Marketing Research is the systematic process of gathering, analyzing, and interpreting information about a market, target audience, competition, or industry trends. It helps businesses identify opportunities, assess consumer needs, preferences, and behaviors, and evaluate the effectiveness of marketing strategies. Marketing research can be classified into primary research (collecting new data through surveys, interviews, or experiments) and secondary research (analyzing existing data like reports or publications). It provides critical insights that guide decision-making, enhance customer satisfaction, and improve product or service offerings. Effective marketing research ensures that organizations remain competitive and responsive in dynamic market environments.

Features of Marketing Research:

1. Systematic Process

Marketing research follows a structured and methodical approach. It begins with identifying the problem or opportunity, followed by designing the research plan, data collection, analysis, and interpretation. This systematic process ensures accuracy and reliability in findings, which are critical for informed decision-making.

- Example: A company launching a new product systematically conducts surveys and focus groups to evaluate consumer demand.

2. Objective-Oriented

The primary goal of marketing research is to provide solutions to specific marketing problems or to uncover opportunities. It focuses on collecting relevant data and generating actionable insights to achieve predefined objectives. By remaining goal-focused, marketing research helps avoid irrelevant or excessive data collection.

- Example: A company may conduct research specifically to understand why sales of a product are declining.

3. Data-Driven

Marketing research relies on data, whether qualitative (opinions, emotions, or motivations) or quantitative (numbers, statistics, or trends). The quality of the research is directly tied to the accuracy, relevance, and timeliness of the data collected.

- Example: A retailer analyzing customer purchase patterns uses sales data to design targeted promotions.

4. Analytical in Nature

Marketing research emphasizes rigorous analysis of collected data to derive meaningful insights. Various analytical tools and statistical techniques are used to interpret the data, identify trends, and make forecasts. This ensures that decisions are not based on guesswork but on factual evidence.

- Example: A software company uses predictive analytics to estimate customer lifetime value based on historical behavior.

5. Continuous and Adaptive

Marketing research is not a one-time activity but an ongoing process. Markets are dynamic, with changing consumer behaviors, preferences, and competitive forces. Businesses must adapt their research efforts to stay relevant and updated with current trends.

- Example: Social media platforms conduct regular research to understand user preferences and develop new features accordingly.

6. Problem-Solving Orientation

Marketing research aims to solve real-world problems by identifying issues and suggesting practical solutions. It provides actionable recommendations to enhance marketing strategies, product development, or customer engagement.

- Example: Research findings may indicate the need for better customer service training to improve satisfaction levels.

Types of Marketing Research:

1. Exploratory Research

This type of research is conducted when the problem is not clearly defined, and the objective is to explore new ideas or insights. It is qualitative in nature and helps identify potential issues, opportunities, or solutions. Techniques like focus groups, in-depth interviews, and open-ended surveys are commonly used.

- Example: A company exploring the viability of a new product concept by interviewing a small group of target customers.

2. Descriptive Research

Descriptive research aims to describe the characteristics of a specific market or consumer group. It is often quantitative and provides information about consumer demographics, behaviors, and preferences. Surveys, observational studies, and data analysis are typical methods used.

- Example: A retailer conducting a survey to understand the purchasing habits of millennials.

3. Causal Research

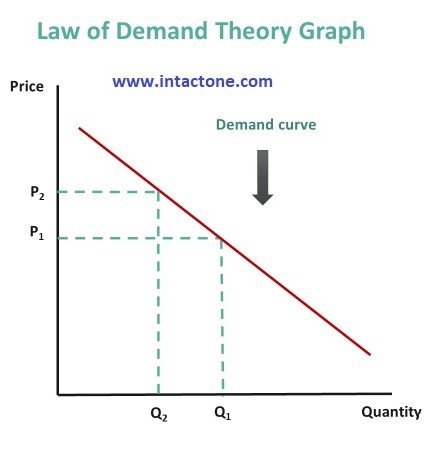

Also known as experimental research, causal research is conducted to identify cause-and-effect relationships between variables. It tests hypotheses to determine how changes in one variable (e.g., price) impact another (e.g., sales).

