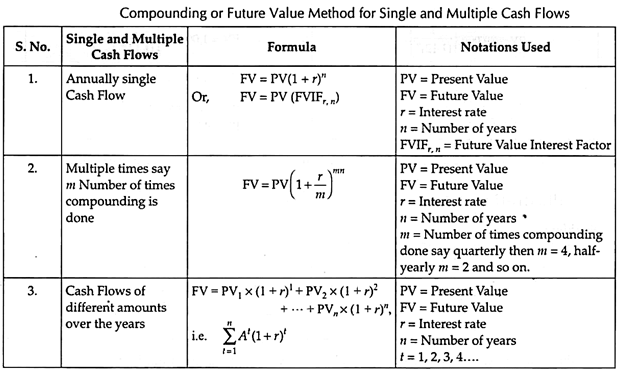

Compounding or Future Value Method

Compounding is just the opposite of discounting. The process of converting Present Value into Future Value is known as compounding.

Future Value of a sum of money is the expected value of that sum of money invested after n number of years at a specific compound rate of interest.

Key differences between Compounding and Discounting:

| Basis of Comparison | Compounding | Discounting |

|---|---|---|

| Definition | Future value (FV) | Present value (PV) |

| Focus | Value growth | Value reduction |

| Process | Adding interest | Removing interest |

| Direction | Present to future | Future to present |

| Use | Investment growth | Valuation analysis |

| Formula | FV = PV × (1 + r)^n | PV = FV ÷ (1 + r)^n |

| Objective | Maximize returns | Evaluate worth today |

| Application | Savings, investments | Loan, cash flow eval |

| Time Horizon | Future-oriented | Current-oriented |

| Example | Bank deposits | Bond valuation |

3 thoughts on “Time Value of Money: Compounding, Discounting”