Models are the techniques which help us to understand complex things and ideas in a clear manner.

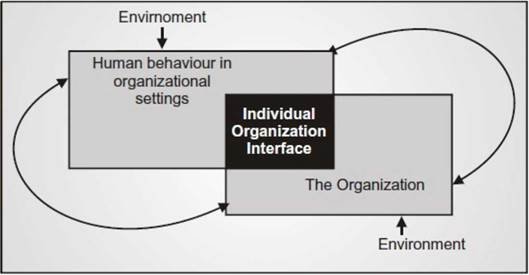

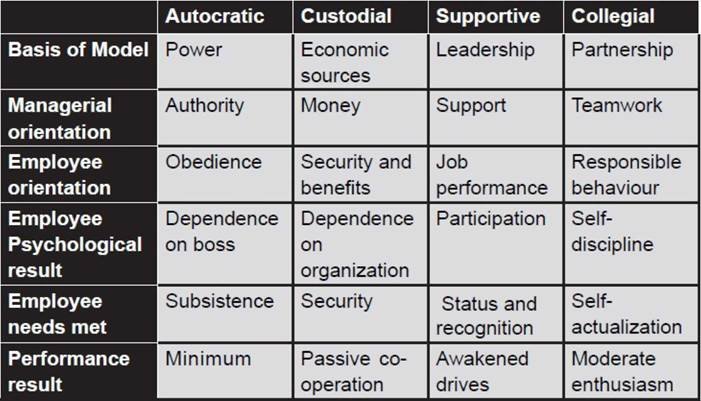

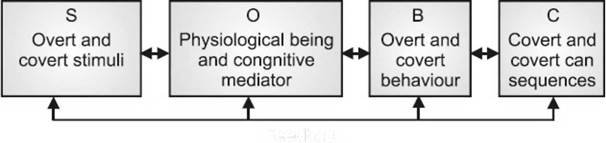

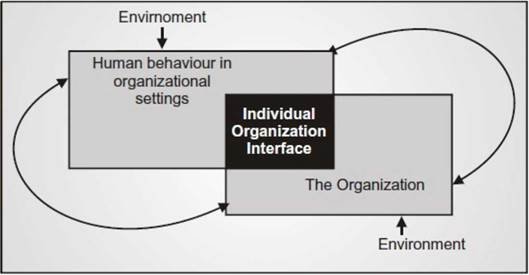

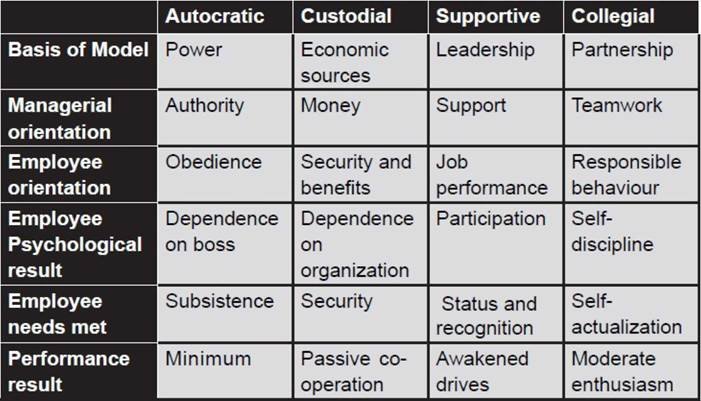

Models are frameworks or possible explanations why do people behave as they do at work. There are so many models as many are organizations. Varying results across the organizations are substantially caused by differences in the models of organizational behaviour. All the models of organizational behaviour are broadly classified into four types: autocratic, custodial, supportive and collegial. We discuss these four models beginning with the autocratic. O.B. is the study of human behaviour in organizations, the interface between human behaviour and the organization and the organization itself. The following figures shows, this interrelationship clearly.

The Autocratic Model

The basis of this model is power with a managerial orientation of authority. The employees in turn are oriented towards obedience and dependence on the boss. The employee need that is met is subsistence. The performance result is minimal.

In case of an autocratic model, the managerial orientation is doctorial. The managers exercise their commands over employees. The managers give orders and the employees have to obey the orders. Thus, the employees orientation towards the managers/bosses is obedience. Under autocratic conditions, employees give higher performance either because of their achievement drive or their personal liking to the boss or because of some other factor.