- Example: A business running A/B tests on two different ad campaigns to measure their impact on customer engagement.

4. Qualitative Research

This research focuses on understanding consumer emotions, motivations, and behaviors through non-numerical data. It uses methods like focus groups, interviews, and ethnographic studies to gather in-depth insights.

- Example: A luxury brand conducting interviews to understand how customers perceive exclusivity.

5. Quantitative Research

Quantitative research collects and analyzes numerical data to identify trends, patterns, and relationships. It relies on large sample sizes and uses techniques like surveys, statistical analysis, and structured questionnaires.

- Example: A telecom company analyzing customer satisfaction scores through large-scale surveys.

6. Primary Research

Primary research involves collecting original data directly from respondents. It provides specific insights tailored to the research objectives and is conducted through surveys, experiments, and direct observations.

- Example: A startup conducting an online poll to gauge interest in its new app.

7. Secondary Research

This type of research involves analyzing existing data from sources like reports, studies, industry publications, and government statistics. It is cost-effective and useful for understanding broader trends.

- Example: A business using market reports to understand industry growth rates.

8. Product Research

Product research focuses on understanding consumer preferences and feedback related to a product’s features, packaging, or usability. It helps in product development and enhancement.

- Example: A beverage company testing different flavors with a focus group.

9. Market Segmentation Research

This research identifies distinct consumer segments within a broader market based on demographics, behaviors, or preferences. It helps businesses target the right audience effectively.

- Example: A fashion retailer segmenting its market into groups based on age and lifestyle.

10. Competitive Analysis Research

This type examines competitors’ strategies, strengths, and weaknesses. It provides insights into the competitive landscape and helps businesses differentiate themselves.

- Example: A software company analyzing its competitors’ pricing and features.

Process of Marketing Research:

1. Identifying the Problem or Opportunity

The first step in the marketing research process is clearly defining the problem or identifying the opportunity. This step is critical, as it sets the foundation for the entire research process. A poorly defined problem may lead to irrelevant or misleading results. Businesses need to determine what they want to achieve, whether it is understanding declining sales, evaluating a new product’s potential, or exploring customer preferences. For instance, a company may want to know why customer satisfaction levels have decreased over the past quarter.

2. Developing the Research Plan

Once the problem is identified, the next step is to design a comprehensive research plan. This involves selecting the type of research (exploratory, descriptive, or causal) and determining the research approach (qualitative, quantitative, or a mix of both). Additionally, researchers decide on the methods for data collection, such as surveys, interviews, focus groups, or experiments. The plan should also outline the sampling method, sample size, and research budget. A well-thought-out research plan ensures that the process is efficient and cost-effective.

3. Collecting Data

Data collection is a crucial step that involves gathering information from primary or secondary sources. Primary data is collected firsthand through methods like questionnaires, interviews, and observations. Secondary data is obtained from existing sources such as market reports, government publications, and industry databases. The choice of data collection method depends on the objectives and available resources. For instance, if a business wants real-time customer feedback, it may use online surveys or social media polls.

4. Analyzing the Data

After data collection, the next step is to organize, analyze, and interpret the information to derive meaningful insights. Statistical tools, software, and techniques like regression analysis, correlation, and data visualization are often employed. This step involves identifying patterns, trends, and relationships within the data. For example, analysis may reveal that customers prefer specific product features or that price sensitivity is affecting sales.

5. Presenting the Findings

Once the data is analyzed, the results need to be compiled into a clear and concise report. The report typically includes an executive summary, research objectives, methodology, key findings, and actionable recommendations. Visual aids like graphs, charts, and tables are often used to make the findings easier to understand. This presentation helps decision-makers grasp the key insights and make informed choices based on the research.

6. Taking Action and Monitoring Results

The final step in the marketing research process is to implement the recommendations and monitor the outcomes. Businesses use the insights gained to develop strategies, improve products, or enhance customer experiences. Continuous monitoring ensures that the implemented actions are achieving the desired results and allows for adjustments if necessary. For instance, if a marketing campaign based on research insights shows positive results, it validates the research process.

Tools and Techniques of Marketing Research:

1. Data Collection Tools

a. Surveys and Questionnaires

Surveys are one of the most popular tools for collecting primary data. They involve structured questions designed to gather quantitative or qualitative insights.

- Example: Online surveys using platforms like Google Forms, SurveyMonkey, or Qualtrics.

- Benefit: Cost-effective and scalable for large audiences.

b. Interviews

Interviews provide in-depth insights by engaging participants in detailed discussions. They can be conducted face-to-face, via phone, or online.

- Example: One-on-one interviews with key customers to explore their motivations.

- Benefit: Allows for probing and clarifying responses.

c. Focus Groups

Focus groups involve moderated discussions with a small group of participants to gather opinions and ideas.

- Example: A retailer organizing focus groups to test new store layouts.

- Benefit: Reveals group dynamics and diverse perspectives.

d. Observation

Observation involves monitoring consumer behavior in real-world settings without direct interaction.

- Example: Watching how shoppers navigate a store.

- Benefit: Captures actual behavior rather than self-reported data.

e. Experiments

Experiments test specific variables to determine cause-and-effect relationships.

- Example: A/B testing two versions of a website landing page.

- Benefit: Provides reliable data for decision-making.

2. Data Analysis Tools

a. Statistical Software

Statistical tools like SPSS, SAS, and R help analyze large datasets and uncover trends, correlations, and patterns.

- Example: A company using SPSS to analyze survey results.

- Benefit: Ensures accurate and sophisticated data analysis.

b. Data Visualization Tools

Tools like Tableau, Power BI, and Excel create visual representations of data, such as charts and graphs.

- Example: A marketer using Tableau to create dashboards for campaign performance.

- Benefit: Makes complex data easy to understand and interpret.

c. Predictive Analytics

Predictive tools use algorithms and machine learning to forecast future trends and behaviors.

- Example: An e-commerce platform predicting customer purchase likelihood.

- Benefit: Enables proactive decision-making.

3. Online Tools

a. Social Media Analytics

Platforms like Hootsuite and Brandwatch analyze consumer sentiment and behavior on social media.

- Example: Tracking brand mentions and hashtags to measure campaign effectiveness.

- Benefit: Provides real-time insights into public opinion.

b. Web Analytics

Google Analytics and similar tools track website traffic, user behavior, and conversion rates.

- Example: Monitoring the effectiveness of an ad campaign through website traffic spikes.

- Benefit: Helps optimize digital marketing strategies.

c. CRM Systems

Customer Relationship Management (CRM) tools like Salesforce and HubSpot track customer interactions and preferences.

- Example: Analyzing customer purchase history to identify upselling opportunities.

- Benefit: Enhances customer relationship strategies.

4. Secondary Research Tools

a. Industry Reports and Publications

Reports from organizations like Nielsen, Gartner, or McKinsey provide valuable secondary data.

- Example: Using market trends from a Nielsen report to strategize.

- Benefit: Saves time and resources on primary research.

b. Government Data

Government databases, like Census data or economic reports, offer comprehensive and reliable information.

- Example: Analyzing population trends for market expansion.

- Benefit: Provides credible data for broad insights.

5. Qualitative Techniques

a. SWOT Analysis

This technique assesses a business’s strengths, weaknesses, opportunities, and threats.

- Example: A company analyzing its competitive edge in a new market.

- Benefit: Supports strategic planning.

b. Ethnographic Research

This involves observing consumers in their natural environments to understand their habits and lifestyles.

- Example: Studying how rural communities use a product.