Evidences such as the industrial civilization of the United States and organizational crises do suggest that the autocratic model produced results. However, its principal weakness is its high human cost. The combination of emerging knowledge about the needs of the employees and ever changing societal values and norms suggested managers to adopt alternative and better ways to manage people at work. This gave genesis to the second type of models or organizational behaviour.

The Custodial Model

The basis of this model is economic resources with a managerial orientation of money. The employees in turn are oriented towards security and benefits and dependence on the organization. The employee need that is met is security. The performance result is passive cooperation.

While studying the employees, the managers realized and recognized that although the employees managed under autocratic style do not talk back to their boss they certainly think back about the system. Such employees filled with frustration and aggression vent them on their co-workers, families and neighbors. This made the managers think how to develop better employee satisfaction and security. It was realized that this can be done by dispelling employees’ insecurities, frustration and aggression. This called for introduction of welfare programmers to satisfy security needs of employees. Provision for an on site day-care centre for quality child care is an example of welfare programme meant for employees. Welfare programmes lead to employee dependence on the organization. Stating more accurately, employees having dependence on organization may not afford to quit even there seem greener pastures around. The welfare programmes for employees started by the Indira Gandhi National Open University (IGNOU), New Delhi are worth citing in this context, IGNOU, in the beginning provided its employees facilities like house-lease facility, subsidized transport facility, day-time child care centre in the campus, etc. These made employees dependent on IGNOU which, in turn, became custodian of its employees.

The basis of this model is partnership with a managerial orientation of teamwork. The employees in turn are oriented towards responsible behavior and self-discipline.

Although the custodian approach brings security and satisfaction, it suffers from certain flaws also. Employees produce anywhere near their capacities. They are also not motivated to increase their capacities of which they are capable. Though the employees are satisfied, still they do not feel motivated or fulfilled in their work they do. This is in conformity with the research finding that the happy employees are not necessarily most productive employees. Consequently managers and researchers started to address yet another question. “Is there better approach/way to manage people?” The quest for a better way provided a foundation for evolvement to the supportive type of model of organizational behaviour.

The Supportive Model

The basis of this model is leadership with a managerial orientation of support. The employees in turn are oriented towards job performance and participation. The employee need that is met is status and recognition. The performance result is awakened drives.

The supportive model is founded on leadership, not on money or authority. In fact, it is the managerial leadership style that provides an atmosphere to help employees grow and accomplish their tasks successfully. The managers recognize that the workers are not by nature passive and disinterested to organizational needs, but they are made so by an inappropriate leadership style. The managers believe that given due and appropriate changes, the workers become ready to share responsibility, develop a drive to contribute their mite and improve themselves. Thus, under supportive approach, the management’s orientation is to support the employee’s job performance for meeting both organizational and individual goals.

However, the supportive model of organizational behaviour is found more useful and effective in developed nations and less effective in developing nations like ours because of employee’s more awakening in the former and less one in the latter nations.

The Collegial Model

The collegial model is an extension of the supportive model. As the literal meaning of the work ‘college’ means a group of persons having the common purpose, the collegial model relates to a team work/concept. The basic foundation of the collegial model lies on management’s building a feeling of partnership with employee. Under collegial approach, employees feel needed and useful. They consider managers as joint contributors to organizational success rather than as bosses.

Its greatest benefit is that the employee becomes self-discipline. Feeling responsible backed by self-discipline creates a feeling of team work just like what the members of a football team feel. The research studies report that compared to traditional management model, the more open, participative, collegial managerial approach produced improved results in situations where it is appropriate.

Although there are four separate models, almost no organization operates exclusively in one. There will usually be a predominate one, with one or more areas overlapping in the other models.

The first model, autocratic, had its roots in the industrial revolution. The managers of this type of organization operate out of McGregor’s Theory X. The next three models begin to build on McGregor’s Theory Y. They have each evolved over a period of time and there is no one “best” model. The collegial model should not be thought as the last or best model, but the beginning of a new model or paradigm.