- Benefit: Offers deep, contextual insights.

Advantages of Marketing Research

(i) Marketing research helps the management of a firm in planning by providing accurate and up- to-date information about the demands, their changing tastes, attitudes, preferences, buying.

(ii) It helps the manufacturer to adjust his production according to the conditions of demand.

(iii) It helps to establish correlative relationship between the product brand and consumers’ needs and preferences.

(iv) It helps the manufacturer to secure economies in the distribution о his products.

(v) It makes the marketing of goods efficient and economical by eliminating all type of wastage.

(vi) It helps the manufacturer and dealers to find out the best way of approaching the potential.

(vii) It helps the manufacturer to find out the defects in the existing product and take the required corrective steps to improve the product.

(viii) It helps the manufacturer in finding out the effectiveness of the existing channels of distribution and in finding out the best way of distributing the goods to the ultimate consumers.

(ix) It guides the manufacturer in planning his advertising and sales promotion efforts.

(x) It is helpful in assessing the effectiveness of advertising programmes.

(xi) It is helpful in evaluating the relative efficiency of the different advertising media.

(xii) It is helpful in evaluating selling methods.

(xiii) It reveals the causes of consumer resistance.

(xiv) It minimizes the risks of uncertainties and helps in taking sound decisions.

(xv) It reveals the nature of demand for the firm’s product. That is, it indicates whether the demand for the product is constant or seasonal.

(xvi) It is helpful in ascertaining the reputation of the firm and its products.

(xvii) It helps the firm in determining the range within which its products are to be offered to the consumers. That is, it is helpful in determining the sizes, colours, designs, prices, etc., of the products of the firm.

(xviii) It would help the management to know how patents, licensing agreements and other legal restrictions affect the manufacture and sale of the firm’s products.

(xix) It is helpful to the management in determining the actual prices and the price ranges.

(xx) It is helpful to the management in determining the discount rates.

Limitations of Marketing Research

1. High Costs

Conducting marketing research can be expensive, especially for small businesses with limited budgets. Expenses for hiring research agencies, designing surveys, collecting data, and using analytical tools can add up quickly. This financial constraint may force companies to compromise on the quality or scope of the research.

- Example: A startup may avoid conducting large-scale surveys due to high costs, leading to limited insights.

2. Time-Consuming Process

Marketing research is a time-intensive process that involves multiple steps, including planning, data collection, analysis, and reporting. In fast-moving markets, by the time the research is complete, the insights may already be outdated, rendering them less useful.

- Example: A company taking months to complete research for a new product launch may lose its first-mover advantage.

3. Risk of Inaccurate Data

The accuracy of marketing research depends on the quality of data collected. If the data is incorrect, biased, or incomplete, the insights derived from it will also be flawed. Poor sampling techniques, respondent dishonesty, or misinterpretation can lead to unreliable results.

- Example: Customers providing false responses in a survey to avoid revealing their true preferences.

4. Limited Scope

Marketing research often focuses on specific issues, making it difficult to gain a holistic view of the market. Additionally, certain qualitative factors, like emotional responses or cultural nuances, may be difficult to quantify or measure accurately.

- Example: Research that examines customer satisfaction but overlooks external factors like economic conditions influencing buying behavior.

5. Dependency on Respondents

Marketing research relies heavily on respondents’ participation and honesty. If respondents are unwilling to engage, provide inaccurate information, or exhibit bias, the results can be compromised. Non-response or low response rates can also affect the validity of the study.

- Example: Online surveys often experience low response rates, leading to insufficient data for meaningful analysis.

6. Rapid Market Changes

Markets are dynamic, with trends, consumer preferences, and competition evolving rapidly. Research findings may become irrelevant by the time they are implemented, especially in industries like technology or fashion where changes occur frequently.

- Example: A company basing its advertising strategy on outdated research results may fail to connect with current consumer trends.

Like this:

Like Loading...