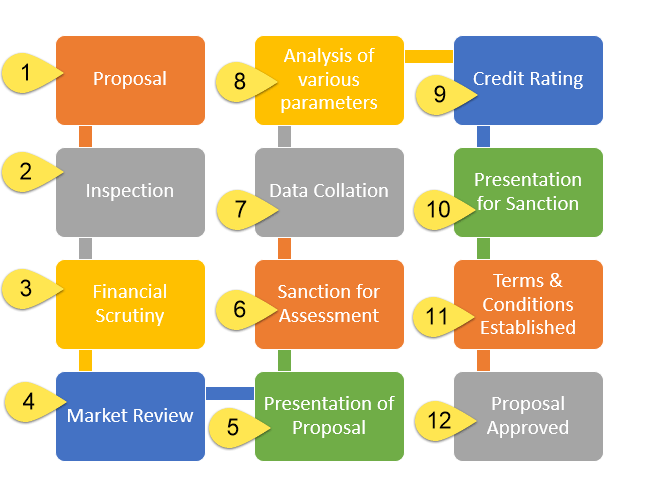

Now, the sum and substances of these four models of organizational behaviour are summarized in Table.

Interpretation of Different Models : Various conclusions may be drawn from the study of different models as follows :

(i) As soon as the understanding of human behaviour develops or social conditions change, the model is bound to change. No one model is best for all times.

(ii) Models or organizational behaviour are related to hierarchy of human needs. As society advances on the need hierarchy, new models are developed to serve the higher order needs that is paramount at that time.

(iii) Present tendency towards more democratic models of organizational behaviour will continue to develop for long run.

(iv) Different models will remain in use though new model predominates as most appropriate for general use at any given time as task conditions differ from time to time and organization to organization.

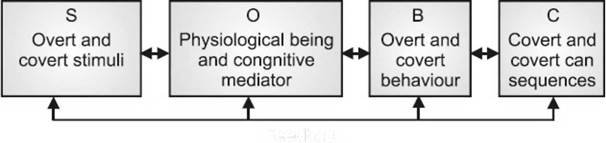

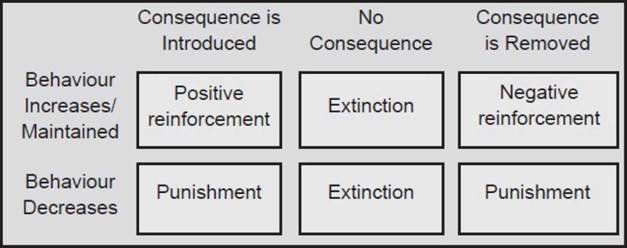

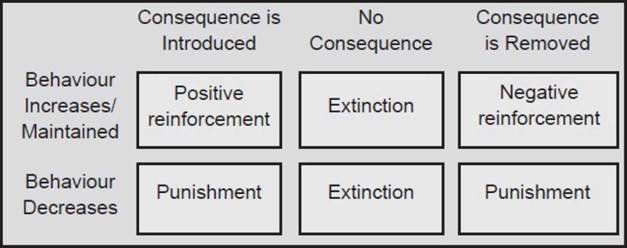

Fig. A-B-Cs of Orgnizational Behaviour Modification

Challenges and Opportunities for Organizational Behaviour

- The Creation of a Global Village

- Adapting to Different People

- Improving Quality and Productivity

- Improving People’s Skills

- Management Control to Empowerment

- Stability to Flexibility

- Improving Ethical Behavior

Environmental Challenges: Globalization, Information Technology, Total Quality, Diversity and Ethics are like comparative advantage of labor in the market. Like Nokia Finland recruits employees from India, China, BMW and Mercedes build their cars outside their native places like their plants are mainly in South Africa. Another opportunity is through increased foreign assignments. Challenges like workforce diversity, cross cultural leadership, decision making, communication, dual career couple, stimulating innovation and change in the organization.

It is important to upgrade various types of technical and managerial skills to remain competitive in business environment, to manage workforce diversity and to implement ways of improving ethical behaviour within the organization at all levels.

The managers are posed with many challenges and opportunities to use “Organizational Behavior” concepts to enhance the overall effectiveness of individuals, groups and organization.

Some of the issues which need support from behavioural science and other interdisciplinary fields to offer creditable solutions are:

Improving People’s Skills

The employees and executives are really in need of a boost up to be equipped with the required skills relevant to the technological changes, structural changes, environmental changes which are accelerated at a fast pace. In absence of the fastback possession, the targeted goals can’t be achieved in time.

Main skills on focus are

Managerial skills which include listening, motivating, planning, organizing, leading, problem solving, decision making.

Technical skills.

To enhance these skills seminars, training and development session, career development programmes, induction and socialization and many more tools and techniques are adopted.

Designing an effective performance appraisal system with built-in training modules to help lower level cadres to upgrade their skill sets (conceptual, relational etc.) would be a remarkable.

Improving Quality and Productivity

Quality is a parameter which makes a product or service best or worst for the customers and users. It is a measure of expectation. A student expects the pen, she/he just bought, to write. The failure of the pen to write will express the failure of the product to meet the customer’s expectation.

“Deming” defined quality as a predictable degree of uniformity and dependability at low cost and suited to the market.

The key dimensions of quality are:

- Performance

Primary/Perceptual characteristics of a product as signal, coverage, display quality etc. which are visible.

- Features

Secondary characteristics, added features such as alarm clock added in mobile phones.

- Conformance

To meet specifications according to industry standards.

- Reliability

Probability of a product’s failure within a specific period of time.

- Durability

Measure of product’s life having both economic and technical dimensions.

- Services

Resolution of problems and complaints.

- Response

Human-Human interface, such as courtesy of the dealer.

- Aesthetics

Sensory characteristics such as exterior finish.

- Reputation

Past performance and other intangibles such as being awarded rank first.

Managers confront the challenges of fulfilling the specific requirements of a customer. Implementing total quality management and re-engineering products to improve productivity and quality.

Responding to Globalization

With mostly market driven business, whenever the demand exists irrespective of distance, location, climatic conditions, the business operations are expanded to gain their market share and remain top ranked. Making maximum use of mass communication, internet, faster transportation, products and services are spreading across nations.

Example of such globalization is “more than 95% of Nokia cell phones are being sold outside of their home country Finland”.

Globalization affects a manager in

- A manager has to manage a diversified workforce that is likely to have very different needs, aspirations and attitudes from the ones that they are used to manage in their home country.

- Understanding culture of local people in order to adapt appropriate management style for the success the operations. It is important for the manager to show tolerance to sensitivity to various individual in the workforce.

Empowering People

The main concern is to delegate power and responsibility to lower level workforce and assigning more freedom to make choices about their schedules, operations, procedures and method of solving their work related problems.

The implementation of empowerment concept brings around reshaping of relationship between the manager and the employees where the manager works as a coach, advisor, sponsor, facilitator and a guide.

The manager must learn how to give up control and employees must learn how to take responsibility for their work and make better decision. This in many cases brings change in leadership style.

Coping with Temporariness

The product life cycles are slimming up and thus the methods of operations are improving and fashions are changing very fast. This rapid changing era brings a temporariness feel among the organization’s environment. The very long periods of stability is lost in the recent years due to competitiveness in providing better experience.

Actual jobs that workers perform are in a permanent state of flux so they need to upgrade their knowledge and skill sets.

Stimulating Innovation and Change

Today’s successful organizations must foster innovation and be proficient in the art of change, else they will become extinct in due course of time and vanish from business. Flexibility needs to be maintained at all times along with continually improving their quality and handle constant competition. The managers need to stimulate employee’s creativity and tolerance for change.

Emergence of E-Organization

Some important aspects that need to be discussed here are:

(i) E-Commerce

This refers to the business operations involving electronic mode of transactions encompassing presenting products on websites and filling order. Online shopping is a point of focus for media.

(ii) E-Business

It refers to the full breadth of activities included in a successful Internet-based enterprise. E-Commerce is a subset of e-business which includes developing strategies for running Internet-based companies, creating integrated supply chains, collaborating with partners to electronically coordinate design and production, identifying a different kind of leader to run a ‘virtual’ business, finding skilled people to build and operate intranets and websites and running the administrative side.

(iii) Growth rate of e-business

The application of internet operations are initially covers a small part of the business. A popular application of e-business is merely using the internet to better manage an ongoing business. E-business applications are also helping in improving communications with internal and external stakeholders and to better perform traditional business functions.

This is even becoming a government concern to use it for providing utility services through internet.

Improving Ethical Behaviour

The complexity of business operations is forcing workforce to face ethical dilemmas, where they are required to define right and wrong conduct in order to complete their assigned activities. The ground rules governing the constituents of good ethical behaviour has not been clearly defined. Blurring out of differentiation between right things from wrong behaviour becomes a dent in an organization.

The managers must evolve code of ethics to guide employees through ethical dilemmas. Organizing workshops, seminars, training programs help improving behavior of employees.

It is the duty of every individual to keep the climate within an organization healthy in terms of ethics and principals and maintain minimal degree of ambiguity

Like this:

Like Loading...